Pre-Open Data

Key Data for the Week

- Thursday – AUS – Trade Balance widened in April, up from $5.8 billion in March to $8.0 billion. Imports fell 3.2%, while exports rose 3.0%.

- Friday – EUR – Retail Sales

- Friday – US – Unemployment Rate

Australian Market

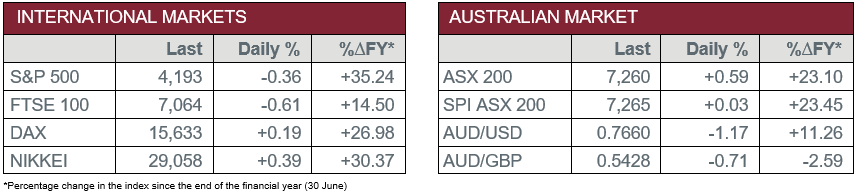

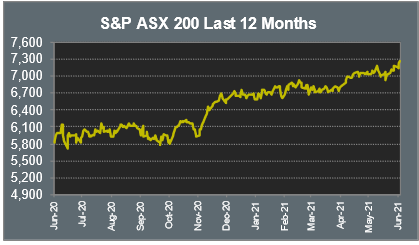

The Australian sharemarket advanced 0.6% yesterday, as all sectors except Consumer Discretionary posted gains. Energy was the strongest performing sector, up 3.3%, followed by Utilities and Information Technology, which added 2.1% and 1.6% respectively.

Strong oil prices boosted Energy stocks; Woodside Petroleum gained 3.1%, while Santos lifted 3.8% and Oil Search climbed 4.1%. Uranium miner Paladin eased 4.2% despite commencing trade on an over the counter market in the US.

The Information Technology sector was lifted by gains among buy-now-pay-later providers. Afterpay added 3.4% and Zip Co gained 4.4%, while Sezzle rallied 22.7% after the company entered a three-year agreement with US retailer Target Corporation to offer their payments system in-store and online. Accounting software provider Xero rose 2.3%, while artificial intelligence company Appen lifted 2.4%.

All four major banks closed higher; ANZ gained 1.5% and Westpac added 1.1%, while Commonwealth Bank and NAB both rose 0.9%. Insurers were also stronger; NIB closed up 2.2% and Insurance Australia Group lifted 1.2%, while QBE Insurance gained 0.1%.

The Australian futures market points to a 0.03% rise today.

Overseas Markets

European sharemarkets were mixed overnight. Banking stocks varied; Barclays slipped 0.1% and Lloyds fell 0.9%, while Deutsche Bank added 0.7%. By the close of trade, the UK FTSE 100 gave up 0.6% and the STOXX Europe 600 eased 0.1%, while the German Dax rose 0.2%.

US sharemarkets were weaker on Thursday as strong economic data raised concerns among investors that the US Federal Reserve may withdraw its stimulus earlier than expected. Automaker stocks were stronger; Ford gained 7.2% and General Motors climbed 6.4% after the company announced H1 2021 results were stronger than previous guidance, while Tesla lost 5.3% following reports of weak sales in China. Financial services stocks were lower; PayPal gave up 1.7% and MasterCard fell 1.4%, while PagSeguro Digital bucked the trend to gain 3.6%. By the close of trade, the NASDAQ and Dow Jones both slipped 0.1%, while the S&P 500 closed down 0.4%.

CNIS Perspective

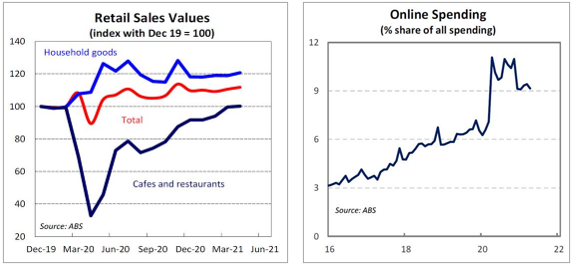

The overall trend in retail sales remains strong, despite a significant slump in early 2020. Data released yesterday revealed retail sales rose 1.1% for the month of April and up 11.8% relative to pre-pandemic levels in December 2019.

The trend reflects a continued increase in consumer confidence, a relatively high household savings ratio (as we wrote about yesterday), the strong recovery in employment and a strong housing market, which is helping to boost household balance sheets.

Further, the pandemic underpinned big changes in spending habits. Spending at cafés and restaurants fell sharply last year, however, is now back to pre-pandemic levels. A clear standout has been the household goods sector. While being stuck at home, many Australians have splurged on new TVs, whitegoods and other household appliances.

We are also doing more of our shopping online. Before the pandemic, online purchases accounted for around 6% of retail sales and had been trending up for several years. The pandemic has accelerated this shift.

The broad outlook for consumer spending remains strong given the factors outlined above, however, we may experience a few hurdles along the way with some isolated lockdowns, which further shows the importance of the vaccine rollout.

Should you wish to discuss this or any other investment related matter, please contact your Investment Services Team on (02) 4928 8500.

Disclaimer

The material contained in this publication is the nature of the general comment only, and neither purports, nor is intended to be advice on any particular matter. Persons should not act nor rely upon any information contained in or implied by this publication without seeking appropriate professional advice which relates specifically to his/her particular circumstances. Cutcher & Neale Investment Services Pty Limited expressly disclaim all and any liability to any person, whether a client of Cutcher & Neale Investment Services Pty Limited or not, who acts or fails to act as a consequence of reliance upon the whole or any part of this publication.

Cutcher & Neale Investment Services Pty Limited ABN 38 107 536 783 is a Corporate Authorised Representative of Cutcher & Neale Financial Services Pty Ltd ABN 22 160 682 879 AFSL 433814.

Cutcher's Investment Lens | 7 - 11 April 2025

The failed $3 million super tax: Division 296 is done… or is it?

Cutcher's Investment Lens - Update on Trump & Tariffs | 31 March - 4 April 2025

Liberation Day - April 2025 Snapshot

Smart investing for SMEs: The basics on how to get started and grow your business.