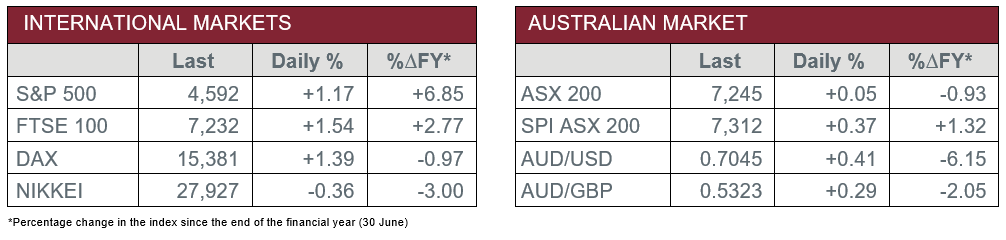

Pre-Open Data

Key Data for the Week

- Monday – AUS – MI Inflation remained steady at 3.1% in November.

- Monday – AUS – Job Ads surged 7.4% in November, following a 7.5% rise in October.

- Tuesday – CHINA – Trade Balance

- Tuesday – AUS – RBA Interest Rate Decision

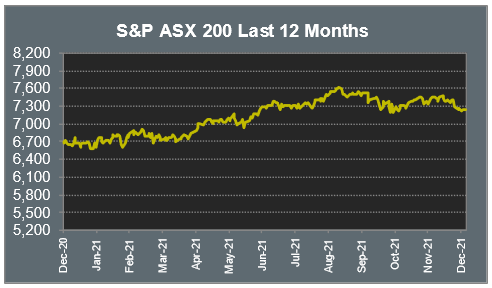

Australian Market

The Australian sharemarket added 0.1% yesterday, in what was a mixed day of trading. Heavy losses in the Information Technology and Heath Care sectors overshadowed gains made in the Consumer Staples and Energy sectors.

The Information Technology sector slumped 2.2% yesterday, as inflationary and Omicron worries meant investors moved towards more defensive sectors. Afterpay fell 4.3% after the company postponed a meeting regarding the takeover by Square. Zip and Sezzle followed suit, as they lost 10.1% and 16.1% respectively. Accounting software provider, Xero, conceded 1.8%, while software company, Altium, closed the session 3.8% lower.

Metcash, a supermarket supplier, added 7.3%, after the company raised their first-half profit as a result of more people shopping locally during lockdowns. Coles and Woolworths rose 2.7% and 2.6% respectively, as the Consumer Staples sector jumped 1.9%.

The Energy sector also enjoyed gains, as the price of oil rebounded slightly. Woodside Petroleum and Oil Search both lifted 0.8%, while Santos added 1.4%.

The Australian futures market points to a 0.37% rise today.

Overseas Markets

European sharemarkets lifted overnight, as fears surrounding the Omicron variant eased. As a result, travel stocks rose late in the trading session; easyJet jumped 5.5%, Ryanair added 4.4% and Air France soared 6.0%. The Energy sector enjoyed a jump in the price of oil; Royal Dutch Shell added 2.1% and BP lifted 1.5%. By the close of trade, the UK FTSE 100 added 1.5% and the German DAX and the STOXX Europe 600 both added 1.4%.

US sharemarkets also gained on Monday, as top US officials put investors at ease following comments made regarding the latest variant of COVID-19. As a result, the Information Technology gained after being heavily weakened on Friday; Apple added 2.2%, while Amazon and Microsoft lifted 1.1% and 1.0% respectively. Health Care stocks declined, as Moderna lost 13.5% and Pfizer shed 5.1%. By the close of trade, the Dow Jones added 1.9% and the S&P 500 increased 1.2%, while the NASDAQ gained 0.9%.

CNIS Perspective

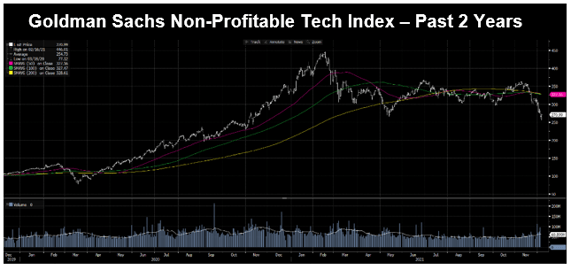

How quickly sentiment can change, with the fears that Omicron could weigh on global economic growth and add to the supply chain disruptions now compounded by the US Federal Reserve announcement last week that it is considering removing its stimulus quicker than previously planned. After an amazing performance over the past 18 months, ‘non-profitable’ tech companies have been hit hard over the past few weeks. These are fast growing tech companies that have been trading at record valuations that attempt to steal from the Jeff Bezos Amazon playbook, those that burn cash for all out-growth and sector domination. This is a very exciting space, looking for the next big tech champion, with huge amounts of potential, but recently this has been reflected in stock prices, as investors forecast the future.

The biggest news for the global high-growth tech sector is not Omicron, but the fear that interest rates will begin to rise. Weak balance sheets don’t matter whilst liquidity is plentiful and money is very cheap, which has allowed some of the best stock performers to be companies that actually lose money. However, with higher inflation and the threat of higher interest rates, a correction has been triggered in these stocks, which has returned them to more realistic valuations and growth prospects.

What is interesting is whilst stock markets have had an aggressive correction due to aforementioned factors, bond markets are not yet reacting to recent inflation data and the concern it is causing central banks. This recent volatility appears to be creating an opportunity to add some of the winners from global growth that have been most negatively affected in recent weeks.

Should you wish to discuss this or any other investment related matter, please contact your Investment Services Team on (02) 4928 8500.

Disclaimer

The material contained in this publication is the nature of the general comment only, and neither purports, nor is intended to be advice on any particular matter. Persons should not act nor rely upon any information contained in or implied by this publication without seeking appropriate professional advice which relates specifically to his/her particular circumstances. Cutcher & Neale Investment Services Pty Limited expressly disclaim all and any liability to any person, whether a client of Cutcher & Neale Investment Services Pty Limited or not, who acts or fails to act as a consequence of reliance upon the whole or any part of this publication.

Cutcher & Neale Investment Services Pty Limited ABN 38 107 536 783 is a Corporate Authorised Representative of Cutcher & Neale Financial Services Pty Ltd ABN 22 160 682 879 AFSL 433814.

Cutcher's Investment Lens | 7 - 11 April 2025

The failed $3 million super tax: Division 296 is done… or is it?

Cutcher's Investment Lens - Update on Trump & Tariffs | 31 March - 4 April 2025

Liberation Day - April 2025 Snapshot

Smart investing for SMEs: The basics on how to get started and grow your business.