The Australian Government has recently passed the Small Business Investment Boost measures announced in the 2022-23 Budget into law.

The Technology Investment Boost and Skills & Training Investment Boost are designed to support small businesses with digital adoption and employee upskilling. Under the measures, businesses have the ability to deduct an additional 20% of the eligible expenditure related to these investments.

Below is a guide to the eligibility and claim limits of each Investment Boost scheme.

Small Business Technology Investment Boost

Small businesses can claim the deduction for the cost of investments for digital business operations or the digitisation of business operations, and depreciating assets such as portable payment devices, cyber security systems, and cloud-based service subscriptions.

Eligibility

- Small businesses with an aggregated annual turnover of less than $50 million for the income year in which you incur the expenditure

- Tax deductible expenditure occurred between 7:30pm AEDT 29 March 2022 – 30 June 2023

- Depreciating assets first used, or installed ready for use, by 30 June 2023

Amount You Can Claim

Businesses can claim an additional 20% of eligible technology related expenditure up to the annual $100,000 expenditure cap for each qualifying income year;

- Up to $20,000 for the period 29 March 2022 – 30 June 2022

- Up to $20,000 for the period 1 July 2022 – 30 June 2023

All deductions will be claimed in the 2023 financial year tax return.

What You Can Claim

- Digital Enabling Items – computer and telecommunications hardware and equipment, software, internet costs, systems and services that form and facilitate the use of computer networks

- Digital Media and Marketing – audio and visual content that can be created, accessed, stored or viewed on digital devices, including web page design

- e-Commerce – goods or services supporting digitally ordered or platform-enabled online transactions, portable payment devices, digital inventory management, subscriptions to cloud-based services, and advice on digital operations or digitising operations, such as advice about digital tools to support business continuity and growth

- Cyber Security – cyber security systems, backup management, and monitoring services

Example

Mary owns a small gym that earns less than $50 million aggregated turnover per year and wants to improve the accessibility of her businesses services for her members by digitising some of the operations.

She decides to purchase five new iPads for her trainers to use with clients ($2,000) and two new portable payment devices ($200). She makes these purchases on 1 March 2023 and begins using the assets on 15 March 2023.

Mary can claim the cost of the total amount ($2,200) of the depreciating asset as a deduction under temporary full expensing (TFE) in the 2022-23 business tax return if they meet the TFE criteria. The Small Business Investment Boost bonus deduction is calculated as 20% of the cost of the assets ($440).

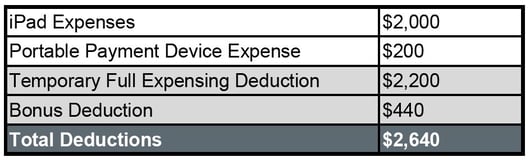

Therefore, in the business 2022-23 tax return, Mary claims:

Small Business Skills And Training Boost

Small businesses can claim the deduction for costs incurred for the provision of external training courses. Some exclusions will apply, such as in-house or on-the-job training and expenditure on external training courses for persons other than employees.

Eligibility

- Small businesses with an aggregated annual turnover of less than $50 million for the income year in which you incur the expenditure

- Tax deductible expenditure occurred between 7:30pm AEDT 29 March 2022 – 30 June 2024

Amount You Can Claim

Businesses can claim an additional 20% of eligible employee training expenditure for the following periods;

- 29 March 2022 – 30 June 2022

- 1 July 2022 – 30 June 2023

- 1 July 2023 – 30 June 2024

What You Can Claim

- Costs for external training provided to employees either in-person in Australia or online by Australian registered providers (training.gov.au)

- Incidental expenses relating to external training (charged by registered training provider) such as the cost of books or equipment required for the course

- Expenditure must be already deductible for your business under taxation law

- Where deductions are to be claimed over time such as for capital deductions, the bonus deduction is calculated as 20% of the full amount of the eligible expenditure (it can be claimed upfront in the first income year in which the bonus deduction is available)

Businesses may continue to deduct expenditure that is ineligible for the bonus deduction in accordance with the existing tax law. Eligible expenditure incurred by 30 June 2022 can be claimed in 2023 financial year tax returns in addition to deductions for expenses incurred between 1 July 2022 and 30 June 2023.

If your business is registered for GST and the training is not GST-free, the bonus deduction is calculated on the GST exclusive amount plus any GST you cannot claim as a GST credit in carrying on your business.

Example

Ian owns a psychology business that earns less than $50 million aggregated turnover per year and pays one of his office administrators to undertake an office management training course in February 2023 that costs $1,500 (with an Australian registered provider). He knows it's a good course as he sent the now Business Manager on the same one in April 2022.

The full $1,500 for the course is deductible under the existing tax law as a business operating expense, and as the business meets all of the criteria for the Small Business Skills and Training Boost, it is eligible for the bonus deduction of 20% ($300).

Since Ian also incurred the cost of his other employee completing the course between 7:30pm AEDT 29 March 2022 and 30 June 2022, he can also claim the bonus deduction on that expense. Due to the delayed claiming rules, he can claim this in the business 2022-23 tax return.

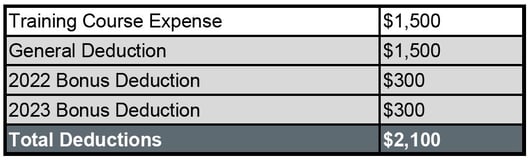

Therefore, in the business 2023-23 tax return, Ian claims:

Unsure of your eligibility for the Technology or Skills & Training Investment Boost measures, or what you can claim? Contact us today to speak to one of our experienced accountants.

Cutcher's Investment Lens | 7 - 11 April 2025

The failed $3 million super tax: Division 296 is done… or is it?

Cutcher's Investment Lens - Update on Trump & Tariffs | 31 March - 4 April 2025

Liberation Day - April 2025 Snapshot

Smart investing for SMEs: The basics on how to get started and grow your business.