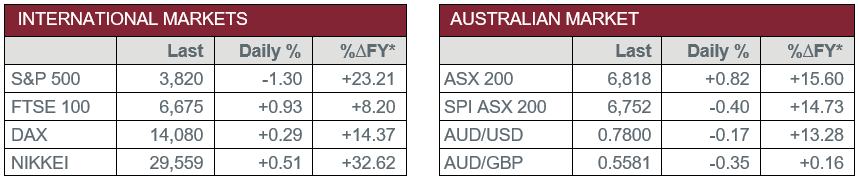

Pre-Open Data

Key Data for the Week

Key economic data released this week:

- Wednesday – AUS – Gross Domestic Product rose 3.1% in the December quarter, to post two consecutive quarters of +3.0% growth for the first time on record. However, growth for 2020 was down 1.1%.

- Wednesday – EUR – Producer Price Index rose 1.4% in February, while it was flat on an annual basis.

- Thursday – AUS – Retail Sales

- Thursday – EUR – Retail Sales

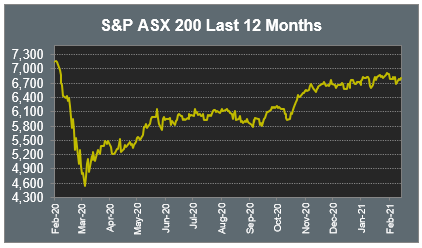

Australian Market

The Australian sharemarket rose 0.8% in a mixed session of trade. The Materials sector was the best performer; Fortescue Metals Group lifted 5.7% and South32 added 4.7%, while BHP and Rio Tinto rose 3.5% and 2.0% respectively.

The Financials sector also outperformed, led by the big four banks, which all rose between 1.1% and 2.5%.

The Health Care sector finished lower; CSL lost 1.0% and Cochlear fell 3.2%, while Sonic Healthcare bucked the trend to add 0.2%.

Consumer Staples stocks weakened; Woolworths slipped 1.7% and Coles lost 0.8%. The Information Technology sector also underperformed as Xero lost 2.7% and Afterpay fell 2.2%.

Nine Entertainment lost 1.0% after the announcement CEO Hugh Marks will be replaced by the boss of its Stan streaming business, Mike Sneesby.

The Australian futures market points to a 0.40% fall today, driven by weaker US markets.

Overseas Markets

European sharemarkets were mostly higher on Wednesday, while the broad based STOXX Europe 600 closed flat. UK banks outperformed with Barclays up 5.0%, after Chancellor Sunak announced the "biggest business tax cut in modern British history" and plans to review a tax surcharge on bank profits to make them more competitive against foreign rivals.

US sharemarkets closed lower overnight, with Technology and Consumer stocks the weakest performers, while Energy and Financials outperformed. Spotify and Shopify slipped 7.0% and 6.8% respectively, while Alphabet, Apple, Microsoft and Amazon all fell between 2.4% and 2.9%. PayPal suffered heavy losses, down 5.3%, while MasterCard and Visa fell 0.7% and 0.4% respectively.

By the close of trade, the Dow Jones slipped 0.4%, the S&P 500 lost 1.3% and the NASDAQ lost 2.7%.

CNIS Perspective

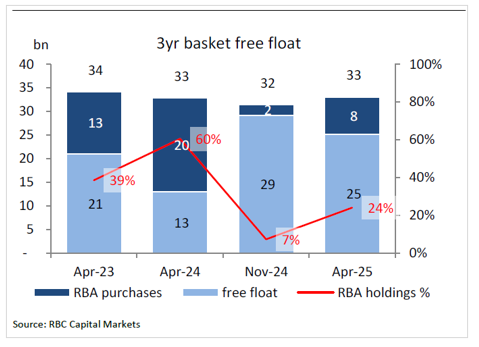

The last thing any central bank wants right now is a bond market sell-off and this week, the RBA clearly showed how determined they were in protecting the local bond market.

On Tuesday, the RBA entered the bond market and purchased $4 billion worth of bonds to prevent a sell-off and to defend their yield curve.

In fact, they’ve bought so many 3-year bonds they now own $13 billion of the $34 billion on offer, or 39% of the April 2023 dated bonds, and 60%, or $20 billion of the $33 billion April 2024 dated bonds.

As the RBA now owns more than half of the April 2024 bonds on issue, it makes price control a lot easier, given there is less available for trading.

Some sections of the market have been worried about inflation running wild. Clearly, central banks have a fair degree of control over this, and its unlikely to happen without a fight.

Should you wish to discuss this or any other investment related matter, please contact your Investment Services Team on (02) 4928 8500.

Disclaimer

The material contained in this publication is the nature of the general comment only, and neither purports, nor is intended to be advice on any particular matter. Persons should not act nor rely upon any information contained in or implied by this publication without seeking appropriate professional advice which relates specifically to his/her particular circumstances. Cutcher & Neale Investment Services Pty Limited expressly disclaim all and any liability to any person, whether a client of Cutcher & Neale Investment Services Pty Limited or not, who acts or fails to act as a consequence of reliance upon the whole or any part of this publication.

Cutcher & Neale Investment Services Pty Limited ABN 38 107 536 783 is a Corporate Authorised Representative of Cutcher & Neale Financial Services Pty Ltd ABN 22 160 682 879 AFSL 433814.

Smart investing for SMEs: The basics on how to get started and grow your business.

ATO updates: A quick guide on what business owners need to know.

Cutcher's Investment Lens | 24 - 28 March 2025

Is your current super fund holding you back? It might be time for an SMSF.

Cutcher's Investment Lens | 17 - 21 March 2025