Interest rates are climbing and borrowing capacities are reducing. Young people are struggling to find affordable and available houses without having to compromise on location or size. It’s never seemed harder to break into the housing market for first home buyers.

For doctors, however, a possible solution may be found through ‘rentvesting’.

The concept of rentvesting is a strategy that involves purchasing an investment property while continuing to rent in a desirable location. Instead of compromising on lifestyle, doctors can invest in property that fits their budget and financial goals, while also maintaining flexibility in choosing where they live.

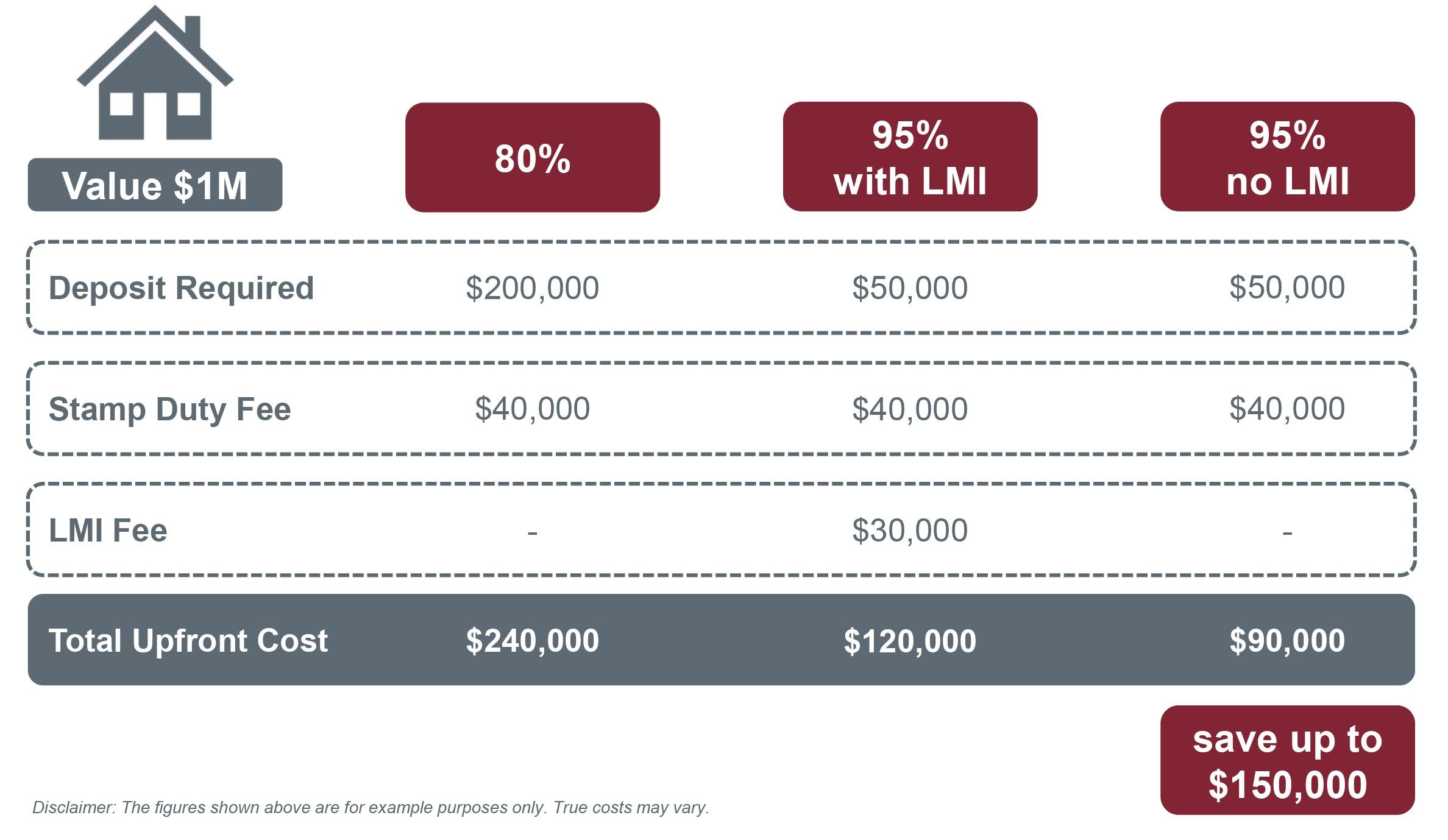

Critically, through Cutcher & Neale Finance, doctors can borrow up to 95% of the property value with no Lenders Mortgage Insurance (LMI), greatly enhancing their ability to enter the property market sooner.

Benefits Of Rentvesting

Financial flexibility

Medical professionals often face uncertainties in their early careers due to lengthy training and specialisation. Rentvesting provides them with financial flexibility, enabling them to invest in real estate without tying up their capital in a primary residence. This allows doctors to allocate their savings strategically, diversify their investment portfolio and take advantage of potential capital appreciation.

Tax benefits

Rentvesting can offer tax advantages for doctors. Expenses related to the investment property, such as interest payments, maintenance costs and property management fees can be tax-deductible, reducing their overall tax liability. This can be beneficial during the early stages of a medical career when financial resources might be more limited and a tax refund could come in handy.

Property portfolio growth

Rentvesting allows doctors to build a property portfolio, generating a passive income stream that complements their medical profession. Over time as property values appreciate and rental income increases, doctors can leverage their equity to acquire more investment properties, accelerating wealth creation.

Doctors often need to live in proximity to hospitals or medical facilities, which can be in expensive urban areas. Rentvesting provides the flexibility to rent a home in the desired location while purchasing an investment property in an area with strong growth potential and rental demand. This way, doctors can balance their personal and professional needs effectively while also setting themselves up for future security.

No Lenders Mortgage Insurance (LMI)

For many homebuyers, particularly those with a deposit of less than 20%, LMI is another added cost. However, Cutcher & Neale Finance offer specialized loan products that allow doctors to borrow up to 95% of the property value without incurring LMI. This exclusive benefit can save thousands of dollars on a property purchase and make homeownership more accessible for medical professionals.

Building wealth for the future

Rentvesting provides doctors with an opportunity to build reliable wealth over the long term. As they continue to earn a steady income, make mortgage repayments, and benefit from property appreciation, they are securing their financial future and setting themselves up for a comfortable retirement.

Rentvesting can be an empowering solution for doctors seeking to enter the property market while maintaining flexibility in where they live. By investing in property while renting in a preferred location, doctors can enjoy numerous benefits such as financial flexibility, tax deductions and the ability to build a property portfolio.

The added advantage of borrowing up to 95% of the property value without LMI empowers doctors to overcome financial barriers and achieve their homeownership dreams sooner. As the real estate market continues to evolve, rentvesting allows doctors to balance both their personal and professional aspirations effectively.

Are you looking for expert advice from a medical finance specialist? Get in touch with our Finance Advisors today to learn more about your options.

Dean is the head of the Residential & Commercial Finance division at Cutcher & Neale. With over a decade of experience previously working within the private banking industry, he enables the firm to provide independent, dedicated and personal finance solutions to clients.

Dean specialises in finance solutions such as home loans, investment loans, refinance, commercial loans and bespoke lending for certain professions.

Cutcher's Investment Lens | 14-18 April 2025

Cutcher's Investment Lens | 7 - 11 April 2025

The failed $3 million super tax: Division 296 is done… or is it?

Cutcher's Investment Lens - Update on Trump & Tariffs | 31 March - 4 April 2025

Liberation Day - April 2025 Snapshot

.webp)