Pre-Open Data

Key Data for the Week

Key economic data released this week:

- Tuesday – AUS – RBA Interest Rate Decision – The RBA cut the Official Cash Rate from 0.25% to a historical low of 0.1%.

- Wednesday – AUS – Retail Sales

- Wednesday – US – Presidential Election

Australian Market

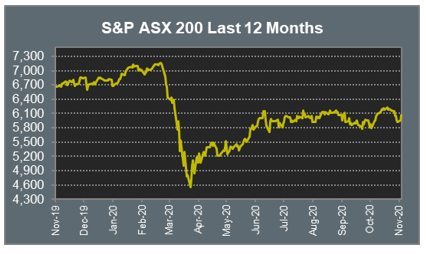

The Australian sharemarket climbed 1.9% yesterday, its strongest performance in a month. The gains followed a solid lead from overseas markets and the RBA’s decision to cut the Official Cash Rate to a historical low. All sectors closed higher, led by the Energy sector, up 5.3% following a rebound in oil prices. Woodside Petroleum added 5.5% and Santos jumped 6.5%, while Oil Search surged 7.5%.

The Industrials sector also enjoyed gains on Tuesday; Cleanaway Waste Management lifted 3.4%, Auckland International Airport added 2.1% and Sydney Airport rose 1.9%. Freight provider Brambles jumped 5.7% after the company raised its earnings guidance, stating that underlying profit growth is estimated to be between 3-5% for the financial year.

Travel and leisure stocks also outperformed; Webjet gained 8.7%, Flight Centre rose 7.0% and Helloworld Travel added 6.0%, while Qantas increased 3.7%.

The Financials sector closed higher; Commonwealth Bank rose 1.4%, ANZ added 1.1% and NAB lifted 0.4%, however, Westpac Bank fell 0.6%. Asset Managers were mixed; Magellan climbed 4.1%, while Australian Ethical Investment slipped 3.5%.

The Australian futures market points to a 0.07% rise today.

Overseas Markets

European sharemarkets extended its gains on Tuesday, as the broad based STOXX Europe 600 closed 2.3% higher, its best day since mid-June. The Financials sector led the gains; Barclays lifted 5.9% and Lloyds Bank rose 5.1%, while HSBC and Deutsche Bank gained 4.3% and 2.3% respectively. Automobile stocks also outperformed; Luxury automaker Ferrari improved 7.1% after the company provided an optimistic earnings forecast, while BMW and Volkswagen gained 4.1% and 3.1% respectively.

US sharemarkets also advanced overnight as investors awaited the results of the US presidential election. Gains were broad based, with the Industrials and Financials sectors the strongest performers. Goldman Sachs increased 4.1% and Citigroup added 3.1%, while Bank of America rose 2.6%. The Information Technology sector also closed higher; NVIDIA climbed 3.5% and Spotify gained 2.1%, while Microsoft and Apple improved 2.0% and 1.5% respectively. By the close of trade, the Dow Jones rose 2.1% and the NASDAQ lifted 1.9%, while the S&P 500 gained 1.8%.

CNIS Perspective

Today is all about the US election, with global markets focused on the results, as each state’s votes begin to flow in.

Results start to dribble in mid-morning Australian time, and in the past the outcome has been known in the early afternoon, in what can be a volatile day of trading, especially in currency markets.

However, this year’s results could be delayed to some degree, with a record 98 million ballots already cast prior to election day, which could take days, if not longer, to tally.

A Democratic clean sweep could see a US$3 trillion stimulus package issued, while under a hypothetical outcome of a stalemate Biden win and Republican control of the Senate, the total could be closer to just US$1 trillion. Both likely to have an effect on currency and equity markets.

While it will be a fascinating day to watch play out, currency markets overnight have succumbed to pre-polls, pricing in the increased likelihood of a Biden victory, which has seen the softening of the US Dollar against most major currencies as more government stimulus leads to a devaluation of the US currency.

Should you wish to discuss this or any other investment related matter, please contact your Investment Services Team on (02) 4928 8500.

Disclaimer

The material contained in this publication is the nature of the general comment only, and neither purports, nor is intended to be advice on any particular matter. Persons should not act nor rely upon any information contained in or implied by this publication without seeking appropriate professional advice which relates specifically to his/her particular circumstances. Cutcher & Neale Investment Services Pty Limited expressly disclaim all and any liability to any person, whether a client of Cutcher & Neale Investment Services Pty Limited or not, who acts or fails to act as a consequence of reliance upon the whole or any part of this publication.

Cutcher & Neale Investment Services Pty Limited ABN 38 107 536 783 is a Corporate Authorised Representative of Cutcher & Neale Financial Services Pty Ltd ABN 22 160 682 879 AFSL 433814.

Cutcher's Investment Lens | 17 - 21 March 2025

Put your hard-earned dollars to work: Smart investing for doctors.

Fringe Benefits Tax year-end: Important updates and insights.

Cutcher's Investment Lens | 10 - 14 March 2025

Cutcher's Investment Lens | 3 - 7 March 2025