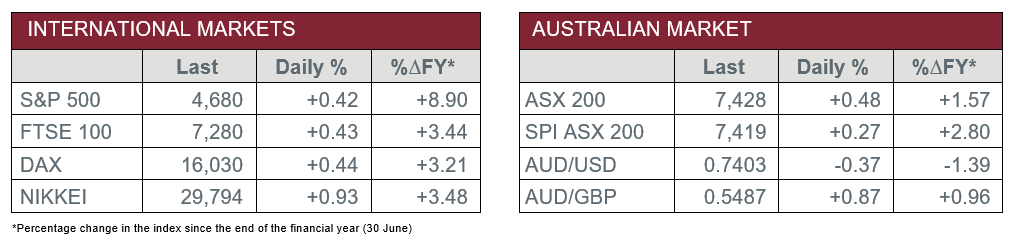

Pre-Open Data

Key Data for the Week

- Thursday – AUS – Retail Sales fell 4.4% for the September quarter.

- Thursday – UK – BoE Policy Meeting – The target interest rate remained unchanged at 0.1%.

- Friday – EUR – Retail Sales

- Friday – US – Unemployment Rate

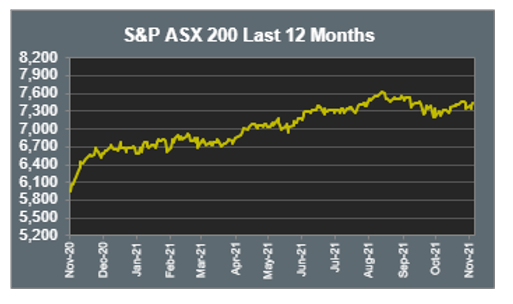

Australian Market

The Australian sharemarket edged 0.5% higher on Thursday, despite mixed September quarterly company reports which distracted investors. Most sectors advanced again yesterday, however, Energy was a major detractor, down 2.0%, after global oil prices weakened. The companies hardest hit included Woodside Petroleum (-2.7%), Beach Energy (-4.8%) and Oil Search (-3.1%).

The Industrials sector gained 0.6%, roughly in line with the overall market, however, some notable performers included Cleanaway Waste Management (2.8%) and Qantas (1.8%). Similarly, the Health Care sector performed modestly, up 0.5%, with Australian Clinical Labs (1.6%) and Pro Medicus (3.3%) being standouts.

The Financials sector performed well, ahead 1.0%, with all major banks in the green. Commonwealth Bank led gains, up 1.4%, followed by ANZ (0.9%), NAB (0.4%) and Westpac (0.2%). Macquarie Group (1.3%) continued to steam ahead, ~14.3% higher month on month, to now sit just above $200 per share. Insurance group NIB Holdings (5.8%) was another key mover, after it revealed an 8.5% increase in revenue since July.

Other companies that reported included food related stocks, Domino’s Pizza (-18.4%) and poultry group Ingham’s (-5.0%). Both commented on increased food costs which threatened profit margins. Alternatively, CSR, one of Australia’s largest construction groups, jumped 4.7%, after it reported increased profit.

The Australian futures point to a 0.27% rise today.

Overseas Markets

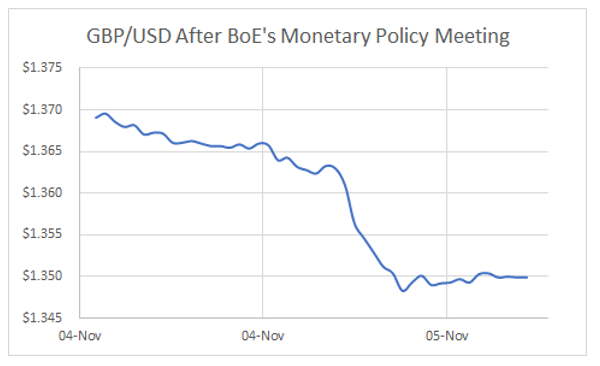

European sharemarkets closed higher on Thursday, as the Eurozone’s volatility gauge fell to its lowest level since mid-June. The European STOXX 600, German DAX and UK FTSE 100 all advanced around 0.4%. Market performance, and low volatility, can be attributable to the Bank of England’s unexpected decision to keep interest rates on hold despite inflation concerns. Gains made in the session were led by real estate stocks, which broadly rose 2.3%. Other notable stocks included Veolia Environnement, which added 4.2%, and British bank Barclays, which lost 4.0%.

US sharemarkets were mixed yesterday, as investors digested news that the Federal Reserve, like its global counterparts, was in no rush to increase interest rates. This resulted in the Financials sector down 1.3%, the primary laggard in the session. On the other hand, the Information Technology sector led gains, up 1.5%, dragged higher by computer chip related stocks. This came after chip manufacturer Qualcomm (12.7%) issued a strong financial forecast. Chip designer, NVIDIA (12.0%), also benefitted from the positive industry outlook. Meanwhile, technology giants Microsoft (0.7%), Alphabet (1.3%) and e-commerce retailer Amazon (2.8%) performed strongly. This resulted in the technology heavy NASDAQ closing up 0.8%, while the S&P 500 rose 0.4% and the Dow Jones was 0.1% lower.

CNIS Perspective

The Bank of England (BoE) held interest rates steady overnight, defying many investors’ expectations that it would become the first major central bank to hike rates following the pandemic.

The BoE voted 7-2 to keep its benchmark interest rate unchanged at the historic low of 0.1%. The move sent the British Pound tumbling and triggered a rally in government bonds.

The decision to back away from raising rates attracted a storm of criticism over the BoE’s communications, with BoE Governor Andrew Bailey just last month talking about the need to act now to keep inflation expectations in hand.

The BoE has signalled that the cost of living will intensify, with inflation expected to hit 5% by next April. It also cut its economic growth forecasts for the UK, but more encouragingly, only expects a small rise in the unemployment rate from the ending of the furlough scheme.

Make no mistake though, interest rate lift-off is just around the corner.

Should you wish to discuss this or any other investment related matter, please contact your Investment Services Team on (02) 4928 8500.

Disclaimer

The material contained in this publication is the nature of the general comment only, and neither purports, nor is intended to be advice on any particular matter. Persons should not act nor rely upon any information contained in or implied by this publication without seeking appropriate professional advice which relates specifically to his/her particular circumstances. Cutcher & Neale Investment Services Pty Limited expressly disclaim all and any liability to any person, whether a client of Cutcher & Neale Investment Services Pty Limited or not, who acts or fails to act as a consequence of reliance upon the whole or any part of this publication.

Cutcher & Neale Investment Services Pty Limited ABN 38 107 536 783 is a Corporate Authorised Representative of Cutcher & Neale Financial Services Pty Ltd ABN 22 160 682 879 AFSL 433814.

Cutcher's Investment Lens | 7 - 11 April 2025

The failed $3 million super tax: Division 296 is done… or is it?

Cutcher's Investment Lens - Update on Trump & Tariffs | 31 March - 4 April 2025

Liberation Day - April 2025 Snapshot

Smart investing for SMEs: The basics on how to get started and grow your business.