Pre-Open Data

Key Data for the Week

- Tuesday – AUS – RBA Interest Rate Decision – The interest rate was left unchanged at 0.1%.

- Tuesday – EUR – Retail Sales increased 4.6% in May, beating expectations of 4.4%.

- Wednesday – EUR – Industrial Production

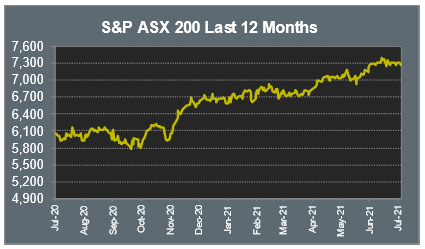

Australian Market

The Australian sharemarket recorded its biggest loss in over two weeks as a result of the Reserve Bank’s decision to begin easing economic support and bond buying, despite their decision to leave the cash rate unchanged at 0.1%.

The Financials sector recorded a 0.5% drop and was weakened by the big four banks. Commonwealth Bank fell 0.6% and Westpac shed 0.3%, while ANZ and NAB conceded 0.3% and 0.2% respectively. Fund Managers also weakened; Australian Ethical Investment lost 1.1% and Magellan Financial Group slipped 1.9%.

Mixed performances among the major miners resulted in a 0.1% fall in the Materials sector. Fortescue Metals was the biggest detractor, down 1.4%, and Rio Tinto lost 0.6%, while BHP bucked the downward trend to close 0.8% higher.

Energy shares outperformed after OPEC called off a meeting that was set to increase the supply of oil. As a result, Oil Search lifted 4.6%, while Woodside Petroleum and Beach Energy both finished the session 2.0% higher.

The Australian futures market points to a 0.15% decline today.

Overseas Markets

European sharemarkets closed lower on Tuesday, as investors returned to the bond market ahead of economic uncertainty. The Energy sector slipped 1.8% as the price of oil retreated from multi-year highs; BP shed 3.8%, Total fell 2.1% and Royal Dutch Shell lost 2.0%. By the close of trade, the pan-European STOXX 600 lost 0.5%.

US sharemarkets were mixed overnight as the Dow Jones and S&P 500 both declined, while the NASDAQ reached another record closing high. The Information Technology sector rallied which helped the NASDAQ continue its recent run; Amazon outperformed, up 4.7%, Apple added 1.5% and Fortinet lifted 1.3%. By the close of the session, the Dow Jones lost 0.6%, the S&P 500 slipped 0.2% and the NASDAQ rose 0.2%.

CNIS Perspective

The RBA yesterday gave an update to three of its key policies including the Official Cash Rate (OCR), the Yield-Curve Control (YCC) program and bond purchasing program.

As expected, the OCR was left unchanged at 0.10%. However, the RBA’s statement on the outlook for interest rates did have some subtle changes.

This included RBA Governor Philip Lowe stating, “the condition for an increase in the cash rate depends upon the data, not the date”. By the data, Lowe is referring to inflation being sustainably within its 2-3% target range.

The YCC program, which aims to keep the 3-year government bond yield at around 0.10%, was also left unchanged. It is currently pegged to the April 2024 bond, and is unlikely to extend any further out in duration.

Previous suggestions of the RBA extending this maturity out further would mean the OCR would not start to rise until 2025, which is inconsistent with the robust economic conditions.

The most notable change in policy was the reduction of its bond buying program from September. Currently, the RBA purchases $5 billion of bonds per week. The program involves the RBA buying government bonds of maturities between 5 and 10 years. It is one of the unconventional policies used by the RBA to keep lending rates low in the economy. It is also helping to keep the Australian dollar lower.

From early September, RBA purchases will decrease to $4 billion a week until at least mid-November. The tapering is in response to the strong economic recovery and improved outlook.

Should you wish to discuss this or any other investment related matter, please contact your Investment Services Team on (02) 4928 8500.

Disclaimer

The material contained in this publication is the nature of the general comment only, and neither purports, nor is intended to be advice on any particular matter. Persons should not act nor rely upon any information contained in or implied by this publication without seeking appropriate professional advice which relates specifically to his/her particular circumstances. Cutcher & Neale Investment Services Pty Limited expressly disclaim all and any liability to any person, whether a client of Cutcher & Neale Investment Services Pty Limited or not, who acts or fails to act as a consequence of reliance upon the whole or any part of this publication.

Cutcher & Neale Investment Services Pty Limited ABN 38 107 536 783 is a Corporate Authorised Representative of Cutcher & Neale Financial Services Pty Ltd ABN 22 160 682 879 AFSL 433814.

Cutcher's Investment Lens | 7 - 11 April 2025

The failed $3 million super tax: Division 296 is done… or is it?

Cutcher's Investment Lens - Update on Trump & Tariffs | 31 March - 4 April 2025

Liberation Day - April 2025 Snapshot

Smart investing for SMEs: The basics on how to get started and grow your business.