Pre-Open Data

Key Data for the Week

Key economic data released this week:

- Wednesday – US – FOMC Minutes – The minutes of the FOMC expressed concern that government relief provided to date was insufficient. The members expressed the view that more government stimulus would be provided. Further discussion involved the Fed’s asset purchase program, which signalled an openness to possibly increasing bond buying in the future. The meeting’s rate projections were for them to remain close to zero until 2023.

- Thursday – EUR – ECB Monetary Policy Meeting Accounts

- Thursday – US – Initial Jobless Claims

Australian Market

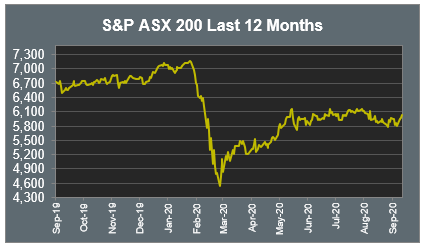

The Australian sharemarket ended yesterday’s session 1.3% higher, to close above 6,000 points for the first time since early September. Boosted by the release of the government’s latest Federal Budget on Tuesday night, gains were widespread, with Materials the only sector to weaken.

Consumer stocks enjoyed a strong session, boosted by stage two tax cuts being brought forward by two years; online retailers Temple & Webster and Kogan.com rose 9.5% and 6.0% respectively, while JB Hi-Fi rose 3.6% and Harvey Norman climbed 2.0%.

Buy now pay later companies also rose on the back of the Federal Government’s Budget, Splitit surged 13.5%, Zip Co strengthened 4.7%, Sezzle climbed 3.0% and Afterpay added 1.6%.

The Financials sector was buoyed by the big four banks, which all registered gains of between 2.0% and 2.6%, with Westpac the best performer.

The Australian futures market points to a 0.41% rise today, driven by stronger US markets overnight.

Overseas Markets

European sharemarkets were mixed on Wednesday. Mining stocks outperformed after JP Morgan took an "extreme overweight" position on the sector. Deutsche Post rose 3.9% after the German logistics group said it expected "exceptionally strong" business up to Christmas, boosted by the ongoing growth of ecommerce. Tesco slid 0.7% despite a first half surge in profits for Britain’s largest supermarket chain. The German DAX rose 0.2%, however, the STOXX Europe 600 and UK FTSE 100 both slipped 0.1%.

US sharemarkets rose overnight, after President Trump encouraged Congress to pass a series of smaller standalone fiscal stimulus bills, including a further round of US$1,200 stimulus checks and support for airlines totaling US$25 billion. Trump tweeted this fiscal support, in addition to a proposed US$135 billion for the Paycheck Protection Program for small business, would be paid for with unused funds from the CARES Act. The announcement followed yesterday’s abrupt decision by Trump to call off ongoing negotiations with the Democratic Party regarding a more comprehensive stimulus bill. Airline companies rose on the back of news, with the additional support set to provide a much-needed boost to an industry that has been ravaged by the COVID-19 pandemic. The Dow Jones airlines index ended the session 3.5% higher in response.

Technology heavyweights Alphabet (+0.5%), Apple (+1.7%) and Microsoft (+1.9%) all posted improvements, while ecommerce giants Alibaba and Amazon climbed 1.4% and 3.1% respectively. By the close of trade, the Dow Jones and the NASDAQ both gained 1.9%, while the S&P 500 lifted 1.7%.

CNIS Perspective

There has been little sympathy for President Trump in the polls after contracting COVID-19 late last week. His ongoing cavalier attitude towards the virus that has taken the lives of 211,000 Americans has added to the widening lead for Biden. Overnight more than 40 tweets by President Trump in two hours, at first calling off talks on a new stimulus package, before later, confusingly appearing to support some stimulus measures.

With unemployment still high at 7.9%, with 14 million people without jobs through no fault of their own, this flip flopping on a further rescue package that would ease the financial pressure on households that are struggling pay their bills and feed their family, would unlikely endear himself to the needy. For now, it would appear those people will have to wait until post the 3rd November election and make do with America’s miserly unemployment-insurance system.

If the polls prove to be correct (Biden currently has an even bigger lead now than Obama did at this point in 2008) and the Democrats win in a landslide, controlling the House of Representatives and Senate, the prospect of an even larger legislated stimulus package is likely to further entice voters.

Should you wish to discuss this or any other investment related matter, please contact your Investment Services Team on (02) 4928 8500.

Disclaimer

The material contained in this publication is the nature of the general comment only, and neither purports, nor is intended to be advice on any particular matter. Persons should not act nor rely upon any information contained in or implied by this publication without seeking appropriate professional advice which relates specifically to his/her particular circumstances. Cutcher & Neale Investment Services Pty Limited expressly disclaim all and any liability to any person, whether a client of Cutcher & Neale Investment Services Pty Limited or not, who acts or fails to act as a consequence of reliance upon the whole or any part of this publication.

Cutcher & Neale Investment Services Pty Limited ABN 38 107 536 783 is a Corporate Authorised Representative of Cutcher & Neale Financial Services Pty Ltd ABN 22 160 682 879 AFSL 433814.

Cutcher's Investment Lens | 17 - 21 March 2025

Put your hard-earned dollars to work: Smart investing for doctors.

Fringe Benefits Tax year-end: Important updates and insights.

Cutcher's Investment Lens | 10 - 14 March 2025

Cutcher's Investment Lens | 3 - 7 March 2025