If you have investments in real estate or are looking to grow or build a property portfolio, negative gearing isn’t new to you. Nor is it new to the spotlight. Or the Senate floor.

But it might be getting old soon.

Senate crossbenchers have recently called on both the Labor and Coalition parties to reconsider the scope of benefits to investors under negative gearing. While a common tax strategy for wealth accumulation, it’s often seen as a heavy contributor to housing price inflation.

So, what is negative gearing, and why should you capitalise on it while you can?

What Is Negative Gearing?

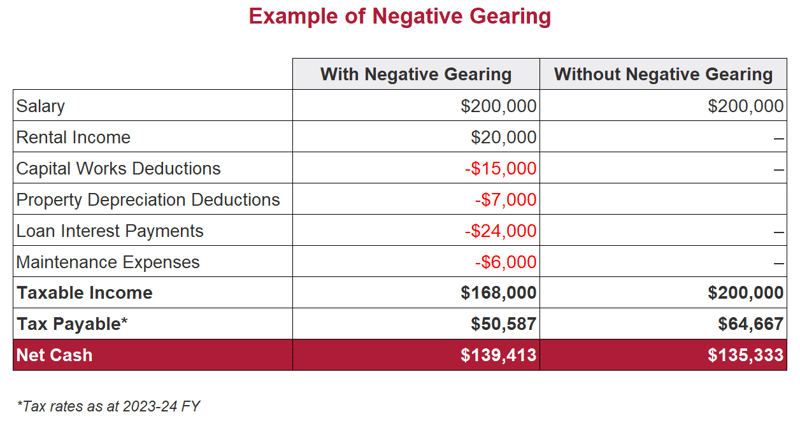

Negative gearing is a tax strategy that mitigates this somewhat, allowing property investors to offset losses incurred from rental properties against their total taxable income. It also allows for a tax concession on the capital gains they would owe upon selling the property.

Tax deduction schemes such as negative gearing have generous benefits for high-income earners, making it a common strategy for those affected by a higher tax liability. However, negative gearing benefits investors at all tax levels, whether you’re just starting out along your career path or reaching retirement. Property investment is a popular choice due to its long-term, material nature and historical tendency towards appreciation.

By capitalising on negative gearing, you can leverage your investment and benefit from tax deductions while simultaneously building long-term, stable wealth through real estate.

Capital Growth Is Key

If you are considering purchasing an investment property, it’s important to understand the fundamentals of the market you are entering. The primary aim is to achieve solid capital growth over time.

Investment property interest rates are currently at approximately 6.5% while property rental yield can be as low as 3–4%. This means that before any other deductions are applied, your investment is already negatively geared.

In this higher interest rate environment, long-term capital growth is a vital requirement within your portfolio. Otherwise, you’re simply making a loss instead of growing your wealth. By working with an expert financial advisor, you can create a strategy to positively grow your portfolio or optimise your current investments for growth.

Additional Deductions

An investment property portfolio also offers other tax deductions to include within your tax strategy.

Capital Works deductions

While land normally appreciates in value over time, material assets such as property tend to depreciate due to the natural wear and tear that occurs. For properties constructed after 1987, 2.5% of the structural costs can be written off for the first 40 years after construction.

In most cases, you’ll need a quantity surveyor report for this (which is deductible too). Don’t forget that renovations qualify for the 2.5% write-off too.

Depreciation deductions

Fixtures and fittings like carpet, blinds, and hot water services can all be depreciated. Once again, a quantity surveyor report will assist. The benefit of these deductions is that they are non-cash, meaning you don’t need to spend additional money to claim them.

50% Capital Gains tax discount

Properties held for longer than 12 months qualify for a 50% discount of the net capital gain (property value increase). Keep in mind that this applies from the date of exchange of contracts, not the date of settlement.

Repairs and maintenance

For genuine rental property repairs, you can claim 100% of the cost, but make sure you don’t get this confused with a replacement or improvement. What’s the difference? Repairs effectively restore your property to its original condition, while improvements better it beyond this or increase its value.

Utilities, taxes, and strata fees

It’s important to be thorough so you don’t miss the simple things, such as these kinds of costs. It’s advisable to arrange for your property manager or real estate agent to pay for these from the rent you receive. This means that these items will then be included in your annual summary and won’t be forgotten.

The three key components of negative gearing are rent, interest and depreciation:

Negative To Positive

If nothing else, this recent call for negative gearing reform has sparked plenty of conversations about what that would look like. If you’re considering property investment or looking to add to your portfolio, there could be an opportunity to safeguard it from the effects of any future reforms or abolishment.

The current discussions have raised the concept of grandfathering — clauses designed to protect the historical status quo.

If negative gearing reform does occur, it would not be unusual for the government to allow investors with portfolios built under current rules to retain these benefits but place restrictions on post-reform purchasers. By doing so, policymakers would aim to mitigate the disruptive impact of reforms while still addressing concerns about housing affordability.

Negative gearing has been deeply entrenched in our housing market for decades, and any potential changes to the current scheme are likely to be cautiously undertaken. Likewise, building a property portfolio takes time and due consideration.

If you are considering property investment or looking to expand your portfolio, purchasing in the short to medium term could be an opportunity to protect your tax strategies from the effects of any future reform.

Our expert Advisors are here to help guide you along your wealth creation journey. Contact us today to find the positives within the negatives.

Dean is the head of the Residential & Commercial Finance division at Cutcher & Neale. With over a decade of experience previously working within the private banking industry, he enables the firm to provide independent, dedicated and personal finance solutions to clients.

Dean specialises in finance solutions such as home loans, investment loans, refinance, commercial loans and bespoke lending for certain professions.

Cutcher's Investment Lens | 7 - 11 April 2025

The failed $3 million super tax: Division 296 is done… or is it?

Cutcher's Investment Lens - Update on Trump & Tariffs | 31 March - 4 April 2025

Liberation Day - April 2025 Snapshot

Smart investing for SMEs: The basics on how to get started and grow your business.

.webp)