Pre-Open Data

Key Data for the Week

- Monday – EUR – Consumer Confidence

- Monday – US – Existing Home Sales

- Tuesday – US – Markit Manufacturing PMI

- Wednesday – AUS – Construction Work Done

- Wednesday – US – Gross Domestic Product

- Wednesday – US – New Home Sale

- Thursday – AUS – Private Capital Expenditure

- Friday – AUS – Retail Sales

- Friday – UK – Nationwide House Prices

Australian Market

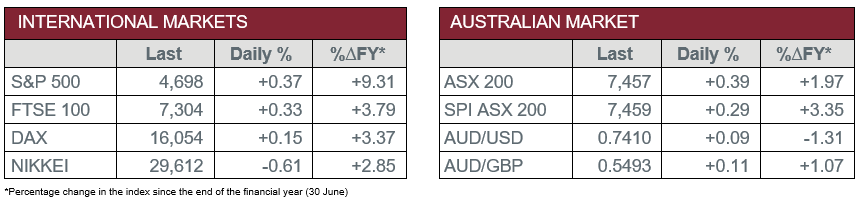

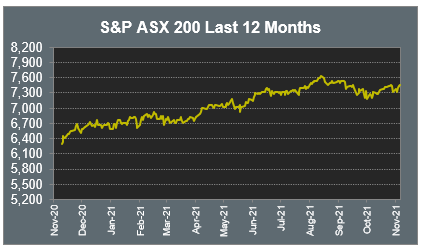

The Australian sharemarket advanced 0.4% on Friday. The Telecommunications sector led the gains, up 1.6%, followed by Consumer Staples and Utilities, which gained 1.1% and 0.9% respectively. Over the week, the local ASX 200 rose 1.8%.

Mining heavyweights posted gains on Friday despite continued pressure on the price of iron ore; Rio Tinto and Fortescue Metals both lifted 0.6%, while BHP gained 0.2%. Gold miners also enjoyed solid gains; Northern Star Resources rallied 6.3%, while Evolution Mining and Newcrest Mining closed up 4.8% and 3.6% respectively.

The Financials sector eked out a 0.1% gain. Commonwealth Bank added 1.1%, NAB rose 0.8% and ANZ lifted 0.3%, while Westpac gave up 2.8%. Fund managers also advanced; Australian Ethical Investment climbed 5.3% and Magellan Financial Group lifted 2.2%.

The Australian futures market points to a 0.29% rise today, driven by stronger overseas markets.

Overseas Markets

European sharemarket posted gains on Friday. Travel stocks advanced following news that Pfizer completed a successful trial of its antiviral pill for COVID-19; International Airline Group rose 5.4%, easyJet added 6.0% and Lufthansa rallied 6.1%. Banking stocks were mixed; HSBC closed up 1.0% and Barclays gained 0.5%, while Lloyds Bank and Credit Suisse both slipped 0.3%.

By the close of trade, the UK FTSE 100 added 0.3% and the German DAX rose 0.2%, while the STOXX Europe 600 closed 0.1% higher.

US sharemarkets also closed higher on Friday. The Energy sector was the strongest performer, up 1.4%; Chevron lifted 1.1%, while ExxonMobil gained 1.0%. Financial services stocks also advanced; MasterCard and Visa added 4.0% and 3.8% respectively, while PagSeguro closed 2.1% higher and BlackRock lifted 0.1%. The Information Technology sector was mixed; Meta Platforms (formerly named Facebook) rose 1.6% and Alphabet closed up 0.4%, while NVIDIA fell 0.2% and Spotify gave up 1.5%.

By the close of trade, the NASDAQ lifted 0.2%, while the S&P 500 and Dow Jones added 0.4% and 0.6% respectively.

Over the week, the Dow Jones rose 1.4% and the S&P 500 gained 2.0%, while the NASDAQ closed 3.1% higher.

CNIS Perspective

Fresh off the plane from Glasgow, Australian Prime Minister Scott Morrison is due to announce a feasibility study for the Port of Newcastle to become a hydrogen hub. The Federal Government will provide a $1.5 million grant for the $3 million report with Macquarie Bank’s Green Investment Group, its partner in the project, making up the difference.

Hydrogen’s global outlook continues to grow in scale as countries around the world strive to achieve net zero carbon emissions. The number of countries with policies that directly support investment in hydrogen technologies is rising. Australia is in an ideal position to become a regional hydrogen superpower, provided it can resolve the commodity’s high production costs compared to other energy sources.

Green hydrogen refers to hydrogen produced with no harmful greenhouse gas emissions. It is made using clean electricity from surplus renewable energy sources, such as solar and wind power, to electrolyse water, without emitting any carbon dioxide in the process. Green hydrogen currently only makes up a small percentage of global hydrogen production (about 0.1% according to the International Energy Agency) because production is expensive.

The Federal Government’s National Hydrogen Strategy sets a goal for commercial renewable hydrogen exports by 2030, with state governments and corporates also providing support for this nascent industry.

Should you wish to discuss this or any other investment related matter, please contact your Investment Services Team on (02) 4928 8500.

Disclaimer

The material contained in this publication is the nature of the general comment only, and neither purports, nor is intended to be advice on any particular matter. Persons should not act nor rely upon any information contained in or implied by this publication without seeking appropriate professional advice which relates specifically to his/her particular circumstances. Cutcher & Neale Investment Services Pty Limited expressly disclaim all and any liability to any person, whether a client of Cutcher & Neale Investment Services Pty Limited or not, who acts or fails to act as a consequence of reliance upon the whole or any part of this publication.

Cutcher & Neale Investment Services Pty Limited ABN 38 107 536 783 is a Corporate Authorised Representative of Cutcher & Neale Financial Services Pty Ltd ABN 22 160 682 879 AFSL 433814.

Cutcher's Investment Lens | 7 - 11 April 2025

The failed $3 million super tax: Division 296 is done… or is it?

Cutcher's Investment Lens - Update on Trump & Tariffs | 31 March - 4 April 2025

Liberation Day - April 2025 Snapshot

Smart investing for SMEs: The basics on how to get started and grow your business.