Based on the public ruling issued by Queensland Revenue Office (QRO), our view is the intention of the QRO is to capture and assess payments to Practitioners under all Service Agreement arrangements, unless an exemption applies.

The approach being taken is grossly unfair. This strict view by QRO and other state-based revenue offices if harmonised, will simply result in a transfer of wealth from the Commonwealth to the States at a cost to the patients.

To make matters more confusing, there are 14 examples provided in the Public Ruling, some of the wording and terminology used in examples results in ambiguity with QRO. Concerningly, the examples represent many familiar arrangements currently in place across majority of medical practices.

Recent Changes in Queensland

The QRO released a Public Ruling (PTAQ000.6.1) dated 22 December 2022, specifically in relation to relevant contracts and medical centres including dental clinics, physiotherapy practices, radiology centres, specialist practices and similar healthcare providers.

The specific purpose of the ruling is to explain the application of the relevant contract provisions in the Payroll Tax Act 1971 (QLD) to medical centres. All public rulings are important as when issued they represent the published view of the Commissioner of State Revenue.

We have previously discussed the outcomes of The Optical Superstore case from 2019 (VIC) and Thomas and Naaz from 2021 (NSW); both of these decisions were in favour of the Commissioner. The Public Ruling released by Queensland references both these cases in many instances.

QRO need to release an update to PTAQ000.6.1 to assist with providing certainty for medical practices and clearer examples (refer to item 1 further below).

Recent Announcement in relation to Thomas and Naaz (New South Wales)

In short; released 14 March 2023; it’s a win for the Commissioner. The Court of Appeal confirmed the Chief Commissioner of NSW Revenues’ assessment of payroll tax to the GP medical practice.

We now wait for the final public ruling from NSW Revenue which does not look like good news for medical practices.

Refresh on Payroll Tax

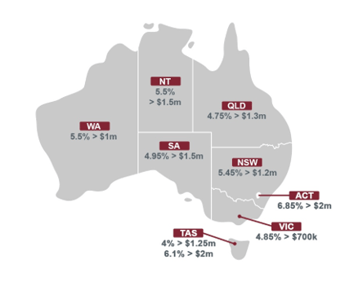

Payroll Tax is administered by state-based revenue offices. Since 2009, all states and territories have used near-identical legislation. The annual thresholds and rates applied continue to differ by each jurisdiction. The Commissioners all signed a Payroll Tax Harmonisation protocol in 2010 confirming their commitment to harmonisation.

Payroll Tax is assessed on Australian taxable wages; the current thresholds and rates are:

Liability for Payroll Tax will also arise if its established amounts are paid under a relevant contract and / or under an employment agency contract to a service provider. The ‘payment’ made under a relevant contract will be added to the taxable wages (generally employees wages and superannuation) and be taken into account in determining the annual liability for Payroll Tax purposes.

The Exemptions of the Recent Queensland Public Ruling

The ruling focuses on three exemptions. If an exemption is satisfied, no payroll tax liability under the relevant contract provisions will apply:

1. Practitioner provides services to the public generally (read more detail below)

2. Practitioner performs work for no more than 90 days in a financial year – for the same Practice or group of Practices (same ownership)

3. Services are performed by two or more persons (however not applicable where an employed nurse from the Practice assists the Practitioner with a patient)

A contract between a medical centre and a Practitioner is not a relevant contract in relation to a financial year if the Commissioner is satisfied the Practitioner who provided the services under the contract ‘ordinarily performs services of that kind to the public generally in that financial year.’

To qualify for the exemption; the Practitioner must provide services of the same kind to other principals, such as other medical centres or hospitals. Whilst lots of Practitioners may work elsewhere the ruling is very prescriptive and aimed at making the exemption very difficult to comply with.

The big issue is that prior to claiming this exemption the medical centre is required to apply to the Commissioner for a determination; this is in complete contradiction to how our Income Tax Legislation works. The Commonwealth relies on self-assessment; why should this differ at a state level? The pressure and costs that will be faced by Practices to obtain professional advice to lodge the exemption is unwarranted.

The Bad News

Uncertainty remains in relation to the running of medical practices and payroll tax. The QRO ruling outlines each contract must be considered individually and, on a case-by-case basis to determine whether it is a relevant contract.

Harmonisation across all states and territories may mean similar rulings are provided by other states and territories. NSW Revenue released a draft ruling late 2021 however there has been no further release of a final public ruling. Other states and territories remain silent on the relevant contractor provisions and approach.

A private ruling application by a medical practice will provide certainty to a medical practice, however there are advisory costs that will need to be incurred in relation to the preparation and lodgement of the ruling and a possibly lengthy period before an opinion is granted by the Commissioner.

The Good News

In a welcome move QRO have announced that medical practices who make payments to ‘contracted GPs’ will have an amnesty until 30 June 2025 to consider their circumstances. Premier Annastacia Palaszczuk raised the issue at a national cabinet meeting on 3 February after Treasurer Cameron Dick had been in discussions with his New South Wales counterpart, Matt Kean, about giving clinics a ‘grace period’.

Whilst this is good news for GP practices; it provides no assistance to ophthalmology practices operating with a service entity structure in place.

To date, there has been no similar amnesty announced by the NSW or Victorian governments.

The delayed approach being taken by NSW, VIC in the wake of Thomas and Naaz and The Optical Superstore cases may mean other revenue offices are reviewing their position instead of taking the strict view formed by QRO. Currently under the Payroll Tax Act all state revenue authorities can review and assess for a period up to the last five years, QRO are the first to provide this amnesty (at date of writing we are waiting on further administrative guidelines).

Where to From Here?

1. We need state revenue authorities to consider the arrangement where patient fees are banked directly into the practitioners bank account instead of a ‘clearing account’ or ‘practice account’ and provide an assessment in relation to the application of relevant contract provisions and ‘taxable wages.’

2. Understand your Practice exposure and risk if your payroll tax liability were assessed. For example, a medical practice that provides services to a couple of Practitioners may fall below the threshold.

3. Understand your statutory requirement to register under your state for Payroll Tax (noting a reduced threshold for VIC).

4. Consider your circumstances and increased costs of running your Practice

5. Clearly understand and document Practitioners in your Practice that work elsewhere and whether they may fit the relevant contracts exemption; we understand this will apply in many instances

6. Seek professional advice

For more information on how Cutcher & Neale can assist you in regards to your payroll tax position, call us on 1800 988 522.

Start strong in January: Why smart tax planning begins well before June

AI Explainer: Who’s Behind the Tools You Keep Hearing About?

Ready for Next-Level Automation? See What’s New in Ostendo 243

Thinking ahead, acting today: Must-know succession strategies for practice owners

From locum shifts to running your own practice: When your cover needs an upgrade