Generally, employers pay the Superannuation Guarantee rate of 10.5% of your ordinary time earnings (OTE) to your super fund.

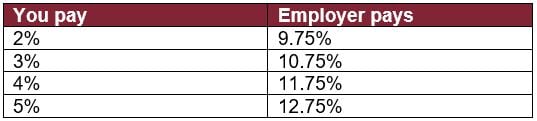

Most Queensland Health employees can also make additional standard contributions. The more you make, the more super you receive from your employer (see below):

From 1 April 2023

Queensland Health employees can now choose to reduce their standard contribution to 0%.

Your employer contribution will decrease to 10.5% of OTE, but the employer can make a one-time top-up contribution during the 2023-24 financial year to bring your 2023 financial year contributions to 12.75% of OTE.

Your standard contribution will not change unless you choose to change it.

Changes from 1 July 2023

From 1 July 2023, you’ll no longer need to make a standard contribution to receive the full 12.75% from your employer.

Furthermore, a change to the definition of “salary” used to calculate superannuation will come into effect. This means that from 1 July 2023, you’ll also receive contributions on shift loadings, allowances, and bonuses, so you may receive more employer contributions.

For new Queensland health employees, it’s worth noting that the employee contribution will default to 5% for most employees and 0% for casuals.

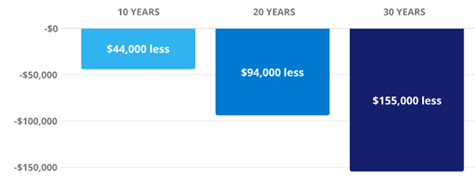

Reducing your standard contribution rate by any amount could have an impact in a number of areas so you will need to consider the following:

- You will still receive super from your employer

- Your take-home pay could increase

- You’ll have less money in super for retirement

- Super co-contributions could be affected, and

- Check if your tax benefits will be affected

Case Study

Martha is a Queensland Health employee, and receives the following remuneration:

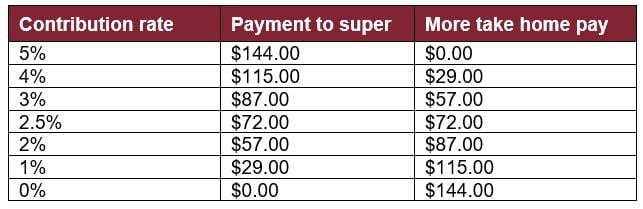

Martha has chosen to make after-tax contributions of 5% of her superannuable salary. What do the changes mean for Martha?

1. Super will be paid at 12.75% of OTE from 1 July 2023.

Martha’s OTE now includes the $5,000 of other allowances so she’ll receive $21 more employer contributions each fortnight after the 15% contributions tax.

2. Employee payments to super are optional.

Martha chooses how much of her fortnightly salary to voluntarily contribute to super. The less she contributes, the more take-home pay she gets.

3. One-off top-up to super.

As mentioned above, between July and September 2023, some Queensland Health employees will receive a one-off top-up contribution to bring their total employer contributions for 2022-23 to 12.75% of their OTE.

Martha will receive a one-off payment of $638 into her super account (12.75% x $5,000 = $638).

If you have any questions relating to your superannuation please get in touch with a member of our award-winning team.

Cutcher's Investment Lens | 7 - 11 April 2025

The failed $3 million super tax: Division 296 is done… or is it?

Cutcher's Investment Lens - Update on Trump & Tariffs | 31 March - 4 April 2025

Liberation Day - April 2025 Snapshot

Smart investing for SMEs: The basics on how to get started and grow your business.