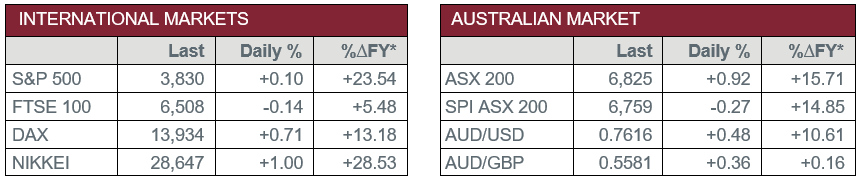

Pre-Open Data

Key Data for the Week

Key economic data released this week:

- Wednesday – AUS – Building Permits rose 10.9% in December. Approvals were up 22.8% on a year earlier.

- Wednesday – EUR – Consumer Price Index rose 0.2% in January, while the annual rate improved from a contraction of 0.3% in December, to a rise of 0.9% in January.

- Thursday – EUR – Retail Sales

- Thursday – UK – BoE Interest Rate Decision

Australian Market

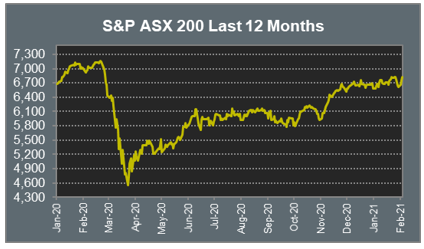

The Australian sharemarket rose 0.9% yesterday, to close higher for a third straight session. All sectors closed higher, except for Materials and Information Technology. Mining heavyweights BHP and Rio Tinto were dragged lower by a fall in the price of iron ore, down 2.2% and 1.1% respectively. Gold miner Saracen Mineral slipped 4.1% on its final trading day on the Australian sharemarket before its merger with Northern Star.

The REITs sector was the strongest performer, led higher by Ingenia Communities and Stockland Group, up 4.8% and 4.4% respectively, while Aventus Group, Centuria Industrial and Goodman Group all rose between 2.0% and 3.7%.

The Financials sector also outperformed, as the big four banks all rose between 1.2% and 1.9%. Fund managers were mixed, Australian Ethical Investment rose 3.7%, while Magellan Financial Group fell 1.3%.

CSL and Cochlear rose 2.2% and 2.3% to lead the Health Care sector higher.

The Australian futures market points to a 0.27% fall today.

Overseas Markets

European sharemarkets were mostly higher on Wednesday. Mercedes-Benz manufacturer Daimler gained 8.9% after the company announced it plans to spin-off its trucks business. HelloFresh added 3.9%, while renewable energy companies Siemens Gamesa and Vestas Wind Systems rose 3.0% and 1.7% respectively. The Italian FTSE MIB added 2.1% after former European Central Bank Chief Mario Draghi accepted the task of forming a new government. By the close of trade, the broad based STOXX Europe 600 rose 0.3%.

US sharemarkets also closed mostly higher overnight, led by the Energy sector on the back of a rise in the price of crude oil. Alphabet climbed 7.4% after the company announced Q4 revenue and EBITDA above expectations. Amazon slipped 2.0% following the announcement CEO Jeff Bezos will step down from his position. Music streaming company Spotify slumped 8.1% after the company released Q4 earnings below expectations.

By the close of trade, the Dow Jones and S&P 500 both added 0.1%, while the NASDAQ closed flat.

CNIS Perspective

Most market analysts were forecasting RBA Governor Philip Lowe would announce a tapering to the central bank’s quantitative easing measures this week, however, the RBA surprised financial markets by doubling the existing bond buying program to $200 billion.

The decisive move to extend the existing $100 billion money printing program beyond April sends a clear message the central bank is prepared to continue supporting the local economy and promote accelerated growth during 2021.

Our local sharemarket reacted positively to the news and the announcement pushed the Australian Dollar lower, something the RBA would like to see, as it fights to contain the currency’s strength over the past several months, a result of the huge stimulus measures adopted by central banks around the world, namely the US Federal Reserve, as well as resilient commodity prices.

With the RBA due to release fresh economic forecasts tomorrow, it appears Australia’s near-term economic prospects continue to improve. Sentiment among consumers and businesses is on the rise, the unemployment rate is falling, fourth quarter inflation was stronger than expected and interest rates are not expected to increase until at least 2024.

Should you wish to discuss this or any other investment related matter, please contact your Investment Services Team on (02) 4928 8500.

Disclaimer

The material contained in this publication is the nature of the general comment only, and neither purports, nor is intended to be advice on any particular matter. Persons should not act nor rely upon any information contained in or implied by this publication without seeking appropriate professional advice which relates specifically to his/her particular circumstances. Cutcher & Neale Investment Services Pty Limited expressly disclaim all and any liability to any person, whether a client of Cutcher & Neale Investment Services Pty Limited or not, who acts or fails to act as a consequence of reliance upon the whole or any part of this publication.

Cutcher & Neale Investment Services Pty Limited ABN 38 107 536 783 is a Corporate Authorised Representative of Cutcher & Neale Financial Services Pty Ltd ABN 22 160 682 879 AFSL 433814.

Smart investing for SMEs: The basics on how to get started and grow your business.

ATO updates: A quick guide on what business owners need to know.

Cutcher's Investment Lens | 24 - 28 March 2025

Is your current super fund holding you back? It might be time for an SMSF.

Cutcher's Investment Lens | 17 - 21 March 2025