Pre-Open Data

Key Data for the Week

- Monday – AUS – TD Securities Inflation

- Tuesday – AUS – RBA Interest rate Decision

- Tuesday – EUR – Employment Change

- Tuesday – EUR – Gross Domestic Product

- Wednesday – US – Consumer Credit

- Thursday – AUS – Weekly Payroll Jobs

- Thursday – CHINA – Consumer Price Index

- Thursday – US – Initial Jobless Claims

- Friday – UK – Industrial Production

- Friday – US – Producer Price Index

Australian Market

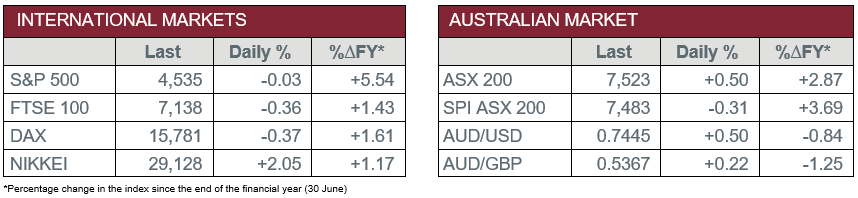

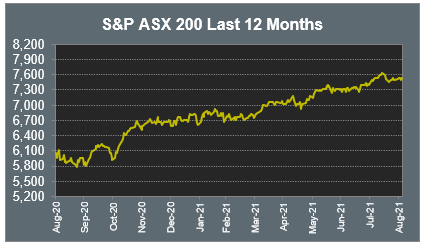

The Australian sharemarket advanced on Friday to close up 0.5%. The Materials and Energy sectors were the top improvers, up 1.2% and 0.8% respectively, while Consumer Staples and Information Technology both finished the session lower. Over the week, the local ASX 200 gained 0.5%, its second consecutive week of improvements.

Mining heavyweights enjoyed gains on Friday despite weakness in the price of iron ore. Rio Tinto climbed 2.5% and BHP rose 1.0%, while Fortescue Metals added 0.7%. Gold miners were mixed; Evolution Mining and Northern Star Resources lifted 0.3% and 0.2% respectively, while Newcrest Mining slipped 0.7%.

Buy-now-pay-later providers weighed on the Information Technology sector; Afterpay lost 2.8%, while Zip Co gave up 1.3%. Enterprise software company TechnologyOne gained 3.5% after announcing it agreed to acquire UK education software provider Scientia Resource Management.

The Australian futures point to a 0.31% fall today.

Overseas Markets

European sharemarkets eased on Friday. Retail and travel stocks were the weakest performers; International Airlines Group fell 2.5%, while easyJet and Lufthansa slipped 1.7% and 1.0% respectively. The Financials sector was also weaker; Lloyds Bank slid 0.5% and Deutsche Bank lost 0.2%, while Barclays Bank finished the session flat.

By the close of trade, the STOXX Europe 600 shed 0.6%, while the UK FTSE 100 and German DAX both fell 0.4%.

US sharemarkets were mixed on Friday, as employment data raised concerns of a slow economic recovery. Information Technology was the strongest sector, up 0.4%; Fortinet and NVIDIA both rose 2.0%, while Apple and Alphabet both added 0.4%. Consumer Discretionary stocks also enjoyed gains; Shopify lifted 0.8% and Amazon added 0.4%.

By the close of trade, the NASDAQ lifted 0.2% and the Dow Jones lost 0.2%, while the S&P 500 closed relatively flat.

CNIS Perspective

The US Securities and Exchange Commission (SEC) Chair Gary Gensler has been calling on Congress to give the agency more authority to better police cryptocurrency trading and lending. Crypto marketplaces for decentralised finance, better known as ‘DeFi’, have grown more than 100-fold the past 18 months, from ~US$1 billion to US$141 billion today by market capitalisation.

A great example of DeFi is the difference when considering the centralised exchanges such as NASDAQ-listed crypto trading platform Coinbase rely on private infrastructure to match supply and demand, which is managed internally in their own servers. In contrast, decentralised exchanges (DEXs) bring buyers and sellers together, are permissionless, meaning that anyone can access them and trade without intermediaries.

Gary Gensler, who is well versed in crypto having taught blockchain technology at MIT, is keen to place some rules around the rising number of financial applications that currently reside in regulatory no man’s land. As cryptocurrencies such as Bitcoin and Ethereum are considered to be commodities by the SEC, the DeFi apps act more like security trading platforms and are reaping in huge numbers in fees. The largest decentralised exchange, UniSwap, charges a 0.3% fee on all transactions, raking in US$4.6 million in fees every day. These applications have grown exponentially, are an amazing innovation and should be applauded, but given their size are now too big and growing too fast to be ignored by regulators.

Should you wish to discuss this or any other investment related matter, please contact your Investment Services Team on (02) 4928 8500.

Disclaimer

The material contained in this publication is the nature of the general comment only, and neither purports, nor is intended to be advice on any particular matter. Persons should not act nor rely upon any information contained in or implied by this publication without seeking appropriate professional advice which relates specifically to his/her particular circumstances. Cutcher & Neale Investment Services Pty Limited expressly disclaim all and any liability to any person, whether a client of Cutcher & Neale Investment Services Pty Limited or not, who acts or fails to act as a consequence of reliance upon the whole or any part of this publication.

Cutcher & Neale Investment Services Pty Limited ABN 38 107 536 783 is a Corporate Authorised Representative of Cutcher & Neale Financial Services Pty Ltd ABN 22 160 682 879 AFSL 433814.

Cutcher's Investment Lens | 7 - 11 April 2025

The failed $3 million super tax: Division 296 is done… or is it?

Cutcher's Investment Lens - Update on Trump & Tariffs | 31 March - 4 April 2025

Liberation Day - April 2025 Snapshot

Smart investing for SMEs: The basics on how to get started and grow your business.