The holiday season is here, and it’s the perfect time to show your team some appreciation with parties and gifts. But you don’t want to get caught paying more than expected. A little planning now can help you avoid a surprise at tax time.

So, what exactly is a Fringe Benefit?

Despite the name, it’s not the next trendy haircut. A Fringe Benefit is actually a perk you provide to an employee that isn’t a part of their paycheck.

It typically includes expenses you, as the employer, cover, that the employee would normally pay for themselves.

Common examples of fringe benefits include:

- Allowing employees to use a company car for personal reasons.

- Providing parking on the premises.

- Paying for study courses or training.

- Giving tickets to concerts or sports events.

- Hosting holiday parties or events.

- Offering gifts to employees.

Fringe Benefits Tax

Fringe Benefits Tax (FBT) applies to fringe benefits you provide to your employees, their families, or associates.

Unlike income tax, FBT is calculated separately based on the value of the benefits provided, and it must be lodged with the ATO.

As an employer, it’s your job to keep track of the fringe benefits you provide. But because FBT is self-assessed, it’s easy to misunderstand what’s taxable, even when you’re trying to do the right thing.

Quick tip: The FBT year is 1 April to 31 March, so make sure you’re ready when it’s time to report!

Planning for the Holiday Season

Holiday events and gifts can be tricky when it comes to FBT. It’s wonderful to celebrate the season and reward your team for their hard work, but it’s also easy to overlook how some expenses might impact your tax.

For example, staff parties and certain gifts could fall under FBT if you’re not careful. The good news? With a little forethought, you can celebrate the season without accidentally overspending or creating extra tax headaches.

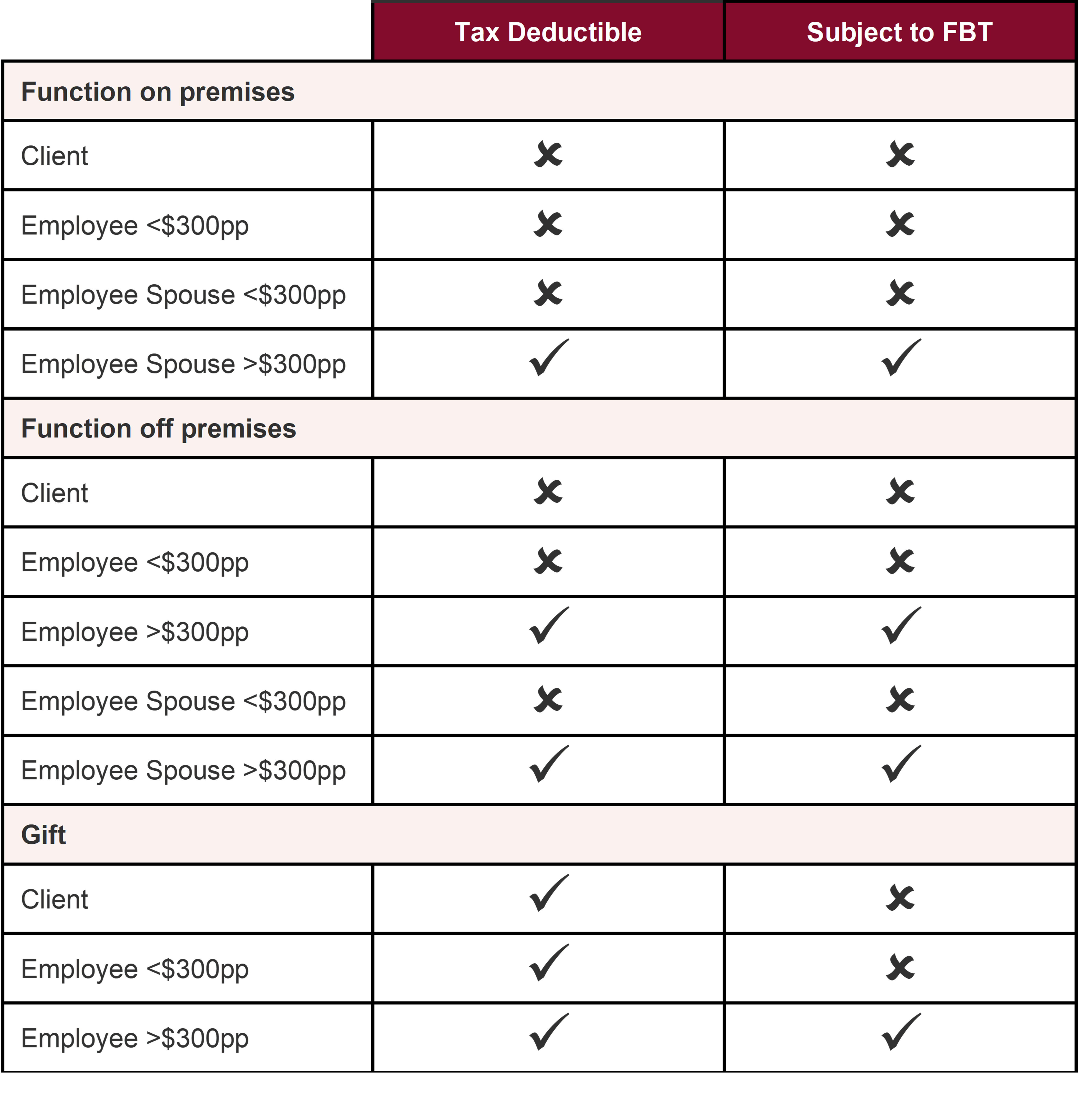

Here’s our gift to you! Our FBT event summary can help you navigate the gift of giving to your employees for the upcoming season:

Please note the above only applies if you are using the actual method to calculate FBT, as opposed to the 50/50 method. When gifting cash bonuses you should always consider the tax consequences. Bonuses are regarded as ordinary times earnings and must be included when calculating super. Not factoring in the appropriate withholding tax may result in a tax bill for your employees come year-end. The responsibility rests with the employer to ensure PAYG, FBT and superannuation are appropriately remitted.

When FBT won't apply

Quick tip: If you decide to give a cash bonus instead of a benefit you won’t have to worry about FBT, but you do need to manage it correctly via payroll.

It’s important to keep in mind that the bonus does count as regular income for your employee. This means:

- Your employee will pay income tax on the bonus.

- You, as the employer, need to handle PAYG withholding and ensure superannuation contributions are made on the bonus amount.

The compliant way to handle a holiday bonus is to process it through payroll. This means all the tax and super obligations are taken care of while still spreading some holiday cheer!

If you’re unsure about how FBT applies to your business, don’t hesitate to seek professional advice from us. It’s always better to be prepared than surprised!

Nicole is passionate about working with clients to assist in wealth creation and wealth accumulation strategies. Nicole takes the time to understand their goals and motivations to provide them with tailored advice. Working closely with clients to better understand their needs, she draws on years of experience to help clients achieve their goals.

Cutcher's Investment Lens | 7 - 11 April 2025

The failed $3 million super tax: Division 296 is done… or is it?

Cutcher's Investment Lens - Update on Trump & Tariffs | 31 March - 4 April 2025

Liberation Day - April 2025 Snapshot

Smart investing for SMEs: The basics on how to get started and grow your business.