Pre-Open Data

Key Data for the Week

- Monday – AUS – Building Approvals eased 7.1% in May, following a 5.7% fall in April.

- Monday – AUS – Retail Sales increased 0.4% in May, up 7.7% year-on-year.

- Tuesday – AUS – RBA Interest Rate Decision

- Tuesday – EUR – Retail Sales

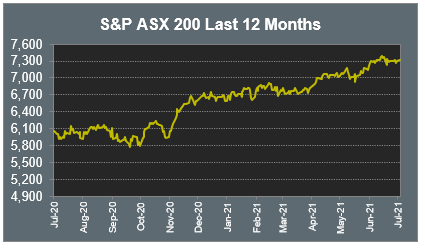

Australian Market

The Australian sharemarket added 0.1% yesterday in a mixed session of trade ahead of the Reserve Bank’s interest rate decision today. The Industrials sector was the main outperformer, up 4.9%, as Sydney Airport rallied 34.0% after the company announced a $22 billion takeover offer, while Auckland Airport rose 5.5%.

The Energy sector also advanced; Woodside Petroleum added 2.8%, while Oil Search and Santos both rose 2.0%. The Materials sector lifted 0.1% with mixed performances among mining heavyweights; Fortescue Metals gained 0.5% and Rio Tinto lifted 0.3%, however, BHP slipped 0.2%.

Consumer Discretionary stocks weakened; Harvey Norman slipped 0.2% and Wesfarmers fell 0.6%, while Super Retail Group gave up 0.9%. Australia’s largest gambling company Tabcorp shed 4.4% after it announced it will demerge its Lotteries and Keno business into a separate ASX-listed company and will not sell its wagering and media arm, which includes TAB outlets and Sky Racing TV.

Losses among the major banks weighed on the Financials sector, which closed down 0.5%. ANZ was the weakest performer, down 0.8%, followed by Westpac, which lost 0.4%, while Commonwealth Bank and NAB both slipped 0.3%. Fund managers also declined; Australian Ethical Investment gave up 8.9%, while Magellan Financial Group lost 2.1%.

The Australian futures market points to 0.26% rise today.

Overseas Markets

European sharemarkets advanced overnight, following the release of positive Eurozone economic data and the announcement by British Prime Minister Boris Johnson that all COVID-19 restrictions are planned to be lifted on 19 July 2021. Travel and leisure stocks improved as a result; International Airlines Group gained 4.9% and easyJet rose 3.2%, while Ryanair lifted 2.0%.

Banking stocks were the strongest performers; Barclays gained 3.1% and Lloyds Bank added 1.9%, while HSBC and Deutsche Bank rose 1.6% and 1.5% respectively. British supermarket chain Morrisons climbed 11.6% to a near eight-year high after US private equity firm Apollo Global Management became the third suitor for the company.

By the close of trade, the German DAX rose 0.1% and the broad based STOXX Europe 600 added 0.3%, while the UK FTSE 100 gained 0.6%.

US sharemarkets were closed on Monday for the 4th of July holiday.

CNIS Perspective

Yesterday saw arguably Australia’s most important listed travel asset, Sydney Airport, receive a takeover offer, in a sure sign that investors are moving forward from COVID-19 and its ramifications across the travel sector.

Sydney Airport floated in 2002 and is the only publicly listed airport in Australia. It received an $8.25/share (or $22 billion) offer from a consortium of private equity firms, a price just shy of pre-pandemic levels.

This comes despite empty corridors in recent times, with the airport’s international passenger numbers still down ~90% and domestic passenger numbers ~40% below pre-COVID levels.

Record low interest rates have fueled the attractiveness of bulky infrastructure assets like Sydney Airport. Just last week, we saw a 49% share of Telstra’s mobile tower network being sold. Further, a stake in Sydney toll road WestConnex is on the cards, with Australian infrastructure at the forefront of merger and acquisition news at the moment, as private equity firms chase trophy assets while debt financing is better than ever.

Should you wish to discuss this or any other investment related matter, please contact your Investment Services Team on (02) 4928 8500.

Disclaimer

The material contained in this publication is the nature of the general comment only, and neither purports, nor is intended to be advice on any particular matter. Persons should not act nor rely upon any information contained in or implied by this publication without seeking appropriate professional advice which relates specifically to his/her particular circumstances. Cutcher & Neale Investment Services Pty Limited expressly disclaim all and any liability to any person, whether a client of Cutcher & Neale Investment Services Pty Limited or not, who acts or fails to act as a consequence of reliance upon the whole or any part of this publication.

Cutcher & Neale Investment Services Pty Limited ABN 38 107 536 783 is a Corporate Authorised Representative of Cutcher & Neale Financial Services Pty Ltd ABN 22 160 682 879 AFSL 433814.

Cutcher's Investment Lens | 7 - 11 April 2025

The failed $3 million super tax: Division 296 is done… or is it?

Cutcher's Investment Lens - Update on Trump & Tariffs | 31 March - 4 April 2025

Liberation Day - April 2025 Snapshot

Smart investing for SMEs: The basics on how to get started and grow your business.