The transition from being an employee or contractor to establishing your own private practice is a significant step in any medical practitioner's career.

Whilst this decision and next step is exciting, it can also be challenging and at times overwhelming given the laundry list of things to consider before you even start.

We understand this dilemma and have compiled a list of our top tips and important decisions that you simply can't afford to get wrong from the start.

Structuring

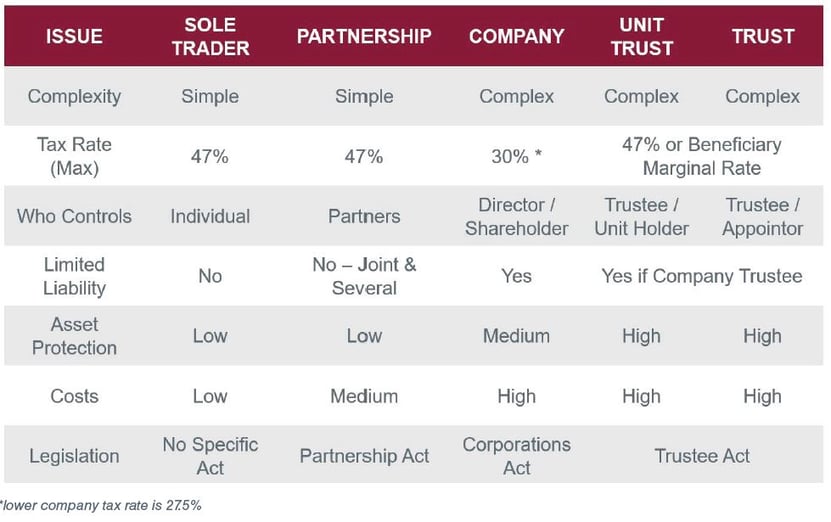

Working out which structure best meets your needs is a key consideration when starting in private practice. Not all structures are the same and its important you know the advantages and disadvantages of all the potential options.

The following table gives you a quick snapshot of the potential structure available and their features:

There are several taxation and non-taxation implications that need to be considered when looking at the above, it is not just one size fits all approach.

Agreements

Once you have decided on which structure will be most suitable for you and your speciality, another key consideration is ensuring you have the appropriate documentation and agreements to support it. If a Service Entity is part of your overall practice structure, correctly executed service agreements will be required.

A poorly constructed service agreement can lead to unanticipated costs for the practice.

If going into business with a third-party, additional agreements may also need to be considered.

Having the right agreements in place will go a long way to safeguard you and your practice.

Finance and Debt

Let's be honest, no one ever really wants to be in debt, but it is important to make sure its structured correctly.

Whether its purchasing rooms, fitting out the space or financing medical equipment, the structure of your finance is important to ensure its as tax efficient as possible and to also help manage cashflow commitments, especially in the early days.

Insurance

Insurance is very important for a medical practitioner and their practice. Not only does it reduce potential financial risk, but it also helps protect your biggest income producing asset, you.

Keep in mind some insurances are simply compulsory. Workers Compensation insurance for employees for example is a compulsory insurance that is required across all industries and in all states.

Being in private practice is by no means an easy task however taking some time to consider the above steps at the start will help set you on the right path.

The team at Cutcher & Neale are here to help, please get in touch if you would like further assistance.

Cutcher's Investment Lens | 17 - 21 March 2025

Put your hard-earned dollars to work: Smart investing for doctors.

Fringe Benefits Tax year-end: Important updates and insights.

Cutcher's Investment Lens | 10 - 14 March 2025

Cutcher's Investment Lens | 3 - 7 March 2025