Pre-Open Data

Key Data for the Week

Key economic data released this week:

- Thursday – EUR – Retail Sales were 2% higher in December, exceeding expectations of a 1.6% rise.

- Thursday – UK – BoE Interest Rate Decision – the BoE left the Interest Rate unchanged at 0.1%.

- Friday – AUS – Retail Sales

- Friday – US – Unemployment Rate

Australian Market

The Australian sharemarket ended its three-day rally yesterday to close 0.9% weaker. Losses were broad based, with the Utilities, REITs and Health Care sectors the weakest performers.

The Energy sector also closed lower on Thursday, down 1.2%. Origin Energy sunk 6.9% after the company lowered earnings guidance for its Energy Markets business. Earnings guidance was lowered to between $1 billion and $1.14 billion, from between $1.15 billion and $1.3 billion, due to the impacts of COVID-19 on energy demand. Woodside Petroleum lost 0.4% and Santos fell 0.7%, while Beach Energy bucked the trend to close up 2.0%.

The Materials sector saw mixed performance among the mining heavyweights. Rio Tinto and Fortescue Metals gained 0.5% and 1.8% respectively, while BHP slipped 0.5%. Goldminers were weaker; Newcrest Mining lost 2.2% and Evolution Mining dropped 2.3%, while Northern Star slumped 3.0%.

The Utilities sector was down 2.0% yesterday. APA Group fell 1.9% and Meridian Energy lost 3.7%. AGL Energy gave up 3.6% after the company announced an expected $2.69 billion write-down.

The Australian futures market points to a 1.02% rise today.

Overseas Markets

European sharemarkets were mixed overnight. The Energy sector underperformed, as BP slipped 1.3% and Royal Dutch Shell lost 2.0% after the company reported its lowest annual profit in two decades. Unilever gave up 6.2% after the company’s sales growth target was lower than expected. By the close of trade, the German DAX rose 0.9% and the STOXX Europe 600 added 0.6%, while the UK FTSE 100 fell 0.1%.

US sharemarkets advanced on Thursday, with the Financials sector the strongest performer. Citigroup added 2.1% and JP Morgan Chase gained 2.3%, while Bank of America rose 2.9%. Financial services also saw strong gains; Visa and MasterCard lifted 3.9% and 2.4% respectively, while PayPal climbed 7.4% after the company’s earnings report exceeded expectations. By the close of trade, the S&P 500 and Dow Jones both gained 1.1%, while the NASDAQ rose 1.2%.

CNIS Perspective

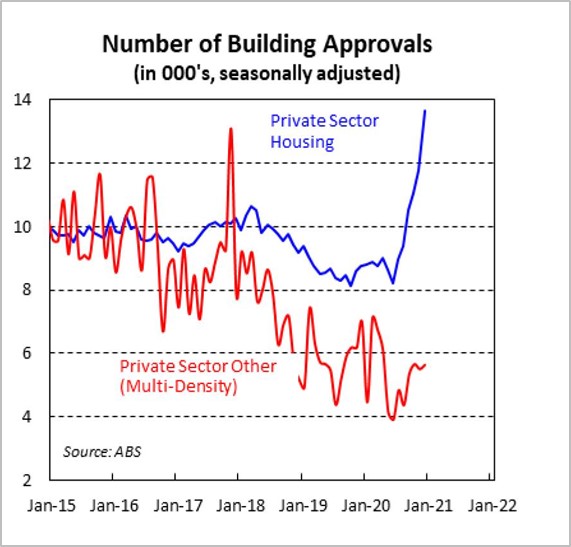

Building approvals have jumped 22.8% from a year ago after a 10.9% rise in December, mainly boosted by private house approvals which were up 15.8% in December, resulting in a jump of 55.6% over the year.

By any measure, this is a boom.

The result is underpinned by historically low interest rates, and with interest rates unlikely to rise any time soon, we should continue to see strong approval numbers into the foreseeable future.

Strong building approvals are positive for the economy as they should boost employment, increase government tax revenue and potentially create much needed wage growth.

Interestingly, building approval growth has been achieved with international borders closed. Therefore little, if any, migration to Australia has contributed to the figures.

Immigration has been a major factor in generating Australian economic growth over many years and without it we would have experienced far more recessions than we have had.

This adds further weight to a favourable economy in 2021 should the borders reopen for migrants, reinforcing the importance on a successful rollout of vaccines.

Should you wish to discuss this or any other investment related matter, please contact your Investment Services Team on (02) 4928 8500.

Disclaimer

The material contained in this publication is the nature of the general comment only, and neither purports, nor is intended to be advice on any particular matter. Persons should not act nor rely upon any information contained in or implied by this publication without seeking appropriate professional advice which relates specifically to his/her particular circumstances. Cutcher & Neale Investment Services Pty Limited expressly disclaim all and any liability to any person, whether a client of Cutcher & Neale Investment Services Pty Limited or not, who acts or fails to act as a consequence of reliance upon the whole or any part of this publication.

Cutcher & Neale Investment Services Pty Limited ABN 38 107 536 783 is a Corporate Authorised Representative of Cutcher & Neale Financial Services Pty Ltd ABN 22 160 682 879 AFSL 433814.

Smart investing for SMEs: The basics on how to get started and grow your business.

ATO updates: A quick guide on what business owners need to know.

Cutcher's Investment Lens | 24 - 28 March 2025

Is your current super fund holding you back? It might be time for an SMSF.

Cutcher's Investment Lens | 17 - 21 March 2025