Following the release of the December 2024 quarter Consumer Price Index (CPI) figure, the Total Superannuation Balance (TSB), which determines an individual’s eligibility to make Non-Concessional Contributions (NCC) to superannuation, and utilise the bring-forward provisions, will increase from $1.9 million to $2 million.

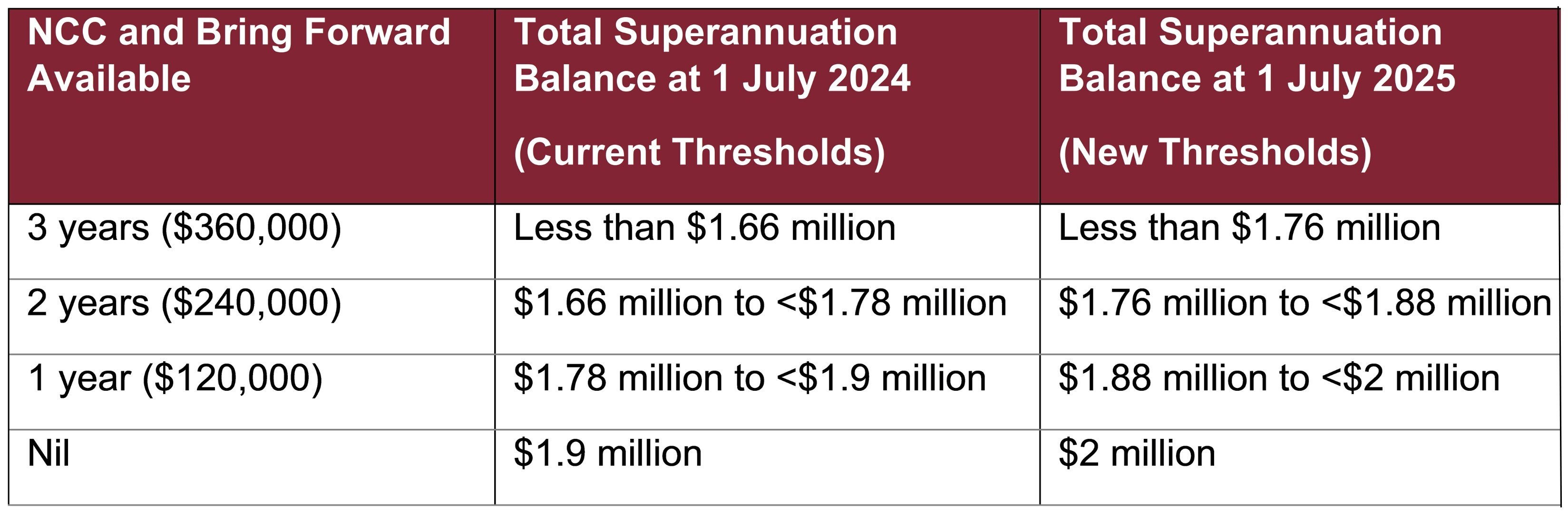

A person’s TSB is determined at 30 June of each financial year and this increase will potentially allow individuals, who were previously capped-out, to now contribute more into superannuation, as follows:

The general Transfer Balance Cap (TBC) will also be indexed from $1.9 million to $2 million from 1 July 2025. The TBC introduced on 1 July 2017, limits the total amount of superannuation assets that a member can transfer to the tax-free retirement phase via an Account Based Pension. The general TBC was originally set at $1.6 million, and this will be the third time it has been indexed.

Unfortunately, this doesn’t mean that you can transfer another $100,000 into your retirement phase on 1 July 2025. An individual’s entitlement to the indexation will occur through “proportional indexation” which works in the following manner:

- If you start a retirement phase income stream for the first time on or after 1 July 2025, you will have a personal TBC of $2 million;

- If you have partially utilised your cap before 1 July 2025, you will only have a proportional entitlement to the $100,000 increase and this will be based on the highest ever balance recorded in your transfer balance account, so your personal TBC will fall somewhere between $1.6 million and $2 million;

- If you have fully utilised your personal Transfer Cap at some stage prior to 1 July 2025, you will not be entitled to any of the $100,000 increase.

It is important to note that the above proportional indexation is not based on your transfer balance account at 1 July 2025 but is based on the highest ever balance recorded in your transfer balance account.

If you have any questions relating to your superannuation please get in touch with a member of our award-winning team.

Sam is the Partner of Cutcher & Neale's Superannuation Division. He believes that with continual changes to Superannuation, it's essential to stay ahead and develop tactical strategies for our clients to ensure their wealth is protected and secured.

With a wealth of knowledge and experience, Sam takes a hands-on, personal approach to ensure our clients have the very best plans in place from the very beginning.

Cutcher's Investment Lens | 7 - 11 April 2025

The failed $3 million super tax: Division 296 is done… or is it?

Cutcher's Investment Lens - Update on Trump & Tariffs | 31 March - 4 April 2025

Liberation Day - April 2025 Snapshot

Smart investing for SMEs: The basics on how to get started and grow your business.