Snapshot

Global financial markets finished around 3% lower during October as bond yields continued to march higher and geopolitical conflict in Israel lowered confidence in the outlook.

Market volatility, as measured by the CBOE Volatility or VIX index, rose accordingly, trading at levels not seen since the United States experienced a regional banking crisis in March.

The turbulence follows comments we made in our August Snapshot where we debated the type of economic slowdown expected over the next 6 to 12 months, being either a soft landing or a hard landing.

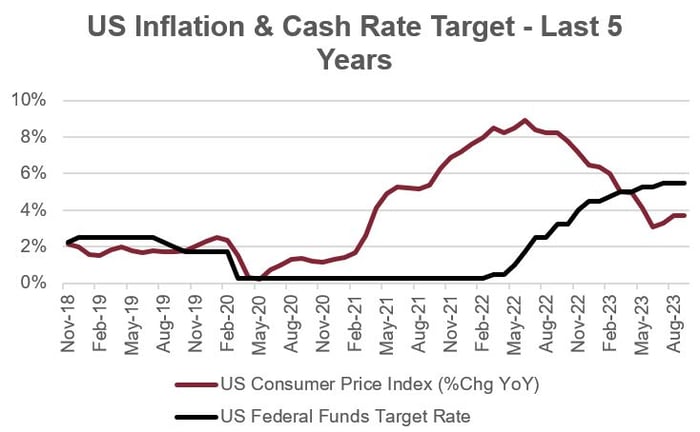

At the time in August, the probability of a soft economic landing in the United States seemed to be rising as economic growth, including retail sales and the labour market, remained strong, while inflation continued to fall.

This momentum continued into September as well, with the economy growing at 4.9% during the quarter, retail sales beating expectations, unemployment remaining low at 3.8%, and inflation falling to 3.7%.

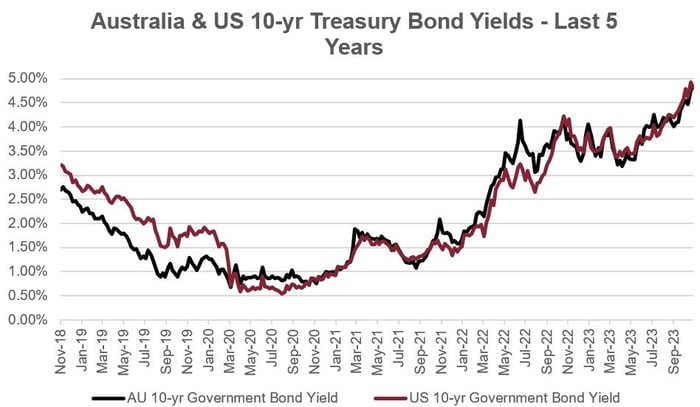

The subsequent rise in bond yields during September and October however, along with the conflict in Israel, have created a more balanced likelihood of a soft versus hard economic landing.

In response to strong economic data and central banks sticking with their higher for longer interest rate policies, the 10-year Australian Government Bond yield rose from 4.03% at the end of August to 4.95% at the end of October. Similarly, the 10-year United States Government bond yield rose from 4.09% at the end of August to 4.91% at the end of October.

Furthermore, a conflict erupted in the Middle East in early October between Israel and Gaza. Although neither party is a major oil producer, concerns about higher oil prices emerged due to alleged Iranian support for Hamas and the risk of the conflict spreading in the region.

Even before the conflict, the global oil market was already experiencing tightness because of OPEC+ production restrictions and voluntary production cuts by Saudi Arabia and Russia. Surprisingly, however, the oil price fell by about 10% during October, while the gold price rose by around 7%.

As we move forward, it remains to be seen whether market movements in September and October are the beginning of a new trend, or if the coming months will revert to their usual seasonal patterns. If the seasonal narrative holds up, the fourth quarter can often lead to a 'Santa Claus' rally and strong equity market returns. Nevertheless, the Investment Committee remains alert in light of recent economic and geopolitical developments, and believes the portfolios are well positioned with high-quality liquid assets should any further volatility be experienced in the coming months.

Key Stocks

Walmart

Cutcher & Neale International Shares Model

Walmart is a renowned American retailer that operates department and grocery stores both in the United States and around the globe. Walmart is most well-known for its discount stores that offer an extensive range of products, ranging from groceries and household items to clothing and electronics.

Walmart has successfully maintained its cost competitiveness edge, affirming its position as a provider of low-cost options. The most recent earnings announcement from the company highlighted impressive results, notably their e-commerce segment, which soared 24% in the quarter, while revenue increased by 5.7%.

The Investment Committee recently decided to add the US retail giant to the International Shares model, with the aim of providing strong defensive exposure within the portfolio.

Merck & Co.

Cutcher & Neale International Shares Model

Merck & Co is an American healthcare company, that provides a diverse range of pharmaceutical products for both consumer healthcare needs and animal health. Merck operates through a range of segments, such as oncology, vaccines, cardiovascular, diabetes and women’s health.

Merck is a leader in healthcare innovation, which has been highlighted by their groundbreaking cancer drug, Keytruda, which is used to treat various types of cancer. This medication has helped the company’s growth significantly, accounting for 40% of its sales.

In terms of investment, Merck & Co offers the portfolio defensive exposure, while also having promising growth prospects. The company has a protected patent until 2028 for the Keytruda drug, while also having many other innovative developments in the pipeline.

Walmart

Cutcher & Neale International Shares Model

Walmart is a renowned American retailer that operates department and grocery stores both in the United States and around the globe. Walmart is most well-known for its discount stores that offer an extensive range of products, ranging from groceries and household items to clothing and electronics.

Walmart has successfully maintained its cost competitiveness edge, affirming its position as a provider of low-cost options. The most recent earnings announcement from the company highlighted impressive results, notably their e-commerce segment, which soared 24% in the quarter, while revenue increased by 5.7%.

The Investment Committee recently decided to add the US retail giant to the International Shares model, with the aim of providing strong defensive exposure within the portfolio.

Merck & Co.

Cutcher & Neale International Shares Model

Merck & Co is an American healthcare company, that provides a diverse range of pharmaceutical products for both consumer healthcare needs and animal health. Merck operates through a range of segments, such as oncology, vaccines, cardiovascular, diabetes and women’s health.

Merck is a leader in healthcare innovation, which has been highlighted by their groundbreaking cancer drug, Keytruda, which is used to treat various types of cancer. This medication has helped the company’s growth significantly, accounting for 40% of its sales.

In terms of investment, Merck & Co offers the portfolio defensive exposure, while also having promising growth prospects. The company has a protected patent until 2028 for the Keytruda drug, while also having many other innovative developments in the pipeline.

Wade is the head of the Investment Services division at Cutcher & Neale and has over 15 years of industry experience in accounting and investment advisory roles.

Wade guides his division on the belief that investment portfolios should be built on transparency and flexibility. His expertise focuses on direct portfolio exposure to both Australian and Global Investment markets.

Start strong in January: Why smart tax planning begins well before June

AI Explainer: Who’s Behind the Tools You Keep Hearing About?

Ready for Next-Level Automation? See What’s New in Ostendo 243

Thinking ahead, acting today: Must-know succession strategies for practice owners

From locum shifts to running your own practice: When your cover needs an upgrade