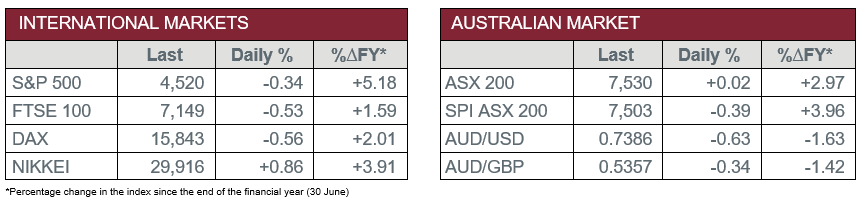

Pre-Open Data

Key Data for the Week

- Tuesday – AUS – RBA Interest Rate Decision was left unchanged at 0.1%.

- Tuesday – EUR – Gross Domestic Product was 2.2% for the June quarter, up from an initial reading of 2.0%.

- Wednesday – US – Consumer Credit

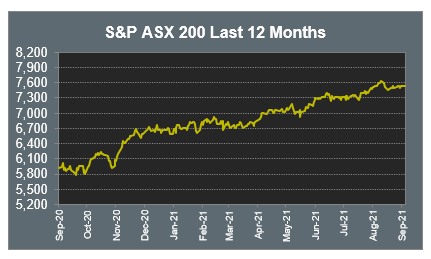

Australian Market

The Australian sharemarket gained less than 0.1% on Tuesday, as the Reserve Bank’s decision to maintain the cash rate boosted investor sentiment late in the trading session. The RBA also noted they will extend the deadline for bond purchases from November to at least February.

The Financials sector lost less than 0.1%, as it recovered late in the day. Westpac was the best performer, up 0.2%. Commonwealth Bank slipped less than 0.1% to close relatively flat, while NAB and ANZ lost 0.7% and 0.1% respectively.

A significant drop in the price of iron ore to ~US$132 per tonne led to losses in the Materials sector. BHP shed 0.4% and Rio Tinto slipped 1.8%, while Fortescue Metals lost 3.1%. Gold miners lost ground; Northern Star Resources dropped 0.9% and Evolution Mining conceded 1.2%.

The Information Technology sector advanced during the day’s trade, up 0.2%. Software company, Altium, added 2.3%, while accounting software provider, Xero, gained 0.7%. The buy-now-pay-later providers had mixed performances; Afterpay lost 0.1%, while Zip lifted 0.1%.

The Australian futures point to a 0.39% fall today.

Overseas Markets

European sharemarkets lost ground on Tuesday to sit just below record highs. The Industrials sector was among the worst performers, as Siemens lost 0.5%, and Airbus conceded 1.5%. Health Care stocks also slipped; AstraZeneca fell 2.0% and Novartis lost 1.2%. By the close of trade, the STOXX Europe 600 and the UK’s FTSE 100 both shed 0.5%, while the German DAX fell 0.6%.

US sharemarkets were mixed overnight, as the S&P 500 closed lower and the NASDAQ reached a new record high. Gains in ‘big tech’ companies aided the NASDAQ’s performance; Apple lifted 1.6%, Amazon added 0.9% and Alphabet, Google’s parent company, was up 0.5%. By the close of trade, the NASDAQ lifted 0.1%, while the Dow Jones lost 0.8%, and the S&P 500 closed 0.3% lower.

CNIS Perspective

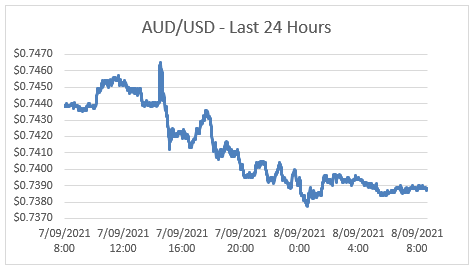

The short-term volatility of the foreign exchange (FX) market makes it almost impossible to predict, with any accuracy or consistency, its imminent direction.

Yesterday was a classic example of just how unpredictable the FX market can be.

Yesterday the RBA announced it would cut its $5 billion a week bond buying program to $4 billion a week as previously planned, in a sign the Australian economy is gathering strength and needs to start being weaned off stimulus.

This spooked the market somewhat, as a further delay in cutting the bond buying program was expected, given what was believed to be, a weaker economic outlook.

Not unexpectedly the AUD gathered support and rose sharply.

Ten minutes later however, for whatever reason, the AUD nosedived.

The FX is made up of a number of different participants, all with different motivations and reasons to transact in the FX market.

Yesterday was a classic example of just how volatile it can be.

Should you wish to discuss this or any other investment related matter, please contact your Investment Services Team on (02) 4928 8500.

Disclaimer

The material contained in this publication is the nature of the general comment only, and neither purports, nor is intended to be advice on any particular matter. Persons should not act nor rely upon any information contained in or implied by this publication without seeking appropriate professional advice which relates specifically to his/her particular circumstances. Cutcher & Neale Investment Services Pty Limited expressly disclaim all and any liability to any person, whether a client of Cutcher & Neale Investment Services Pty Limited or not, who acts or fails to act as a consequence of reliance upon the whole or any part of this publication.

Cutcher & Neale Investment Services Pty Limited ABN 38 107 536 783 is a Corporate Authorised Representative of Cutcher & Neale Financial Services Pty Ltd ABN 22 160 682 879 AFSL 433814.

Cutcher's Investment Lens | 7 - 11 April 2025

The failed $3 million super tax: Division 296 is done… or is it?

Cutcher's Investment Lens - Update on Trump & Tariffs | 31 March - 4 April 2025

Liberation Day - April 2025 Snapshot

Smart investing for SMEs: The basics on how to get started and grow your business.