Pre-Open Data

Key Data for the Week

Key economic data released this week:

- Tuesday – AUS – NAB Business Conditions & Confidence

- Tuesday – AUS – Westpac Consumer Confidence

- Wednesday – CHINA – Consumer Price Index

- Wednesday – US – Consumer Price Index

- Thursday – US – Initial Jobless Claims

- Friday – EUR – Industrial Production

- Friday – UK – Gross Domestic Product

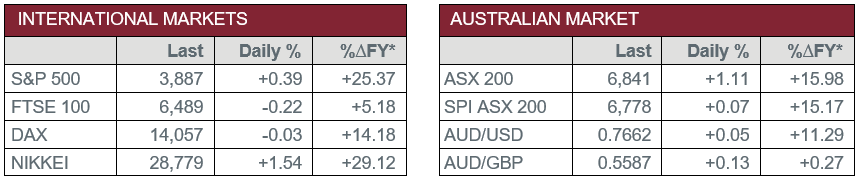

Australian Market

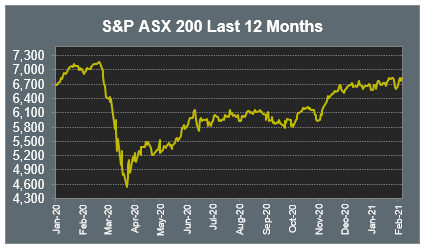

The Australian sharemarket rebounded from Thursday’s losses to post a 1.1% gain on Friday, boosted by Industrials and Information Technology stocks. Improvements across the local market were broad based, as all sectors rose, except for Materials and Utilities. Gains in the Information Technology sector were underpinned by buy now pay later heavyweight Afterpay, which climbed 3.4% to hit a new record high, while Zip Co strengthened 8.0% and EML Payments lifted 7.1%.

The Financials sector was led higher by the big four banks, which all gained between 1.8% and 2.1%, boosted by the RBA’s announcement earlier in the week that the central bank would purchase a further $100 billion in government bonds after April.

The Australian reporting season ramps up this week, with AMP, Boral, Commonwealth Bank, Computershare, Dexus, Newcrest, Suncorp, Telstra and Transurban all set to release their latest earnings.

The Australian futures market points to a 0.07% rise today.

Overseas Markets

European sharemarkets were little changed on Friday. Europe’s largest construction and concessions company Vinci strengthened 5.8%, after the company reported it had beat full year profit forecasts, while Sanofi lifted 1.5%, after the French pharmaceutical giant announced it aimed to increase earnings per share this year, following stronger than expected quarterly results.

US sharemarkets closed higher on Friday, as a slightly lower than expected jobs figure raised hopes that a fiscal stimulus deal will be passed by Congress. Activision Blizzard rose 9.6% after the video game giant announced Q4 results that beat expectations, while Snap, Estée Lauder and Pinterest increased 9.1%, 7.8% and 5.3% respectively, following their latest company earnings results. The Dow Jones lifted 0.3%, while the S&P 500 and NASDAQ added 0.4% and 0.6% respectively to post fresh record highs.

CNIS Perspective

Joe Biden in his first days of US presidency has re-joined the US to the Paris Climate Agreement and blocked construction of an oil pipeline from Canada to combat climate change, quite the contrast from the previous administration that rolled back more than 100 Federal environmental protections. Biden is not only performing a massive U-turn from the Trump administration; the goals he is setting are incredibly aggressive, going way further than the previous Obama-led Democrat administration. While ambitious, Biden’s objectives of eliminating all CO2 from the US economy by 2050 and zero emissions from the electricity sector (power plants) by 2035, are what scientists say is required to stop the most devasting effects from global warming.

Biden’s appointment of political veteran John Kerry to the international climate envoy will allow the US to press foreign nations to play their part in a global climate change agenda. Kerry will also have a seat at the White House National Security Council, something that has never happened before. What this means is that climate change will now be an integral part of every major White House decision on national security and foreign policy.

There are three major sources of planet warming greenhouse gases (GHG) that need to be drastically cut if Biden’s aggressive targets are to be achieved. The largest contributor to pollution is from cars, totalling one third of GHG emissions in the US, followed by power stations and leaking methane emissions from oil and gas plants.

The auto industry is already in the process of aligning itself to Biden’s proposed agenda. Biden has previously pledged to restore the full federal tax credit for electric vehicle (EV) purchases and a 10% tax credit for creating American jobs, which will allow car factories to adapt to EV production. Further proposals include conversion of all US school buses to electric by 2030 and a national network of 500,000 electric vehicle chargers. Combating this largest GHG polluting industry will likely be the lasting legacy of the Biden administration.

Should you wish to discuss this or any other investment related matter, please contact your Investment Services Team on (02) 4928 8500.

Disclaimer

The material contained in this publication is the nature of the general comment only, and neither purports, nor is intended to be advice on any particular matter. Persons should not act nor rely upon any information contained in or implied by this publication without seeking appropriate professional advice which relates specifically to his/her particular circumstances. Cutcher & Neale Investment Services Pty Limited expressly disclaim all and any liability to any person, whether a client of Cutcher & Neale Investment Services Pty Limited or not, who acts or fails to act as a consequence of reliance upon the whole or any part of this publication.

Cutcher & Neale Investment Services Pty Limited ABN 38 107 536 783 is a Corporate Authorised Representative of Cutcher & Neale Financial Services Pty Ltd ABN 22 160 682 879 AFSL 433814.

Smart investing for SMEs: The basics on how to get started and grow your business.

ATO updates: A quick guide on what business owners need to know.

Cutcher's Investment Lens | 24 - 28 March 2025

Is your current super fund holding you back? It might be time for an SMSF.

Cutcher's Investment Lens | 17 - 21 March 2025