Pre-Open Data

Key Data for the Week

Key economic data released this week:

- Thursday – AUS – Trade Balance widened to $7.5 billion in October, continuing the run of uninterrupted trade surpluses since late 2017. The outcome beat market expectations.

- Thursday – EUR – Retail Sales lifted 1.5% in October, after dropping 1.7% in September. Annual growth improved from 2.2% in September, to 4.3% in October.

- Friday – AUS – Retail Sales

- Friday – US – Unemployment Rate

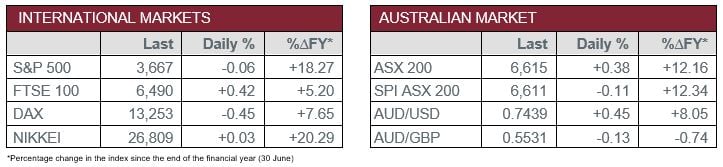

Australian Market

The Australian sharemarket closed higher for a third consecutive session yesterday, as the local ASX ended the day up 0.4%. Gains were driven primarily by the Materials sector, following strength in commodity markets. Mining heavyweights BHP and Rio Tinto rose 4.9% and 6.9% respectively, while Fortescue Metals surged 13.3%, as the price of iron ore continued to lift and closed in on a seven-year high.

Qantas slipped 1.1% after the airline released a trading update. The national carrier reported an increase to its domestic capacity as interstate borders re-open and expects domestic capacity to be ~80% of pre-COVID levels by 3Q21. However, the company signalled international travel is unlikely to restart until July 2021 pending on vaccine progress.

Kogan.com (KGN) strengthened 7.7%, after the company announced the acquisition of NZ based online retailer Mighty Ape for $122.4 million. KGN expects the purchase to result in significant revenue and cost synergies, with the NZ retailer currently having ~700,000 customers.

The Australian futures market points to a 0.11% fall today.

Overseas Markets

European sharemarkets were mixed on Thursday, as gains by mining stocks were offset by a weak eurozone business activity report. Flutter Entertainment was amongst the best performers, with the betting firm up 7.0% after it announced a US$4.18 billion deal to increase its holding in FanDuel to 95%. Rolls Royce surged 15.5% on reports the company was considering a re-entry into the narrow-body jetliner market. The UK FTSE 100 climbed 0.4% to a six-month high, while the broad based STOXX Europe 600 was flat and the German DAX gave up 0.5%.

US sharemarkets eased in late trade from intraday highs overnight, following a media report that Pfizer expects to only rollout about half the doses of its COVID-19 vaccine this year. However, the company is still looking to provide 1.3 billion doses in 2021. Boeing rose 6% after budget airliner Ryan Air ordered an additional 75 of the company’s 737 MAX jets, while Tesla added 4.3% following a broker upgrade. Health Care stocks Illumina and Johnson & Johnson gained 1.5% and 0.6% respectively, while e-commerce giant Alibaba added 2.1%. By the close of trade, the Dow Jones climbed 0.3% and the NASDAQ lifted 0.2%, however, the S&P 500 slid 0.1%.

CNIS Perspective

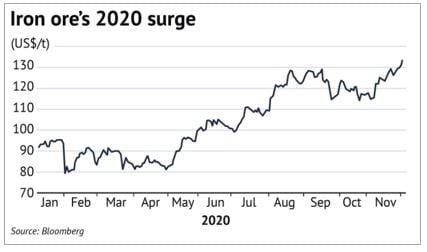

The price of iron ore has soared this week to over US$136 a tonne, its highest price since 2013, as Brazilian giant Vale cut its annual output expectations. Blaming recent rainfall and licencing issues for one of its mines, Vale cut its production target for 2020 to 300-305 million tonnes, from 310-330 million tonnes, and flagged only a limited lift in production for 2021.

The iron ore price has also been supported by strong demand for steel from China, with October steel production up 13% year on year, as the economy goes back into growth mode post-COVID. It would seem somewhat ironic that in the midst of an escalating trade war between China and Australia, with tariffs being slapped on Australian coal, barley, lobsters and wine, that our iron ore has been left largely untouched. The big winners here are clearly Australian miners (BHP, Fortescue Metals and Rio Tinto) as they pick up the slack from Vale and cash in on these escalating iron ore prices.

Should you wish to discuss this or any other investment related matter, please contact your Investment Services Team on (02) 4928 8500.

Disclaimer

The material contained in this publication is the nature of the general comment only, and neither purports, nor is intended to be advice on any particular matter. Persons should not act nor rely upon any information contained in or implied by this publication without seeking appropriate professional advice which relates specifically to his/her particular circumstances. Cutcher & Neale Investment Services Pty Limited expressly disclaim all and any liability to any person, whether a client of Cutcher & Neale Investment Services Pty Limited or not, who acts or fails to act as a consequence of reliance upon the whole or any part of this publication.

Cutcher & Neale Investment Services Pty Limited ABN 38 107 536 783 is a Corporate Authorised Representative of Cutcher & Neale Financial Services Pty Ltd ABN 22 160 682 879 AFSL 433814.

Smart investing for SMEs: The basics on how to get started and grow your business.

ATO updates: A quick guide on what business owners need to know.

Cutcher's Investment Lens | 24 - 28 March 2025

Is your current super fund holding you back? It might be time for an SMSF.

Cutcher's Investment Lens | 17 - 21 March 2025