Picture this: you run a successful business, and you end up expanding by setting up another company. You assume each business is separate for tax purposes – until you get a notice from the state revenue office saying that your businesses are grouped for payroll tax. Suddenly, you’re paying more than expected, and that tax-free threshold you thought you had? It’s now shared across all your businesses.

This is where payroll tax grouping can catch business owners off guard. Here’s what you need to know to avoid these costly surprises.

What is payroll tax grouping?

Payroll tax is a state-based tax on wages paid by employers. Each state and territory have different thresholds and rates, but they all apply grouping provisions to prevent businesses from structuring in a way that avoids payroll tax.

Under these rules, businesses that are linked by ownership, control, or shared employees may be treated as a single group for payroll tax purposes. This means:

✔ All wages across the group are aggregated to determine payroll tax liability.

✔ The group can only claim one tax-free threshold (if applicable).

✔ If one member fails to pay payroll tax, the others may be held jointly liable.

Types of grouping: Where businesses get caught.

The payroll tax grouping rules vary by state and territory, but they generally fall into these categories:

- Common control grouping

Businesses are grouped if they are controlled by the same person or entity.

Trap: Even if businesses operate independently, they can still be grouped if they share a common owner.

- Related entity grouping

Companies can be grouped if they are related under the Corporations Act 2001 (e.g., parent and subsidiary companies).

Trap: A holding company with separate trading entities can be grouped, even if the businesses operate in different industries.

- Use of common employees

If businesses share employees, they can be grouped for payroll tax purposes.

Trap: Even if the businesses have different owners, payroll tax grouping can apply if staff are shared or moved between entities.

- Deemed grouping

Even if a business doesn’t fit neatly into the above categories, the tax office may still deem it part of a group based on its structure and relationships.

Trap: The payroll tax authority has broad discretion to group businesses if they believe tax avoidance is happening.

Claiming the tax-free threshold: What you need to know.

Most states and territories allow one tax-free threshold per group. If your group’s total wages exceed the state’s threshold, payroll tax applies to the entire amount.

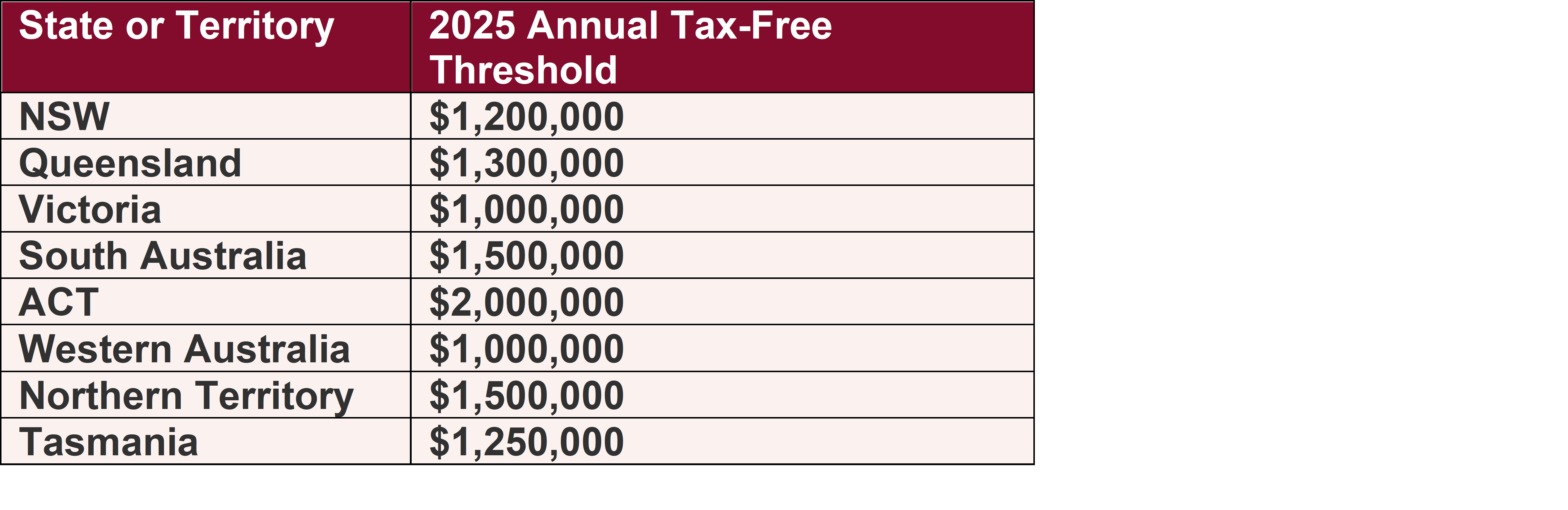

Check your threshold: Each state has different limits.

Tips to stay compliant.

- Regularly review your business structure to check for grouping risks.

- Keep clear records of employee agreements if staff work across multiple entities.

- Apply for exclusions early if you believe your business should not be grouped.

- Monitor state payroll tax updates, as grouping rules and thresholds can change.

- Engage a professional to help keep you on track.

Payroll tax grouping can be a costly surprise if not managed properly. Understanding how the rules apply to your business can help you minimise tax liability and avoid compliance headaches. If you’re unsure, getting professional advice is essential – because when it comes to payroll tax, assumptions can be expensive.

Jace joined the firm in 2005 and has over 20 years' experience in the taxation and business services field. By immersing himself within the industry, he has developed a deep understanding of the financial and operational issues that face businesses and, as a result, provides tailored solutions to bring the best possible outcome to his clients.

Jace takes a holistic approach, allowing him to plan for all aspects of his clients personal finances including their practice / business, investments and superannuation.

Cutcher's Investment Lens | 14-18 April 2025

Cutcher's Investment Lens | 7 - 11 April 2025

The failed $3 million super tax: Division 296 is done… or is it?

Cutcher's Investment Lens - Update on Trump & Tariffs | 31 March - 4 April 2025

Liberation Day - April 2025 Snapshot