Are you structured for success?When setting up or reviewing your business, it is prudent to have met with your advisers, discussed your personal and business circumstances, and then established a structure that best fits your needs.

This structure would usually consider factors such as asset protection and tax efficiency. At the bottom of that list, and often not on that list at all, is your operational requirements.

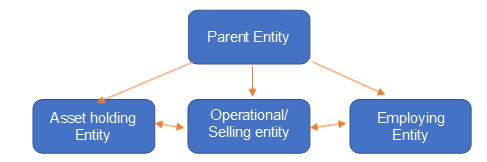

There are many different structures, however one common example may be as follows:

This may be a robust structure in your adviser’s eye. However, it immediately raises several operational issues:

- Do I now need 4 accounting files

- How do I calculate my labour cost and cost of production

- How do I apply the asset cost and maintenance to the product/s I am selling

- What is my true gross and net margin

In these structures we often see a high reliance on calculations and period end journal entries performed by accounting teams to ascertain the true business performance. As these are periodic (e.g., month end, quarter end, or at worst year end), the ability to timely assess performance and make decisions using real time information is lost. The sacrifice of a robust structure is the loss of ability to be dynamic in making decisions and responding to information obtained in real time.

There are, however, a few key actions you can take to ensure your structure is effective in all aspects of your businesses finance and operations:

1. Perform a review of your current structure, discuss with your advisers, and understand whether the needs have changed and if adjustments can be made.

For example, we often see structures that were created due to factors such as workers compensation requirements that may no longer be relevant.

2. Understand Automation potential of current systems

Many solutions now have the ability to automate transaction entry. If this can be done effectively and timely, then the information available will be more relevant and efficiently produced.

Furthermore, there are various reporting solutions that can be implemented that sit over the top of and consolidation all your information sources (e.g., the multiple accounting files, operational systems etc).

3. Explore benefits of a unified solution where all entities are included in one ‘file’

The Cutcher & Neale Software team specialise in implementing many solutions, including those that go beyond that of an accounting file and can manage operations, jobbing, production and labour management, fixed assets all from one unified system and source of truth.

When reviewing your business performance, the cost of not performing the above is often hidden in administration, accounting, and finance costs. The time taken to calculate, process and reconcile journal entries, intercompany transactions followed by reporting on consolidated performance is absorbed in ‘month end reconciliations and reporting’. However, a more stringent look at the time taken to do this will reveal these are often largely inefficient processes that consume the majority of the periodic reporting timeframes.

A focus on efficiency in these areas can alleviate reporting pressures, provide more accurate and timely information, and increase the overall efficiency of your business.

Please contact Cutcher & Neale Business Systems Support to find out how we can assist.

Daniel Ireland

Daniel Ireland

Senior Advisor / Solution Consultant

BCom, CA

Dan started as a trainee at Cutcher & Neale in 2006 and returned in 2015 after a brief stint in commerce. Dan specialises in assisting both new and existing clients to improving the efficiency of operations through technology, as well as working with clients to develop sound financial reporting processes and commercial analysis. His strength lies in building and maintaining strong relationships with clients and partnering with them through oversight of their accounting and finance reporting processes and review and analysis of their results.

Utilising his financial reporting, assurance and systems background as well as leveraging off his commercial accounting experience, Dan also assists clients in assessing their current systems, processes and reporting, and implementing solutions that are not only effective and efficient but also ensuring there are adequate internal controls.

Cutcher's Investment Lens | 7 - 11 April 2025

The failed $3 million super tax: Division 296 is done… or is it?

Cutcher's Investment Lens - Update on Trump & Tariffs | 31 March - 4 April 2025

Liberation Day - April 2025 Snapshot

Smart investing for SMEs: The basics on how to get started and grow your business.