Pre-Open Data

Key Data for the Week

- Monday – EUR – Consumer Confidence remained unchanged at -6.8.

- Monday – AUS – Company Profits rose 4.0% in the September quarter.

- Tuesday – AUS – Building Approvals

- Tuesday – EUR – Consumer Price Index

- Tuesday – US – Consumer Confidence

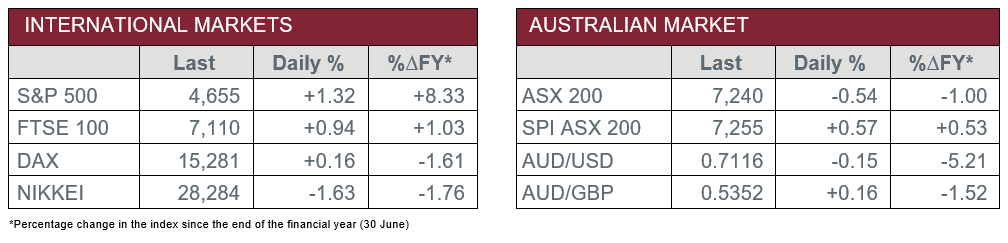

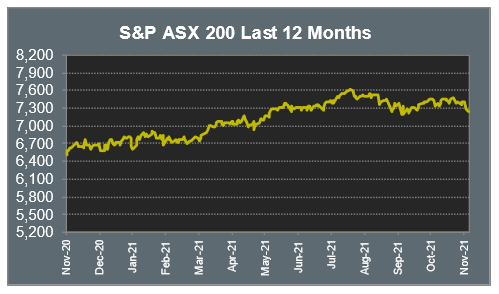

Australian Market

The Australian sharemarket lost 0.5% yesterday, despite falling as much as 1.1% early in the trading session. The Omicron variant of COVID-19 was the main reason for the sharp fall early, as investors prepare for what could be a volatile time given the uncertainty of the new variant.

The REITs sector led the losses as the possibility of a third round of lockdowns dampened investor sentiment. Unibail-Rodamco-Westfield was the worst performer among the shopping centres, as it closed 6.2% lower, while Scentre Group dropped 3.8% and Stockland lost 2.0%

The oil majors weighed on the Energy sector, as it closed 1.4% lower. Woodside Petroleum fell 1.7%, while Santos and Beach Energy conceded 1.5% and 0.8% respectively. During the session, the price of oil rebounded after being heavily weakened on Friday.

The Materials sector provided one of the only positive performances of the ASX. Fortescue Metals gained 2.4% and BHP added 1.4%, while Rio Tinto closed the session 1.0% higher. Lithium producers also gained; Pilbara Minerals added 0.8%, while Vulcan Energy lifted 1.6%.

The Australian futures market points to a 0.57% gain today, lifted by stronger overseas markets.

Overseas Markets

European sharemarkets regained some of Friday’s losses overnight. Travel and leisure stocks enjoyed gains; Lufthansa added 1.6% and easyJet lifted 0.6%, while International Airlines Group jumped 1.6%. The Financials sector also recovered some of the lost ground; ING Groep added 0.5% and Barclays rose 0.9%, while BNP Paribas closed the session 0.2% higher.

By the close of trade, the STOXX Europe 600 added 0.7% and the UK FTSE 100 gained 0.9%, while the German DAX closed 0.2% higher.

US sharemarkets had a sharp rise on Monday, after suffering major losses on Friday. The Information Technology sector boosted the NASDAQ, as NVIDIA Corporation soared 6.0% and Fortinet added 4.9%, while Alphabet and Microsoft gained 2.3% and 2.1% respectively.

The Health Care sector was relatively mixed; Moderna jumped 11.8%, Danaher added 0.6% and Johnson & Johnson gained 0.4%, while Pfizer closed the session 3.0% lower.

By the close of trade, the NASDAQ jumped 2.0%, while the S&P 500 and Dow Jones added 1.3% and 0.8% respectively.

CNIS Perspective

Unfortunately, the term Omicron is something that markets are going to have to deal with leading into the end of the year. It marks the fifth variant of concern identified so far, following Delta, Alpha, Beta and Gamma.

Markets don’t like uncertainty, and that is what comes with a ‘new variant’ of COVID. However, the reaction by markets on Friday was not out of the ordinary. Equities sold off, bond yields tightened, and the US Dollar outperformed other foreign exchanges due to its safe haven nature.

Until more information comes to hand, markets may remain volatile, reflected by last night’s strong reversal of the knee jerk reaction exhibited on Friday, where most of the lost ground from the previous session was recovered. However, a ‘here we go again moment’ seems unlikely to play out. If current vaccines don’t provide adequate cover to the variant, vaccine producers are backing their ability to adapt booster shots to accommodate the new variant.

If the variant stifles growth and requires a return to lockdowns, central banks will again refine, or extend, quantitative easing timelines, and that could encourage yet another bout of buy the dip inflows into equity markets.

Should you wish to discuss this or any other investment related matter, please contact your Investment Services Team on (02) 4928 8500.

Disclaimer

The material contained in this publication is the nature of the general comment only, and neither purports, nor is intended to be advice on any particular matter. Persons should not act nor rely upon any information contained in or implied by this publication without seeking appropriate professional advice which relates specifically to his/her particular circumstances. Cutcher & Neale Investment Services Pty Limited expressly disclaim all and any liability to any person, whether a client of Cutcher & Neale Investment Services Pty Limited or not, who acts or fails to act as a consequence of reliance upon the whole or any part of this publication.

Cutcher & Neale Investment Services Pty Limited ABN 38 107 536 783 is a Corporate Authorised Representative of Cutcher & Neale Financial Services Pty Ltd ABN 22 160 682 879 AFSL 433814.

Cutcher's Investment Lens | 7 - 11 April 2025

The failed $3 million super tax: Division 296 is done… or is it?

Cutcher's Investment Lens - Update on Trump & Tariffs | 31 March - 4 April 2025

Liberation Day - April 2025 Snapshot

Smart investing for SMEs: The basics on how to get started and grow your business.