Pre-Open Data

Key Data for the Week

- Thursday – US – FOMC Meeting Minutes emphasised a patient approach to tapering stimulus measures.

- Friday – CHINA – Consumer Price Index

- Friday – UK – Trade Balance

Australian Market

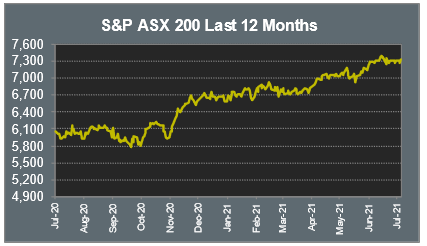

The Australian sharemarket closed in stark contrast to the day prior, providing investors with their biggest gains in more than two weeks as the benchmark ASX 200 added 0.9%.

The largest gains were seen in the Information Technology sector, as it added 2.8% over the course of the session. Sector giant Afterpay lead the way, up 4.6%, while its buy-now-pay-later competitor Zip, added 6.5%. Accounting software provider, Xero, also enjoyed gains and lifted 3.9%.

Increases in all big four banks pushed the Financials sector 0.8% higher. Commonwealth Bank gained 1.1% and NAB added 0.8%, while Westpac and ANZ lifted 0.6% and 0.4% respectively. Fund manager Australian Ethical Investment also enjoyed gains and was up 1.7%.

The Materials sector also closed higher as a result of an increase in the price of iron ore. Fortescue Metals lifted 0.8% and Rio Tinto 0.5%, while BHP detracted from the sector’s performance as it lost 0.1%. Gold miners also strengthened the sector; Newcrest Mining lifted 2.0% and Northern Star added 1.3%.

Travel stocks weakened as lockdowns were extended for an additional week in Sydney; Qantas shed 0.6% and Flight Centre dropped 0.4%.

The Australian futures market points to a 0.15% rise today, driven by stronger overseas markets.

Overseas Markets

European sharemarkets rose overnight as increases in commodity prices lead the Materials sector higher. London-listed BHP gained 1.6% and Glencore added 0.7%, while Rio Tinto jumped 2.6%. Technology stocks benefited from low bond yields; ASML Holdings added 0.6% and Infineon Technologies closed 0.5% higher. By the end of trade, the pan-European STOXX 600 rose 0.8%.

US sharemarkets rose on Wednesday as minutes from the Federal Reserve meeting suggested they may not move to tighten their policy just yet. The Information Technology sector was lifted by Apple (1.8%), PayPal (1.5%) and Microsoft (0.8%). Newly listed ride-share service, DiDi, and online and mobile commerce company, Alibaba, fell 4.6% and 1.7% respectively after incurring a fine from China’s market regulator for failing to report earlier acquisition deals for approval.

By the close of the session, the Dow Jones and the S&P 500 both added 0.3%, while the NASDAQ closed flat.

CNIS Perspective

In the first half of 2021, equity inflows have surpassed all previous records. Inflows of new cash investing into equity funds climbed to about US$580 billion during the period of January to June this year, putting the total for the calendar year on track for a new record. According to data produced by Bank of America, if inflows continue this way for the rest of the year, the total inflows for equity funds will be more than the past two decades combined.

A major factor for the inflows into stocks is the unattractiveness of the other major asset class, fixed income or bonds. The current relatively low bond yields with more than US$12 trillion worth of debt globally that trades with a yield below zero are discouraging. Even with conservative estimates for inflation, the real returns for bonds at present (that is income generated above inflation) is meagre.

The record inflows into rising sharemarkets is likely to continue whilst central banks are consistent with their message around tapering on its current liquidity measures, and while interest rate rises are still kept far off in the distance in 2023.

Should you wish to discuss this or any other investment related matter, please contact your Investment Services Team on (02) 4928 8500.

Disclaimer

The material contained in this publication is the nature of the general comment only, and neither purports, nor is intended to be advice on any particular matter. Persons should not act nor rely upon any information contained in or implied by this publication without seeking appropriate professional advice which relates specifically to his/her particular circumstances. Cutcher & Neale Investment Services Pty Limited expressly disclaim all and any liability to any person, whether a client of Cutcher & Neale Investment Services Pty Limited or not, who acts or fails to act as a consequence of reliance upon the whole or any part of this publication.

Cutcher & Neale Investment Services Pty Limited ABN 38 107 536 783 is a Corporate Authorised Representative of Cutcher & Neale Financial Services Pty Ltd ABN 22 160 682 879 AFSL 433814.

Cutcher's Investment Lens | 7 - 11 April 2025

The failed $3 million super tax: Division 296 is done… or is it?

Cutcher's Investment Lens - Update on Trump & Tariffs | 31 March - 4 April 2025

Liberation Day - April 2025 Snapshot

Smart investing for SMEs: The basics on how to get started and grow your business.