Snapshot

In August, global financial markets experienced some consolidation, with major stock indices showing slight declines.

Market volatility, measured by the CBOE Volatility or VIX index, settled around 13 after a brief spike to 17 earlier in the month.

The Australian Dollar weakened relative to the United States Dollar over the same period, dropping from US$0.69 in mid-July to US$0.64 by the end of August. In the commodities market, oil, iron ore, and coal prices increased by 4.3%, 11.5%, and 11.3%, respectively, while copper and nickel prices decreased by 2.4% and 8.4%.

Two key events in August were the US Federal Reserve's annual economic symposium in Jackson Hole, Wyoming, and the economic challenges facing China.

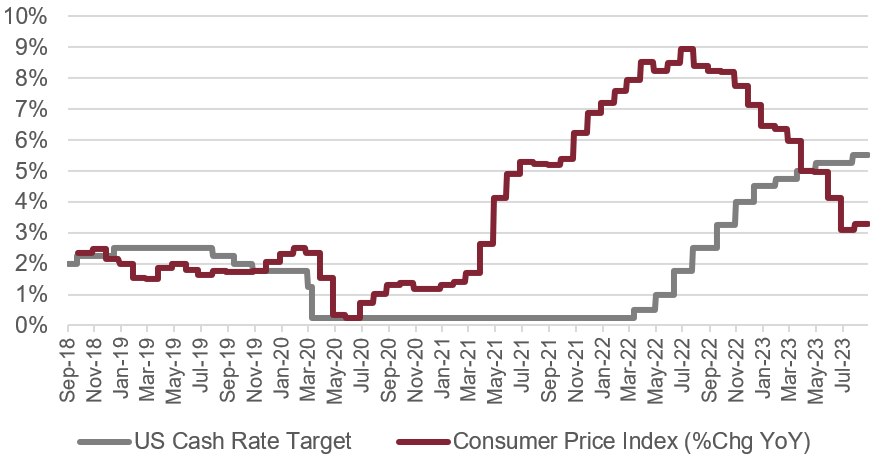

At Jackson Hole, Fed Chair Jerome Powell adopted a hawkish stance, signalling the Fed's readiness to raise interest rates further and maintain a restrictive monetary policy until they are confident that inflation is on track to reach its 2% target. Powell also acknowledged the importance of data in shaping the Fed's future actions.

US Inflation & Interest Rate - Last 5 Years

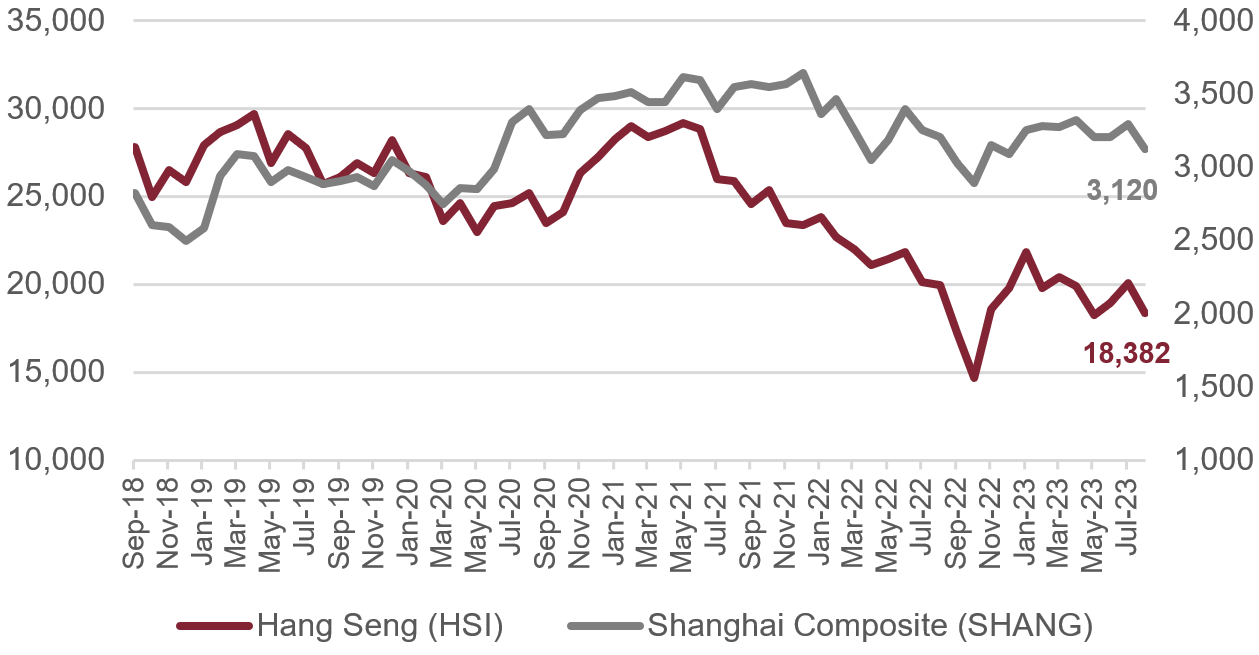

In China, economic difficulties led to weaker markets, with the Shanghai Composite falling nearly 5% and the Hang Seng dropping over 8% in August. This decline followed a substantial drop in exports, down 14.5% year-over-year in July, primarily due to shifting consumer preferences from goods to services and geopolitical tensions. Exports to the US and EU decreased significantly, while exports to Russia increased sharply.

