Helping your children secure their financial future is a goal shared by most parents.

While saving money for your children in bank accounts, managed funds and other investments is a common approach, the tax efficiency and compounding effect of superannuation which makes it an effective savings vehicle cannot be ignored.

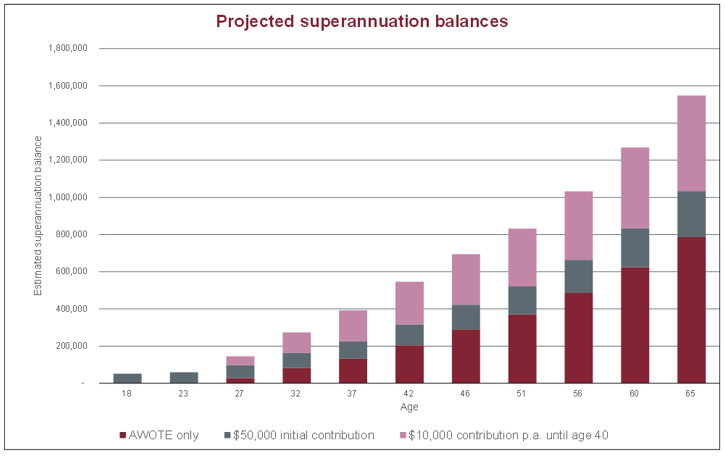

If you have working children, you may know that the superannuation guarantee (SG) currently requires your child’s employer to pay 9.5% of their earnings into their superannuation fund. From July 1, 2021, the SG is legislated to rise in half per cent increments every year until it reaches 12% of wages in 2025. Using average weekly ordinary times earnings figures (AWOTE) and assuming an inflation rate of 1.50% and a super earnings rate of 4%, your child could expect to accumulate a super balance of around $785,000 by age 65.

Investing additional money into your child’s super fund early on in their life can make a significant difference to how much wealth they accumulate in super at retirement. Depending on your tax structure, you may be able to make tax deductible contributions (concessional contributions) into your child’s super fund - the cost to you for making these contributions can potentially be halved due to the tax benefit you receive. In addition, you can consider making one-off after-tax contributions (non-concessional contributions) into your child’s fund.

The graph below illustrates what a one-off non-concessional contribution of $50,000 made to your child’s super fund at age 18 compounds to by age 65 – note that it could add an extra $250,000 to their balance. Even more remarkable to note from the graph is that making yearly non-concessional contributions of $10,000 into your child’s fund from age 18 to age 40 could add a massive $762,000 to their balance by age 65, potentially setting them up for a comfortable lifestyle at retirement.

Superannuation can be a powerful savings option you can use to kick-start and secure your child’s financial future. However, the pros and cons of investing in your child’s super should be weighed carefully and we advise that you consult with your adviser before deciding.

If you would like to discuss this article further, please contact our team.

A fully funded opportunity to improve efficiency for regional NSW manufacturers

Start strong in January: Why smart tax planning begins well before June

AI Explainer: Who’s Behind the Tools You Keep Hearing About?

Ready for Next-Level Automation? See What’s New in Ostendo 243

Thinking ahead, acting today: Must-know succession strategies for practice owners