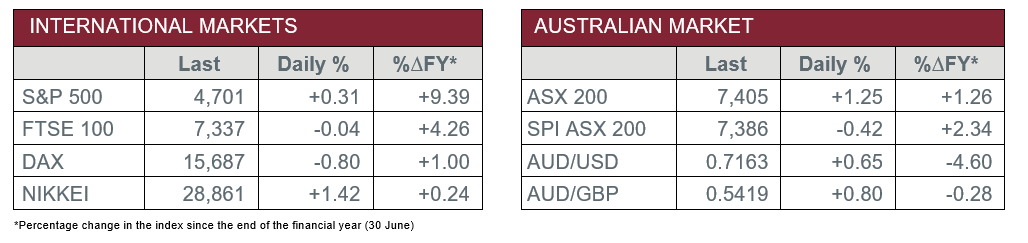

Pre-Open Data

Key Data for the Week

- Wednesday – JAPAN – Gross Domestic Product contracted an annualised 3.6% in the September quarter.

- Thursday – CHINA – Consumer Price Index

- Thursday – US – Initial Jobless Claims

Australian Market

The Australian sharemarket posted further gains on Wednesday, recovering to pre-Omicron levels, as the initial shock of the new COVID-19 variant eased. The local market’s performance came after a strong overnight performance from international markets, alongside a spike in the price of oil and iron ore.

The Energy sector benefited from the sharp increase in oil prices, as the sector broadly gained 1.5%. A key performer included Woodside Petroleum (2.1%), after it announced its $7 billion capital expenditure plan to transition towards a low carbon portfolio by 2030. Additionally, Santos and Oil Search both advanced ~2.2%, after they received approval for their planned merger from the Independent Consumer and Competition Commission of Papua New Guinea.

Telecommunications (2.2%) was another standout, after index heavyweight Telstra advanced 1.3%. This came after Telstra spent ~$615 million at an auction to enhance its 5G network coverage. The company purchased the maximum number of ‘spectrum slots’ permitted, due to government imposed anti-competition regulations.

Other key performers from Wednesday’s session included Super Retail Group (3.8%), Lithium producer Allkem Limited (5.5%), previously known as Orocobre, and Australian Clinical Labs (4.6%).

The Australian futures market points to a 0.42% fall today.

Overseas Markets

European sharemarkets ended a volatile session lower on Wednesday, amid worries over tougher COVID-19 restrictions across the region. This came after British Prime Minister Boris Johnson reimposed social restrictions in England, reinforcing vaccine passport and mask requirements, alongside ordering people to work from home. More defensive health care stocks made gains, up 0.3%, while cyclical retail stocks were down 1.9%. A key mover included HelloFresh, which slid 10.9% after missing earnings expectations. By the close of trade, the STOXX Europe 600 lost 0.6%, the German DAX conceded 0.8% and the UK FTSE 100 closed relatively flat.

US sharemarkets closed slightly higher on Wednesday, encouraged by news from Pfizer (-0.6%) and BioNTech (-3.6%) about their COVID-19 vaccine effectiveness against the new Omicron variant. A key performer was Apple (2.3%), after it maintained its buy rating from brokers. The company’s market capitalisation is approaching US$3 trillion, which, if reached, would make it as large as the world’s fifth largest economy. Other notable movers included cybersecurity stocks Fortinet (1.6%) and CrowdStrike (2.4%). By the close of trade, the Dow Jones inched up 0.1%, the S&P 500 lifted 0.3% and the NASDAQ rose 0.6%.

CNIS Perspective

Around this time every year economic forecasters start gazing into their crystal balls to predict what the future holds. Less than one year ago, in the depths of the pandemic, forecasters were grappling with the risk that COVID-19 would leave in its wake, high and lingering unemployment, widespread bankruptcies and a lasting erosion in the willingness of households and businesses to spend.

However, what is becoming increasingly apparent is that COVID-19 will cause very little long term economic damage. The recovery in business investment and continued improvement in labour productivity suggests the underlying dynamics of real economic growth are reassuringly strong. Over the last four quarters we’ve seen an extraordinary cyclical recovery and strong returns from risk assets, albeit with a bit of volatility of late.

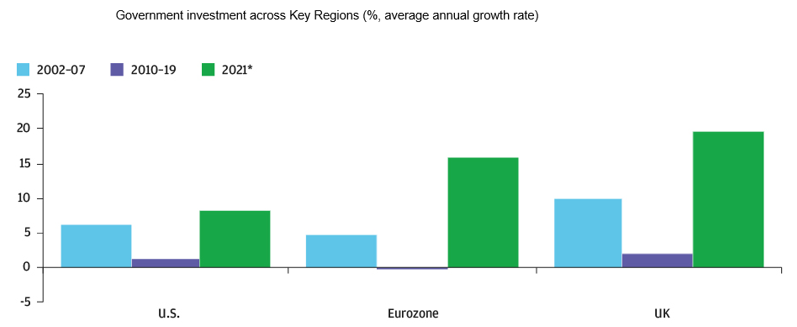

We can all, to a large extent, thank the extraordinary levels of government spending and investment for this outcome. Governments are now committed to multi-year spending plans that have been laid out with an emphasis on rebuilding infrastructure, addressing social inequality and tackling climate change.

Should you wish to discuss this or any other investment related matter, please contact your Investment Services Team on (02) 4928 8500.

Disclaimer

The material contained in this publication is the nature of the general comment only, and neither purports, nor is intended to be advice on any particular matter. Persons should not act nor rely upon any information contained in or implied by this publication without seeking appropriate professional advice which relates specifically to his/her particular circumstances. Cutcher & Neale Investment Services Pty Limited expressly disclaim all and any liability to any person, whether a client of Cutcher & Neale Investment Services Pty Limited or not, who acts or fails to act as a consequence of reliance upon the whole or any part of this publication.

Cutcher & Neale Investment Services Pty Limited ABN 38 107 536 783 is a Corporate Authorised Representative of Cutcher & Neale Financial Services Pty Ltd ABN 22 160 682 879 AFSL 433814.

Cutcher's Investment Lens | 7 - 11 April 2025

The failed $3 million super tax: Division 296 is done… or is it?

Cutcher's Investment Lens - Update on Trump & Tariffs | 31 March - 4 April 2025

Liberation Day - April 2025 Snapshot

Smart investing for SMEs: The basics on how to get started and grow your business.