Pre-Open Data

Key Data for the Week

Key economic data released this week:

- Tuesday – AUS – RBA Interest Rate Decision

- Tuesday – US – Trade Balance

- Wednesday – EUR – ECB President Lagarde Speech

- Wednesday – US – FOMC Minutes

- Thursday – EUR – ECB Monetary Policy Meeting Accounts

- Thursday – US – Initial Jobless Claims

- Friday – AUS – Home Loans

- Friday – UK – Gross Domestic Product

- Friday – UK – Industrial Production

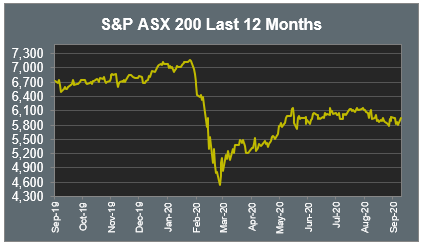

Australian Market

The Australian sharemarket enjoyed its best session since 16 June, buoyed by positive reports of US President Trump’s recovery from COVID-19, as well as increased involvement from fund managers who looked to reposition their share portfolios in response to a negative September and ahead of today’s Federal Budget, which is expected to focus largely on increased government expenditure.

Gains were broad based, with all sectors ending the session higher, led by Energy, as Woodside Petroleum climbed 4.8%. The Financials sector was boosted by the big four banks, which all gained between 3.6% and 4.3%, with Westpac the best performer. Despite iron ore prices remaining steady, mining heavyweights BHP and Rio Tinto rose with the market, up 2.9% and 2.2% respectively, to drive the Materials sector higher. Telecommunications giant Telstra strengthened 2.2%, while Health Care heavyweight CSL rose 1.6%.

The Australian futures market points to a 0.44% rise today, driven by stronger overseas markets overnight.

Overseas Markets

European sharemarkets closed at a two-week high on Monday, buoyed by US President Trump’s positive health update, hopes of a new US stimulus package and dealmaking news. Weir Group strengthened 15.9%, after British engineering firm announced the sale of its oil and gas division. However, the world’s second-largest cinema chain, Cineworld, tumbled 36.2% after the company said it would close all of its UK and US movie theatres this week. The German DAX rose 1.1%, the broad based STOXX Europe 600 climbed 0.8% and the UK FTSE 100 added 0.7%.

US sharemarkets also rose overnight, with Energy, Health Care and Technology stocks among the best performers. Technology heavyweights Spotify (+4.6%), NVIDIA (+4.4%), Apple (+3.1%) and Microsoft (+2.0%) rebounded from Friday's sell-off. Regeneron Pharmaceuticals surged 7.1% after President Trump was given an experimental antibody treatment made by the company, while MyoKardia strengthened 57.8% after pharmaceutical giant Bristol Myers Squibb (+0.8%) announced it would buy the company for around US$13 billion. By the close of trade, the Dow Jones rose 1.7%, the S&P 500 lifted 1.8% and the NASDAQ added 2.3%.

CNIS Perspective

Debate about who is the best US President for equities has stepped up following Trump’s COVID-19 diagnosis.

So far, the debate has centred on Democratic Party leader Joe Biden being associated with a market sell-off, not rally.

However, a look at the correlation between Biden’s probability of winning and the S&P 500 index since April suggests this is not necessarily the case.

The graph below indicates the market has remained strong even as Biden’s probability of winning has increased.

Biden’s campaign is based on US fiscal stimulus through government expenditure and is looked upon as beneficial for US equities in the short to medium term.

Should you wish to discuss this or any other investment related matter, please contact your Investment Services Team on (02) 4928 8500.

Disclaimer

The material contained in this publication is the nature of the general comment only, and neither purports, nor is intended to be advice on any particular matter. Persons should not act nor rely upon any information contained in or implied by this publication without seeking appropriate professional advice which relates specifically to his/her particular circumstances. Cutcher & Neale Investment Services Pty Limited expressly disclaim all and any liability to any person, whether a client of Cutcher & Neale Investment Services Pty Limited or not, who acts or fails to act as a consequence of reliance upon the whole or any part of this publication.

Cutcher & Neale Investment Services Pty Limited ABN 38 107 536 783 is a Corporate Authorised Representative of Cutcher & Neale Financial Services Pty Ltd ABN 22 160 682 879 AFSL 433814.

AI Explainer: Who’s Behind the Tools You Keep Hearing About?

Ready for Next-Level Automation? See What’s New in Ostendo 243

Thinking ahead, acting today: Must-know succession strategies for practice owners

From locum shifts to running your own practice: When your cover needs an upgrade

The million-dollar question: How much super do doctors really need to retire comfortably?