The period leading up to retirement can be a critical time to do some planning to ensure that your retirement goes smoothly.

Retirement planning is never a one-size-fits-all approach - it is all about knowing where you stand financially and the goals you would like to achieve in your post-work life that will make planning much easier.

The first step is to ask yourself some crucial questions such as what your timeline to retirement is? What kind of retirement lifestyle you would prefer? And how much it will cost to live your preferred lifestyle?

How much will you need?

When thinking about how much you would need in retirement, the first step would be to think about your current income and saving levels and any spending you expect to change in retirement (i.e. debts paid off, more holidays, etc).

According to the December 2021 figures from the Association of Superannuation Funds of Australia (ASFA), individuals and couples, around age 67, looking to retire today, would need a certain annual budget to fund a comfortable lifestyle versus a modest one.

The following table compares the suggested annual budgets to the current maximum Age Pension rates being paid by the government and should help you get a general idea of the estimated costs involved in funding your preferred lifestyle.

Note that the ASFA figures assume that people own their home outright and are relatively healthy.

This will be very individual: for those who have been living on $200,000 before retirement, it is unlikely that the above figures would give them the level of lifestyle that they are accustomed to.

Superannuation strategies

The money used to fund your retirement life will likely come from a variety of different sources, of which superannuation would be the most critical one. The more you can put into super before retiring, the more money you are likely to have when you retire.

Strategies for building up your super include voluntarily contributing to your super, which can also offer tax advantages for those earning higher-than-average income.

By voluntarily contributing to your super and maximising your concessional and non-concessional contribution caps every year, you are effectively lowering your tax obligations in the present while also building up your super balance for the future.

The current concessional contribution cap is $27,500 a year and non-concessional contribution cap is $110,000 a year (or up to $330,000 if utilising the three-year bring forward provision).

If you have unused concessional cap amounts from previous years and a total super balance below $500,000, you may also be able to make catch-up concessional contributions.

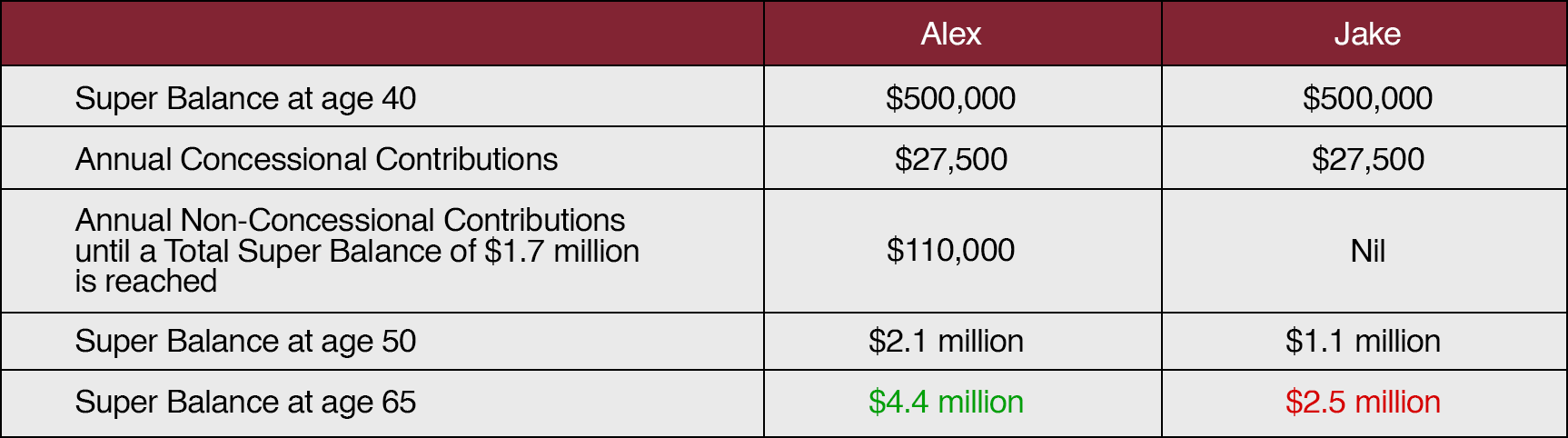

The table below demonstrates how a small difference made to your yearly contributions during your working life can make a huge difference to your retirement outcomes. Alex and Jake are two working 40-year-olds. Both maximise their concessional contributions every year, however, Alex also tops up his non-concessional contributions cap every year until he reaches a Total Super Balance of $1.7 million. As can be seen below, the difference this makes to Alex’s super balance over time is profound.

Depending on how you withdraw your super and at what age, there will also be different tax implications worth investigating, which will depend on your individual circumstances.

Existing debt

When planning retirement, you may want to consider what outstanding debt you have and ways you may be able to reduce it while you are still earning an income. If appropriate, you may also consider drawing down your super, when eligible to do so, to pay off your existing debts.

Sound retirement planning can help give you the confidence to draw down on the retirement income that you have worked so hard to build up to enjoy later in life. While planning your retirement is an important first step in turning your retirement dreams into reality, seeking professional advice and taking actions at the right time is even more important.

Your advisor can help put in place a comprehensive plan and a financial roadmap to help you get there.

Cutcher's Investment Lens | 30 June - 4 July 2025

Cautious Optimism - July 2025 Snapshot

Cloud accounting for small business: More clarity, less admin.

Key business actions for the new financial year.

Cutcher's Investment Lens | 23 - 27 June 2025