The RBA official cash rate increase of 0.5% , means that the cash rate has increased from a record low of 0.1% to 0.85% after the May increase of 0.25% and the June 0.5% increase.

Inflation, supply chain issues and a tight labour market were factors in the RBA’s decision.

The impact of the consecutive rate hikes on variable loan amounts is demonstrated below and is based on:

- a reasonable (not market leading) pre-May variable rate of 2.65%

- principal and interest repayments

- 25 year loan term remaining

LOAN AMOUNT |

MONTHLY INCREASE |

ANNUAL INCREASE |

| $500,000 | $195 | $2340 |

| $1,000,000 | $390 | $4680 |

| $1,500,000 | $586 | $7032 |

| $2,000,000 | $781 | $9372 |

| $2,500,000 | $976 | $11,712 |

| $3,000,000 | $1172 | $14,064 |

From the perspective of interest rates that the banks are now offering, several future rate increases are currently priced in to fixed rates meaning you pay a premium for certainty of repayments.

The banks are now competing hard in the variable rate space for purchases and refinances and this is where we are seeing good pricing discounts.

The reduction of borrowing capacity

Another impact of a rising interest rate environment is that borrowing capacity will reduce.

When banks assess your ability to borrow, they are assessing the interest rate you receive on your funding with the addition of a sensitised rate or buffer added. This buffer is typically around 2.5% above the actual interest rate you receive.

Six months ago your sensitised assessment rate could feasibly be in the 4.5% - 4.75% range given the prevailing low interest rates at the time.

With two recent cash rate hikes, sensitised assessment rates for a variable loan will rise to around 5.5%.

If you are looking at fixing your loan and with fixed rates now typically above four percent, this will result in a sensitised rate in excess of 6.5%.

Therefore applying for finance on a fully variable basis provides greater borrowing capacity than applying for a fixed rate loan.

The higher sensitised rates mean less capability to borrow funds in all income brackets, which logically will have an impact on house prices.

Investors and first home buyers could benefit!

The increasing rate environment may see some winners emerge.

Investors who have some equity or available cash can patiently watch how the rate increases impact the market. There will no doubt be some good buying opportunities that emerge in various locations.

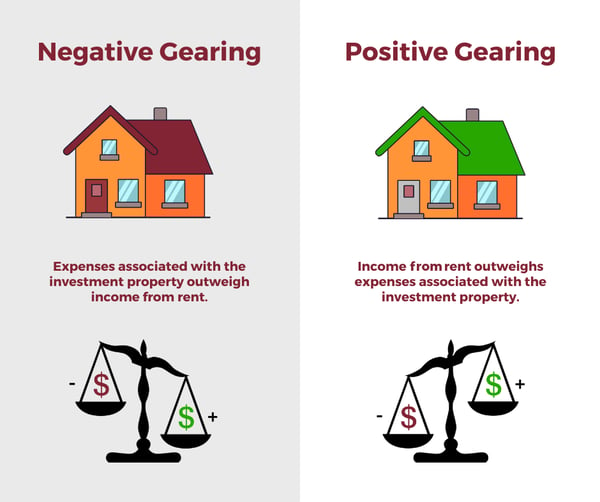

The other advantage for investors is that negative gearing will come back in vogue, where increased investment property expenses from higher interest payments and other costs will outweigh the income from rent. This will provide deductible benefit with rental losses offsetting taxable income.

First Home Buyers will also be able to breathe a little easier… at least in terms of property prices not increasing as quickly.

Over the past couple of years we have seen annualised growth of 20% to 25% in some property markets.

As a first home buyer looking to purchase in the $1m price range, it is extremely difficult when properties in this price range could be increasing in value by $20,000 per month.

We are now starting to see a market slowdown, with subdued capital growth. First home buyers can re-calibrate and be in a position to negotiate from a position of strength in this emerging buyers market.

If you would like to discuss your finance options, please do not hesitate to get in touch with our team.

Smart investing for SMEs: The basics on how to get started and grow your business.

ATO updates: A quick guide on what business owners need to know.

Cutcher's Investment Lens | 24 - 28 March 2025

Is your current super fund holding you back? It might be time for an SMSF.

Cutcher's Investment Lens | 17 - 21 March 2025