Pre-Open Data

Key Data for the Week

Key economic data released this week:

- Monday – CHINA – Trade Balance

- Tuesday – AUS – NAB Business Conditions & Confidence

- Tuesday – EUR – Gross Domestic Product

- Wednesday – CHINA – Consumer Price Index

- Thursday – EUR – ECB Interest Rate Decision

- Thursday – UK – Gross Domestic Product

- Thursday – US – Consumer Price Index

- Friday – US – COVID-19 Vaccine Announcement

Australian Market

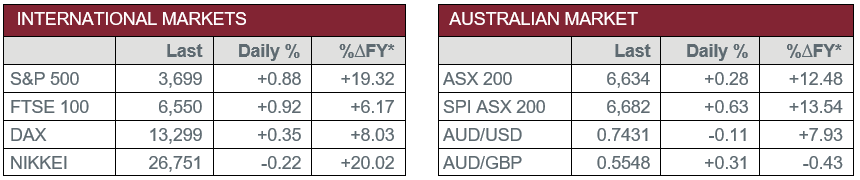

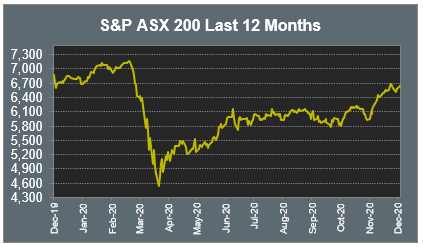

The Australian sharemarket closed higher for a fourth consecutive session on Friday, up 0.3%, to continue to trade around nine-month highs. Sector performance was mixed, with gains driven by Energy and Financials stocks, while the Industrials sector was the major laggard. The local ASX 200 lifted 0.5% across the five trading sessions to Friday, to close higher for a fifth successive week.

The Financials sector gains on Friday were supported the big four banks, which all lifted between 0.3% and 1.3%, with ANZ the best performer. Macquarie Group climbed a further 2.3%, as the company continues to rally following Thursday’s announcement of an acquisition for US financial services firm Waddell & Reed for $2.3 billion.

Iron ore miners were mixed despite the price exceeding US$137 per tonne, as the commodity continues to be well supported by strong demand from China. Mining heavyweights BHP and Rio Tinto gained 0.6% and 0.8% respectively, however, Fortescue Metals slipped 0.2%.

Premier Investments (PMV) added 0.8% after the company held its virtual AGM. The owner behind brands including Jay Jays, Peter Alexander and Smiggle, PMV announced online sales rose 70% for the first 18 weeks of FY21, following record purchases across Black Friday and Cyber Monday.

The Australian futures market points to a 0.63% rise today, driven by broadly stronger overseas markets on Friday.

Overseas Markets

European sharemarkets were stronger on Friday, boosted by oil stocks. Global crude oil prices rose after OPEC+ members reached a compromise to continue to increase output slightly from January and hold subsequent monthly meetings to decide on further movements. Progress trade talks between the European Union and the UK continued, though said to be “very difficult”. Industrials giants CRH (+1.4%), Eiffage (+1.9%), Veolia Environnement (+1.0%) and Vinci (+0.5%) all posted gains.

By the close of trade, the broad based STOXX Europe 600 rose 0.6% and the German DAX climbed 0.4%, while the UK FTSE 100 added 0.9% to nine-month highs.

US sharemarkets all closed stronger on Friday. Lower than expected jobs growth figures in November raised expectations that a new fiscal relief bill will be agreed. Energy, Industrials and Materials were among the best performers. Payment providers enjoyed a strong session; MasterCard (+2.8%), Visa (+2.2%) and PayPal (+1.5%) all strengthened, while Starbucks added 2.7%. The S&P 500 climbed 0.9%, the Dow Jones gained 0.8% and the NASDAQ increased 0.7%.

CNIS Perspective

British mathematician Clive Humby is credited with coining the phrase “data is the new oil”. Often lost in the catchiness of this idea is Humby’s further explanation that “although inherently valuable, data needs processing, just as oil needs refining before its true value can be unlocked”.

The value of “unlocking” data was made abundantly clear last week when S&P Global announced a US$44 billion all-stock deal for IHS Markit, which is set to be the biggest deal of 2020. These are the two biggest data providers on Wall Street. S&P operates 3 primary businesses: 1) bond ratings; 2) stock indexing (including the ubiquitous S&P 500); and 3) data analytics (CapIQ, Platts). IHS Markit is known for its credit derivatives data, as well as energy and transportation data.

Data is an essential resource that powers the information economy in much the way that oil has fuelled the industrial economy. Data flows like oil but we must “drill down” into data to extract value from it.

Should you wish to discuss this or any other investment related matter, please contact your Investment Services Team on (02) 4928 8500.

Disclaimer

The material contained in this publication is the nature of the general comment only, and neither purports, nor is intended to be advice on any particular matter. Persons should not act nor rely upon any information contained in or implied by this publication without seeking appropriate professional advice which relates specifically to his/her particular circumstances. Cutcher & Neale Investment Services Pty Limited expressly disclaim all and any liability to any person, whether a client of Cutcher & Neale Investment Services Pty Limited or not, who acts or fails to act as a consequence of reliance upon the whole or any part of this publication.

Cutcher & Neale Investment Services Pty Limited ABN 38 107 536 783 is a Corporate Authorised Representative of Cutcher & Neale Financial Services Pty Ltd ABN 22 160 682 879 AFSL 433814.

Smart investing for SMEs: The basics on how to get started and grow your business.

ATO updates: A quick guide on what business owners need to know.

Cutcher's Investment Lens | 24 - 28 March 2025

Is your current super fund holding you back? It might be time for an SMSF.

Cutcher's Investment Lens | 17 - 21 March 2025