Shanghai Composite & Hang Send - Last 5 Years

These export challenges indicated a broader economic slowdown affecting both Asia and developed economies. China's domestic issues, including a weakening housing market, cautious consumer spending, and high youth unemployment, exacerbated the situation.

Economists predicted the need for stimulus measures, with a focus on infrastructure spending through bond

issuances.

In response, China's central bank implemented emergency measures, reducing key interest rates.

Furthermore, Beijing introduced initiatives to boost its stock market, including a trading tax cut and plans to revive the capital market. The tax reduction is expected to significantly lower trading costs, but with effects diminishing over time.

To address over-supply and encourage margin lending, China's securities regulator also plans to limit new listings and restrict controlling shareholders' stock sales under specific conditions.

While these measures temporarily boosted the market, experts believe that more comprehensive actions are required to address economic concerns.

China's stock market continues to face pressure, particularly in the Property sector, and foreign investors have remained cautious, reducing exposure to the market by more than US$10 billion in recent times.

Key Stocks

NVIDIA Corporation

Cutcher & Neale International Shares Model

NVIDIA Corporation impressed again in their recent earnings report, with the company surpassing analysts' expectations due to the substantial growth stemming from their artificial intelligence (AI) division. The company announced an 88% growth in sales over just one quarter, with revenue now hitting US$13.5 billion.

The chip designer now sits within the top five largest companies in the US, and as highlighted above, is continuing to grow at an incredible rate. AI has quickly become part of our everyday lives and will continue to have more of an impact as the technology advances. NVIDIA Corporation is well poised in the transition to AI, with their graphical processing units an essential component of the computer systems that are able to process the large amounts of data.

Woolworths Group

Cutcher & Neale Australian Shares Model

Woolworths was another company who impressed in their June earnings report. A normalisation of shopping habits following the COVID-related disruption was the main contributor to the increase in revenue, along with continuing to refine their new store blueprint and progress with their store renewal program.

Woolworths saw the largest revenue increase in their Metro Food Stores, with sales growth of 21.6% over the year. In addition to this, food sales increased 5.0%, while the Woolworths delivery saw a 5.6% increase in sales.

The strong performance has been identified by investors of late, with the share price lifting 15.4% in 2023 thus far, in contrast with main competitor Coles Group, which has declined 0.7% over the same period.

NVIDIA Corporation

Cutcher & Neale International Shares Model

NVIDIA Corporation impressed again in their recent earnings report, with the company surpassing analysts' expectations due to the substantial growth stemming from their artificial intelligence (AI) division. The company announced an 88% growth in sales over just one quarter, with revenue now hitting US$13.5 billion.

The chip designer now sits within the top five largest companies in the US, and as highlighted above, is continuing to grow at an incredible rate. AI has quickly become part of our everyday lives and will continue to have more of an impact as the technology advances. NVIDIA Corporation is well poised in the transition to AI, with their graphical processing units an essential component of the computer systems that are able to process the large amounts of data.

Woolworths Group

Cutcher & Neale Australian Shares Model

Woolworths was another company who impressed in their June earnings report. A normalisation of shopping habits following the COVID-related disruption was the main contributor to the increase in revenue, along with continuing to refine their new store blueprint and progress with their store renewal program.

Woolworths saw the largest revenue increase in their Metro Food Stores, with sales growth of 21.6% over the year. In addition to this, food sales increased 5.0%, while the Woolworths delivery saw a 5.6% increase in sales.

The strong performance has been identified by investors of late, with the share price lifting 15.4% in 2023 thus far, in contrast with main competitor Coles Group, which has declined 0.7% over the same period.

Wade is the head of the Investment Services division at Cutcher & Neale and has over 15 years of industry experience in accounting and investment advisory roles.

Wade guides his division on the belief that investment portfolios should be built on transparency and flexibility. His expertise focuses on direct portfolio exposure to both Australian and Global Investment markets.

Start strong in January: Why smart tax planning begins well before June

AI Explainer: Who’s Behind the Tools You Keep Hearing About?

Ready for Next-Level Automation? See What’s New in Ostendo 243

Thinking ahead, acting today: Must-know succession strategies for practice owners

From locum shifts to running your own practice: When your cover needs an upgrade