A Public Ruling by the Queensland Revenue Office was announced on 19 September 2023.

The ruling aims to address the uncertainty many practices have faced and provides clarity in relation to common payment arrangements for medical centres and the payroll tax implications associated with them.

Within the Public Ruling there are some unusual, detailed examples. Due to this, it’s important that all practices understand the risk associated with their specific legal structure and flow of funds.

|

|

Key Takeaways

|

|

Five Important Considerations

We recommend that practices undertake a thorough review of their arrangements to reduce the risk of an adverse payroll tax finding. A review should cover the following areas:

1. Practitioner Service Agreements

Like any contract or agreement, it’s only as sound as the information included in it. A poorly drafted agreement can leave a practice exposed. Ensure that the agreement does not provide for a regular ‘guaranteed’ minimum to a medical practitioner or any employee style connotations.

2. Understand arrangements for doctors that work elsewhere

Doctors working elsewhere and providing services to the general public outside of the practice may potentially be exempt. However, evidence to support this should be obtained.

3. Banking and practitioner payment processes

The ruling confirms in most cases the use of a trust account or clearing account where the practice controls the monies and makes a payment to a Practitioner now creates significant Payroll Tax Relevant Contract Issues.

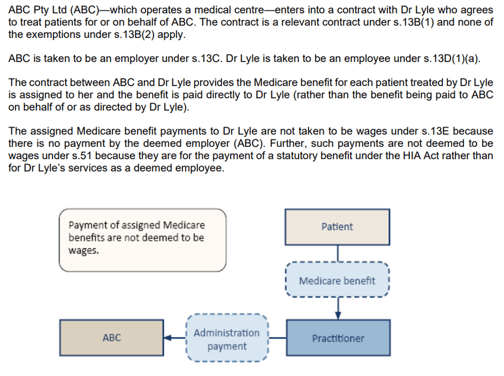

Example 12 from the ruling outlines the specific example of direct banking to doctors:

4. Advertising channels, including website and social media

Practices should review all advertising channels, such as their website and social media, to ensure that the medical practice is not promoting medical practitioners as staff.

5. Amnesty eligibility and application

Consider your practice; are you eligible for the Amnesty and do you need to apply by 10 November 2023?

We are grateful that we were provided the opportunity to consult with the Government in conjunction with AMAQ and Hillhouse Legal to assist in achieving this result for the medical profession in Queensland.

If you would like to speak with one of our Medical Specialist Advisors regarding your potential payroll tax liability, please do not hesitate to contact us.

Related Articles

Queensland Payroll & Land Tax Changes: Concessions and Discount Extensions

The Grossly Unfair Approach to Payroll Tax That May Implicate Your Queensland Medical Practice

Cutcher's Investment Lens | 7 - 11 April 2025

The failed $3 million super tax: Division 296 is done… or is it?

Cutcher's Investment Lens - Update on Trump & Tariffs | 31 March - 4 April 2025

Liberation Day - April 2025 Snapshot

Smart investing for SMEs: The basics on how to get started and grow your business.