Pre-Open Data

Key Data for the Week

- Tuesday – CHINA – Trade Balance surplus narrowed to US$71.7 billion in November, from US$74.25 billion a year earlier.

- Tuesday – AUS – RBA Interest Rate Decision was left unchanged at 0.10%.

- Wednesday – JAPAN – Gross Domestic Product

Australian Market

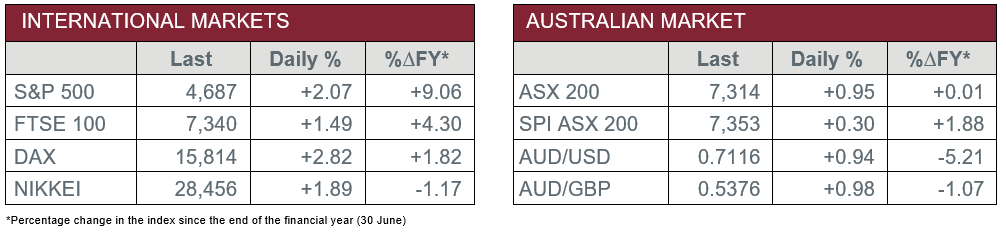

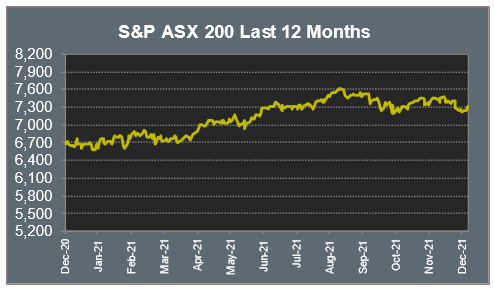

The Australian sharemarket gained 1.0% yesterday, in what was the domestic market’s best day in two months as Omicron worries eased. As expected, the Reserve Bank left the cash rate unchanged in their final meeting of the year.

The Energy sector rose 2.1%, as it followed a solid lead from the US given a rise in the price of oil. Woodside Petroleum and Santos both added 2.0%, while Beach Energy lifted 4.3%, as Omicron is set to have little effects on travel demand.

Easing Omicron worries benefitted travel and leisure stocks. Qantas jumped 3.8%, while Flight Centre and Corporate Travel Management both lifted 5.7%. Webjet also enjoyed gains, to close the session 4.5% higher.

ANZ was the best performer among the big four banks, as it added 1.6%. Westpac and NAB both lifted 1.1%, while Commonwealth Bank gained 0.4%. Magellan Financial Group closed 6.4% lower, as the CEO is set to leave, while Australian Ethical Investment closed the session 4.3% lower.

The Australian futures market points to a 0.30% rise today, driven by stronger overseas markets.

Overseas Markets

European sharemarkets gained on Tuesday, aided by a strong rally in Technology stocks. As a result, Infineon Technologies lifted 5.8%, while ASML Holdings jumped 6.6%. The Materials sector also finished the session higher as Chinese imports of iron ore rose; BHP and Rio Tinto added 5.6% and 4.8% respectively, while Glencore added 3.1%. By the close of trade, the UK FTSE 100 added 1.5%, while the German DAX lifted 2.8% and the STOXX Europe 600 gained 2.5%.

US sharemarkets were also higher overnight, given easing Omicron fears. This resulted in a strong run in the Information Technology sector. Cyber security provider, Fortinet, jumped 8.6%, while Apple and Amazon added 3.5% and 3.0% respectively. Semi-conductor providers NVIDIA and Taiwan Semiconductor also enjoyed gains to lift 8.0% and 2.7% respectively.

By the close of trade, the Dow Jones added 1.4% and the S&P 500 lifted 2.1%, while the NASDAQ soared 3.0%.

CNIS Perspective

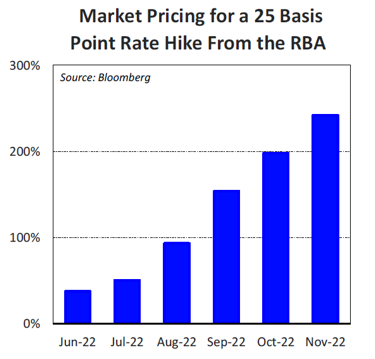

Yesterday’s RBA meeting had a rather upbeat tone to it, with the RBA leaving all settings unchanged, as widely expected.

Interestingly, while they see a strong labour market and moderate pick up in wages growth, they still remain of the view that the pickup in inflation will only be gradual.

They retain the view the underlying rate of inflation will reach 2.5% by the end of 2023 and therefore delay the need for higher interest rates until then.

This looks challenging given the jump in September CPI, pre-end of lockdowns, and the likely continuation of strong inflation through to the end of 2021, in a post lockdown environment.

Markets are fully priced for the first hike to occur in September 2022 and the RBA continued to emphasise “the board is prepared to be patient”.

This may change if the US Federal Reserve adopts a more aggressive tapering or raises their benchmark rate earlier than when they have indicated.

Look for continued weakness in the AUD/USD exchange rate if that’s the case.

Should you wish to discuss this or any other investment related matter, please contact your Investment Services Team on (02) 4928 8500.

Disclaimer

The material contained in this publication is the nature of the general comment only, and neither purports, nor is intended to be advice on any particular matter. Persons should not act nor rely upon any information contained in or implied by this publication without seeking appropriate professional advice which relates specifically to his/her particular circumstances. Cutcher & Neale Investment Services Pty Limited expressly disclaim all and any liability to any person, whether a client of Cutcher & Neale Investment Services Pty Limited or not, who acts or fails to act as a consequence of reliance upon the whole or any part of this publication.

Cutcher & Neale Investment Services Pty Limited ABN 38 107 536 783 is a Corporate Authorised Representative of Cutcher & Neale Financial Services Pty Ltd ABN 22 160 682 879 AFSL 433814.

Cutcher's Investment Lens | 7 - 11 April 2025

The failed $3 million super tax: Division 296 is done… or is it?

Cutcher's Investment Lens - Update on Trump & Tariffs | 31 March - 4 April 2025

Liberation Day - April 2025 Snapshot

Smart investing for SMEs: The basics on how to get started and grow your business.