Pre-Open Data

Key Data for the Week

- Wednesday – UK – House Prices rose 0.7% in October, higher than expected.

- Wednesday – US – FOMC Rate Decision – The target rate remained unchanged (0%-0.25%), but it will reduce bond purchases by US$15 billion each month starting later this month.

- Wednesday – AUS – Building Approvals fell 4.3% in September, well below expectations.

- Thursday – AUS – Retail Sales

- Thursday – UK – BoE Policy Meeting

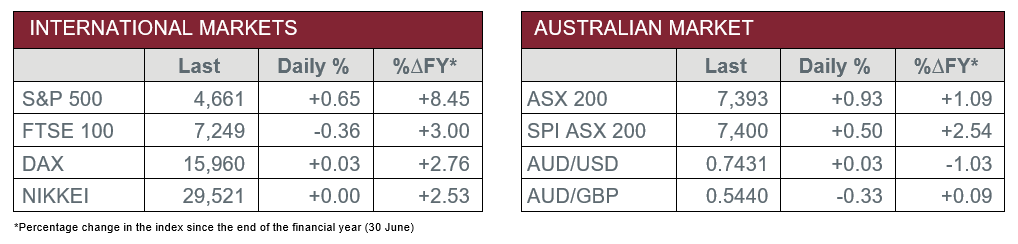

Australian Market

The Australian sharemarket rebounded on Wednesday, as the local market closed 0.9% higher. Most sectors advanced, except Information Technology (-0.2%), led by Materials and Financials. The strength in the Financials sector could be attributable to the Reserve Bank’s meeting on Tuesday, which paved the way for earlier interest rate increases, after it abandoned its 2024 yield curve target and forward guidance.

The Materials sector recovered from losses made earlier this week, as it broadly rebounded 1.4%. Lithium producers were standouts, with Orocobre and Pilbara Minerals ahead 6.7% and 5.4% respectively. Meanwhile, sector heavyweights, BHP (1.1%), Fortescue Metals Group (3.1%) and Rio Tinto (1.2%) also performed well. Another key mover included James Hardie, which advanced 3.6%.

The Financials sector (1.2%) performed strongly, as all four major banks advanced. ANZ led gains, up 2.3%, followed by NAB (1.4%), Commonwealth Bank (1.2%) and Westpac (0.1%). Westpac’s share price has weakened recently after a substandard full-year report, alongside narrowed profit margins, caused by a $460 million rise in costs in the second half of the year. Macquarie Group was another key gainer, ahead 1.9%.

The Australian futures point to a 0.50% rise today.

Overseas Markets

European sharemarkets were mixed on Wednesday, as basic resources stocks broadly gained, as the sector rose 0.9%. The European STOXX 600 closed at record highs, up 0.4%, while the German DAX was relatively flat and the UK FTSE 100 lost 0.4%. In London trade, Rio Tinto held its ground, while BHP edged 0.8% higher. HelloFresh was a key mover in the session, after it advanced 6.5%, as its strong Q3 2021 results continue to drive its share price higher. On the other hand, wind turbine manufacturer, Vestas Wind Systems, plunged 18.2% after it slashed its 2021 outlook for a second time this year.

US sharemarkets reached record highs on Wednesday, after the US Federal Reserve’s plan to taper its bond purchases met investor expectations. This demonstrated the importance of monetary policy forward guidance in managing expectations to limit its impact on markets. The Dow Jones, S&P 500 and NASDAQ all made gains, up 0.3%, 0.7% and 1.0% respectively. Most sectors advanced, led by Consumer Discretionary (1.8%) and Materials (1.1%). Online retail giant, Amazon, was a key mover, as it climbed 2.2%. Other important movers included technology platform providers Prosus (3.8%) and Fastly (8.1%), alongside cryptocurrency miner, Bitfarms (6.5%), and software developer, Unity (2.6%). Meanwhile, game developer Activision Blizzard (-14.1%) suffered, after it delayed the release of two major games.

CNIS Perspective

Tuesday’s RBA board meeting may have appeared as a ‘business as usual’ meeting, but the devil is sometimes in the detail.

While the Official Cash Rate was, as expected, left at 0.10%, the RBA’s decision to discontinue their Yield Curve Control (YCC) suggests improvement in the economy is stronger than expected. Their previously stated YCC was aimed at pegging all government issued bonds maturing before, and including, April 2024 at 0.10%, in line with the Official Cash Rate.

As of Tuesday, the April 2024 bond will not be pegged, which brings forward the likelihood of a rising Official Cash Rate to mid-2023.

Furthermore, this sets a precedent that if economic conditions continue to improve ahead of RBA forecasts, they may discontinue the YCC of April 2023 bonds, bringing forward guidance to November 2022. Likewise, if better yet again, from November 2022 to July 2022.

In other words, the RBA has signalled that a higher Official Cash Rate is likely within a year or two, should the economy show continued resilience.

Should you wish to discuss this or any other investment related matter, please contact your Investment Services Team on (02) 4928 8500.

Disclaimer

The material contained in this publication is the nature of the general comment only, and neither purports, nor is intended to be advice on any particular matter. Persons should not act nor rely upon any information contained in or implied by this publication without seeking appropriate professional advice which relates specifically to his/her particular circumstances. Cutcher & Neale Investment Services Pty Limited expressly disclaim all and any liability to any person, whether a client of Cutcher & Neale Investment Services Pty Limited or not, who acts or fails to act as a consequence of reliance upon the whole or any part of this publication.

Cutcher & Neale Investment Services Pty Limited ABN 38 107 536 783 is a Corporate Authorised Representative of Cutcher & Neale Financial Services Pty Ltd ABN 22 160 682 879 AFSL 433814.

Cutcher's Investment Lens | 7 - 11 April 2025

The failed $3 million super tax: Division 296 is done… or is it?

Cutcher's Investment Lens - Update on Trump & Tariffs | 31 March - 4 April 2025

Liberation Day - April 2025 Snapshot

Smart investing for SMEs: The basics on how to get started and grow your business.