Pre-Open Data

Key Data for the Week

- Tuesday – AUS – NAB Business Confidence & Conditions

- Tuesday – AUS – HIA New Home Sales

- Tuesday – EUR – Gross Domestic Product

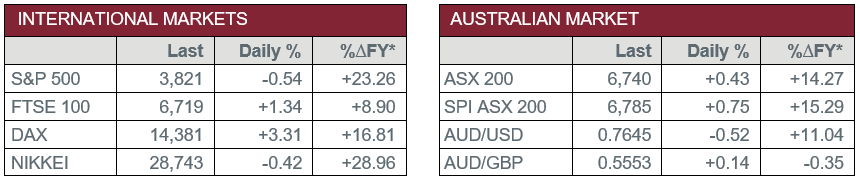

Australian Market

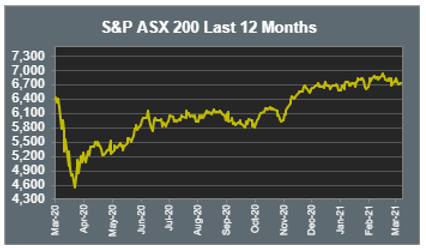

The Australian sharemarket lifted 0.4% on Monday in a mixed session of trade. The Materials sector was the strongest performer, up 1.6%, followed by the Consumer Discretionary and Energy sectors. Market decliners were the Information Technology and Health Care sectors, down 1.1% and 0.8% respectively.

The Materials sector enjoyed strong gains yesterday as the iron ore price climbed 1.7%. Rio Tinto and BHP rallied 2.9% and 2.4% respectively, while Fortescue Metals rose 0.5%. Gold miners were also stronger; Newcrest Mining added 2.7% and Evolution Mining lifted 1.8%, while Northern Star closed 0.3% higher.

The Financials sector rose 0.5%, with mixed performances amongst the major banks. Commonwealth Bank lifted 1.0% and NAB added 0.2%, while Westpac and ANZ fell 0.5% and 0.4% respectively. Asset managers were also mixed; Challenger rose 1.3% and Australian Ethical Investment lifted 0.3%, while Magellan Financial Group slipped 0.7%.

The Health Care sector finished weaker; biotechnology heavyweight CSL fell 1.0% and Sonic Healthcare slipped 0.9%, while Ramsey Health Care closed down 0.6%. Recce Pharmaceutical climbed 4.1% after the company announced it will soon begin trading on Germany’s Frankfurt Stock Exchange.

The Australian futures market points to a 0.75% rise today.

Overseas Markets

European sharemarkets advanced on Monday. The Financials sector climbed 3.7% to reach a new one-year high. Lloyds Bank jumped 4.5% and Europe’s largest bank HSBC gained 4.1%, while Barclays lifted 3.7%. Automakers also outperformed; Volkswagen Group rose 1.2% and Bayerische Motoren Werke AG (BMW) climbed 5.3%. Renewable energy stocks closed stronger; Vestas Wind Systems added 2.3% and Siemens Gamesa gained 2.0%.

By the close of trade, the UK FTSE 100 rose 1.3% and the broad based STOXX Europe 600 gained 2.1%, while the German DAX rallied 3.3%.

US sharemarkets were mixed overnight. Travel and leisure stocks saw strong gains; American Airlines jumped 5.0% and United Airlines rallied 7.0%. The Information Technology sector extended losses; NVIDIA lost 7.0% and Spotify gave up 6.0%, while Apple and Alphabet fell 4.2% and 4.0% respectively. The Financials sector closed 1.3% higher; Citigroup rose 2.8% and Goldman Sachs added 2.1%, while JP Morgan Chase lifted 1.3%. Financial Services were mixed; MasterCard and Visa gained 2.9% and 2.3% respectively, while PayPal shed 5.4%.

By the close of trade, the Dow Jones closed 1.0% higher, while the S&P 500 and NASDAQ lost 0.5% and 2.4% respectively.

CNIS Perspective

Last Friday’s US employment data had widespread implications for financial markets, notably the AUD/USD exchange rate.

The unemployment rate fell 0.1% to 6.2% in February, which continues to reflect a significant improvement from the pandemic high of 14.8%.

Importantly, the employment data suggests there will not be a need for additional economic stimulus that would ultimately further weaken the USD.

Given it’s unlikely there will be any movement in interest rates in either the US or Australia, and with the iron ore price expected to stabilise, or even fall, as Brazil re-enters the iron ore supply chain, the absence of any further stimulus should continue to weaken the AUD against the USD.

Should you wish to discuss this or any other investment related matter, please contact your Investment Services Team on (02) 4928 8500.

Disclaimer

The material contained in this publication is the nature of the general comment only, and neither purports, nor is intended to be advice on any particular matter. Persons should not act nor rely upon any information contained in or implied by this publication without seeking appropriate professional advice which relates specifically to his/her particular circumstances. Cutcher & Neale Investment Services Pty Limited expressly disclaim all and any liability to any person, whether a client of Cutcher & Neale Investment Services Pty Limited or not, who acts or fails to act as a consequence of reliance upon the whole or any part of this publication.

Cutcher & Neale Investment Services Pty Limited ABN 38 107 536 783 is a Corporate Authorised Representative of Cutcher & Neale Financial Services Pty Ltd ABN 22 160 682 879 AFSL 433814.

Cutcher's Investment Lens | 7 - 11 April 2025

The failed $3 million super tax: Division 296 is done… or is it?

Cutcher's Investment Lens - Update on Trump & Tariffs | 31 March - 4 April 2025

Liberation Day - April 2025 Snapshot

Smart investing for SMEs: The basics on how to get started and grow your business.