Investing your money in a share portfolio can be an easy and lucrative way to passively build your wealth. But did you know that the sooner you get started, the better your odds are of success?

The length of time you hold an investment for can affect not only your positive returns, but also how much more those returns can work for you when reinvested.

Risk vs Return

Most people understand the fundamental investment concept of risk and return. That is, investors who take on additional risk are generally rewarded with higher returns, otherwise why would a rational investor take on the risk? What is often missed, or at least not fully appreciated, is the potential impact time has on both the risk and the return of an investment.

Over longer time periods, the variance in an assets price (i.e. the risk of the investment) tends to ‘smooth out’, averaging its profits and losses. When you speak to one of our investment advisors, they will not only assess your tolerance for risk, but also your investment timeframe. These key details are often derived from a fact-finding process and is usually influenced by your personality, life stage, income and wealth level, and experience. Generally, the riskier the investment, the longer the recommended timeframe.

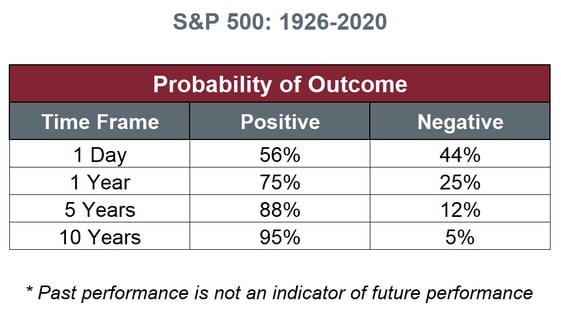

The below table illustrates the impact time has on the probability of investment success in the S&P 500 Index, the primary equity benchmark in the United States, based on how long the investment is held.

Compound Interest on Reinvestment

In addition to this higher probability of success, time can serve to increase the rewards of an investment thanks to compound interest. Once called the “eighth wonder of the world” by Albert Einstein, compound interest refers to the additional interest, made on previously earned and reinvested returns. Over time, this can dramatically increase the potential returns of your initial investment made today.

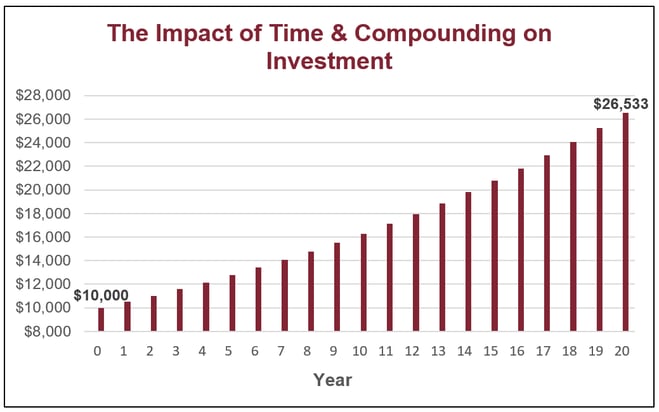

For example, if you invest $100 and earn a 5% net return per annum, you will earn $5 in the first year. If you reinvest that return, your total investment becomes $105. Then the next year, your 5% net return is calculated off your new investment amount, and you earn $5.25 instead. If you continue this trend for 10 years, your total investment will become $162.88. After 20 years your original investment more than doubles to $265.32.

When you increase the original investment by 10 or 100-fold, you can understand why Einstein was such a fan:

Although all assets inherently maintain some level of risk and return, when it comes to investing, time is on your side. Time allows investors to ride out market volatility, mitigate investment timing risk, and ultimately boost the potential returns of an investment made today through compounding.

This benefit, however, can also be the biggest hurdle for those looking to start out. In most cases, the smart investor must make peace with the lack of instant gratification inherent in the statistics. While the advantages of investing early in both life and career can enable higher levels of risk, it’s never too late to explore this pathway of wealth creation. The sooner you invest, the better your chances are of long-term success.

Looking to begin investing but unsure where to start? Get in touch with one of our investment advisors to learn more about our model portfolios and your options.

Cutcher's Investment Lens | 30 June - 4 July 2025

Cautious Optimism - July 2025 Snapshot

Cloud accounting for small business: More clarity, less admin.

Key business actions for the new financial year.

Cutcher's Investment Lens | 23 - 27 June 2025